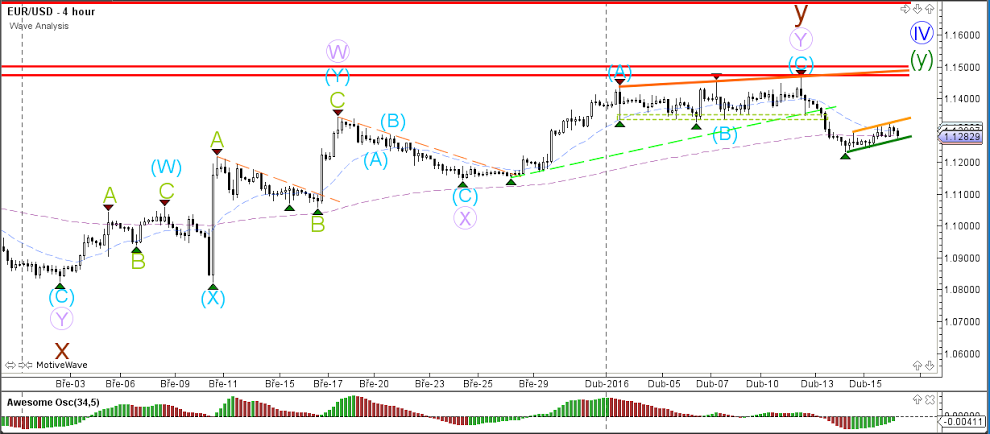

EUR/USD

4 hour

The EUR/USD is building a small bear flag chart pattern (orange and green trend lines). A bullish break could indicate that the larger wave 4 (blue) is still not completed. A bearish break of the bear flag could indicate that a larger retracement or even reversal (and completion of wave 4) is taking place.

1 hour

The EUR/USD chart is showing 2 wave possibilities. The main scenario is a bearish impulsive 5 wave which could occur when the bear flag breaks. The alternative is an ABC (blue) which seems more likely when there is a bullish break of the channel.

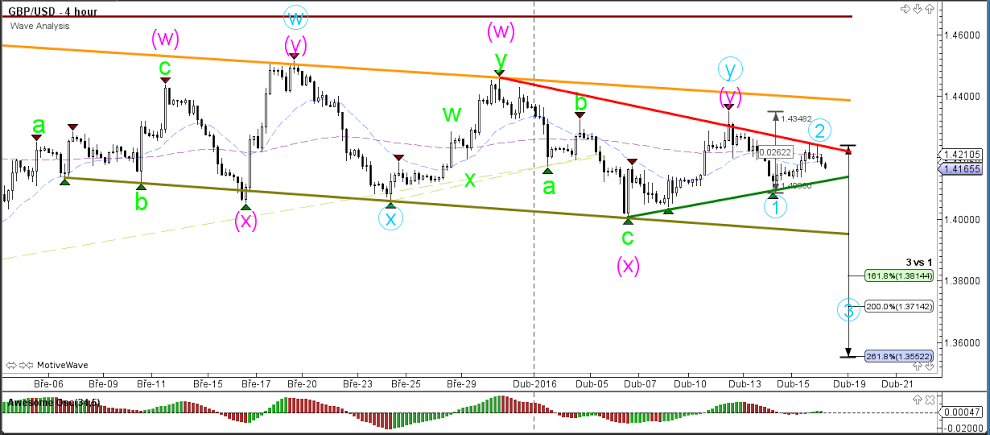

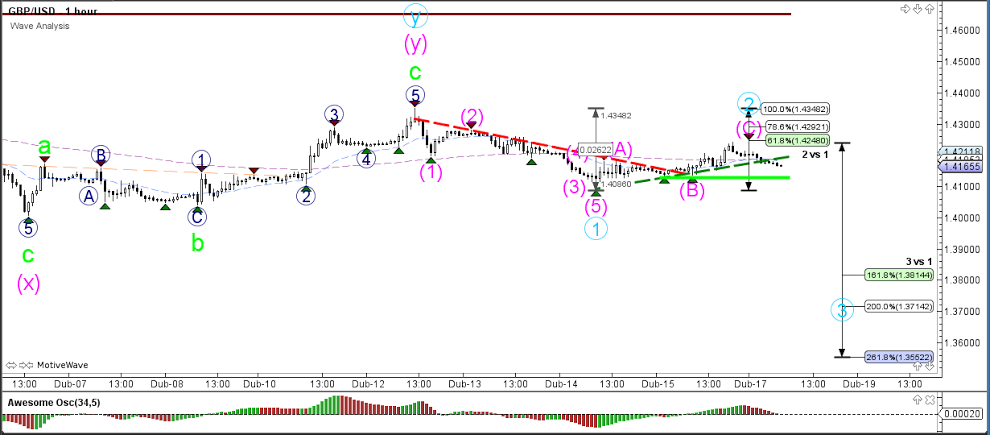

GBP/USD

4 hour

The GBP/USD is in a contracting triangle (green/red) chart pattern. The most likely wave count is a wave 1-2 (blue) but it would only become confirmed if price manages to at least break the support trend line (green). A break above the orange resistance line invalidates the wave count.

1 hour

The GBP/USD could have completed a bullish ABC correction (pink) within wave 2 (blue) but a break below the horizontal support is needed before a bearish break below the trend line becomes more likely.

USD/JPY

4 hour

The USD/JPY made a bearish turn as indicated on Friday and bounced at the 38.2% Fibonacci level. Price is now retesting the bottom (green). A break below support could see price fall towards the Fibonacci targets of wave 5 (green). The 61.8% Fibonacci target is the main target because it is equal to the 38.2% Fibonacci level of wave B (sea green).

1 hour

The USD/JPY broke below the support trend line (dotted green) but now needs to break horizontal support if the bearish momentum and trend is able to continue.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.