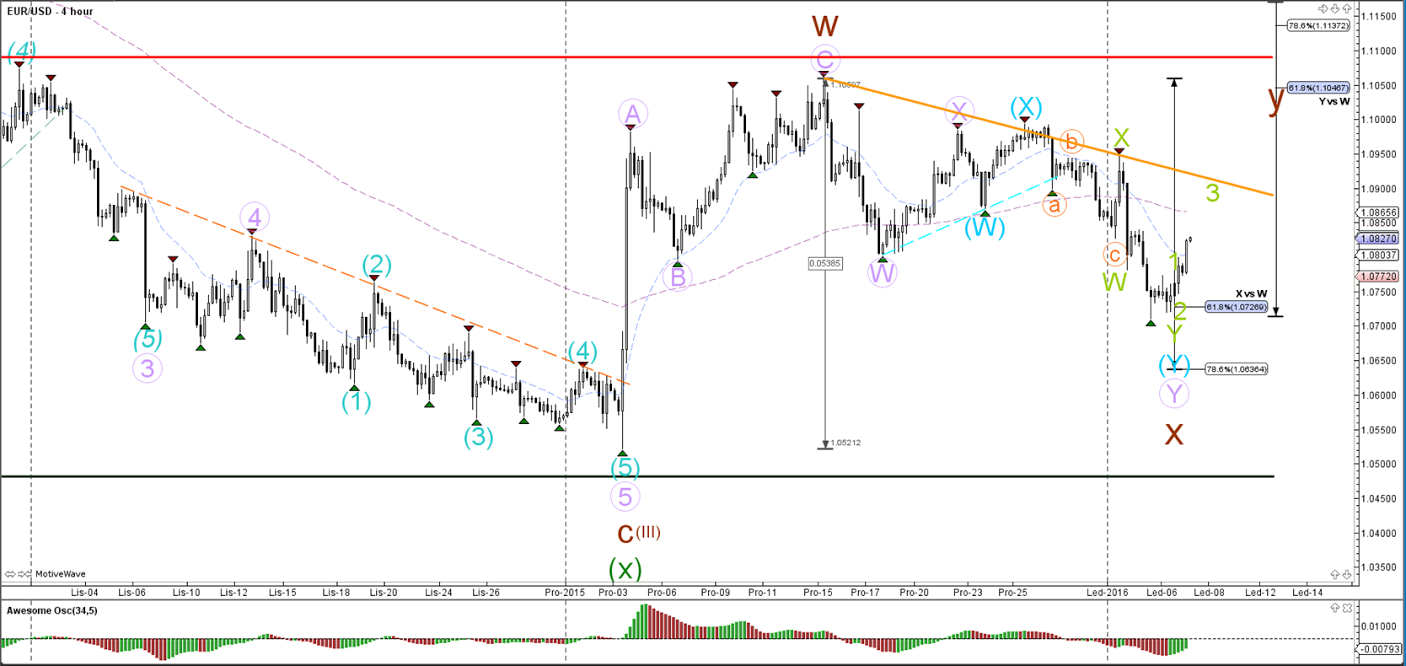

EUR/USD

4 hour

The EUR/USD showed a bullish bounce at the 61.8%, which could complete wave X (brown) depending on whether price can break above resistance (orange).

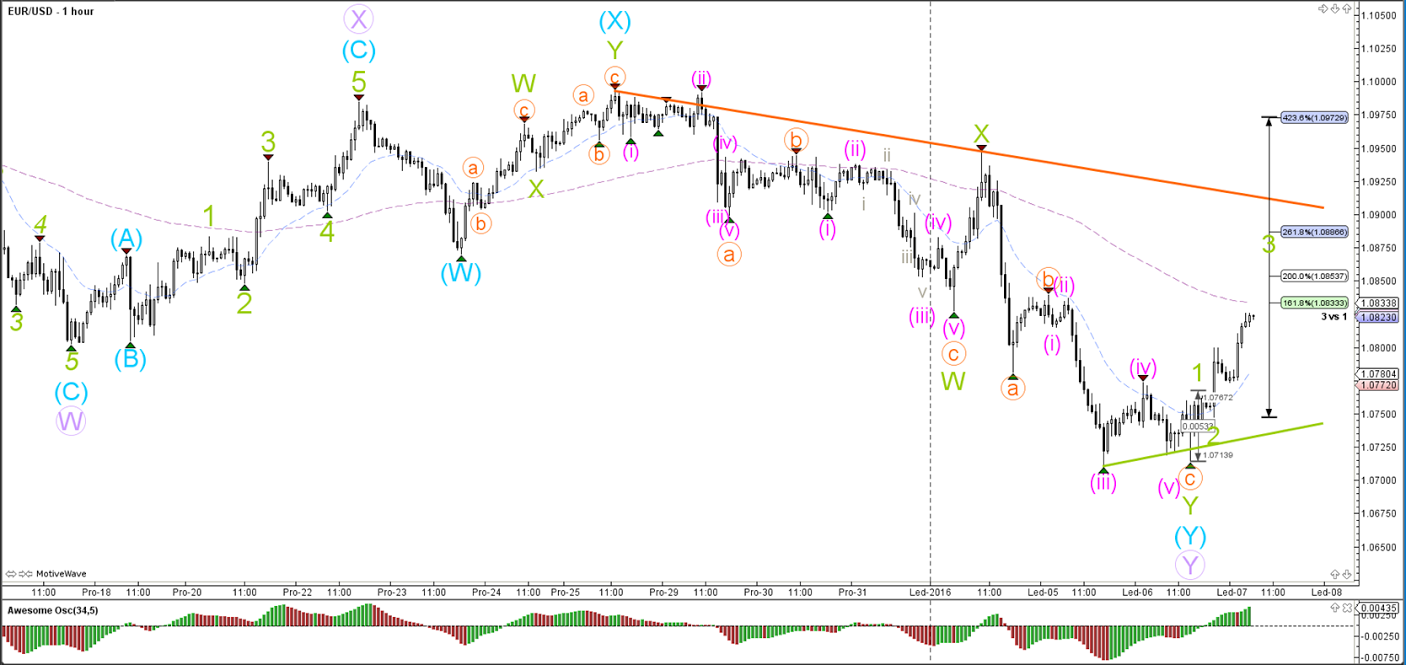

1 hour

The EUR/USD completed wave 5 (pink) at double bottom before making an impulsive bullish rally. The speed of price is suggesting a 123 wave development (green).

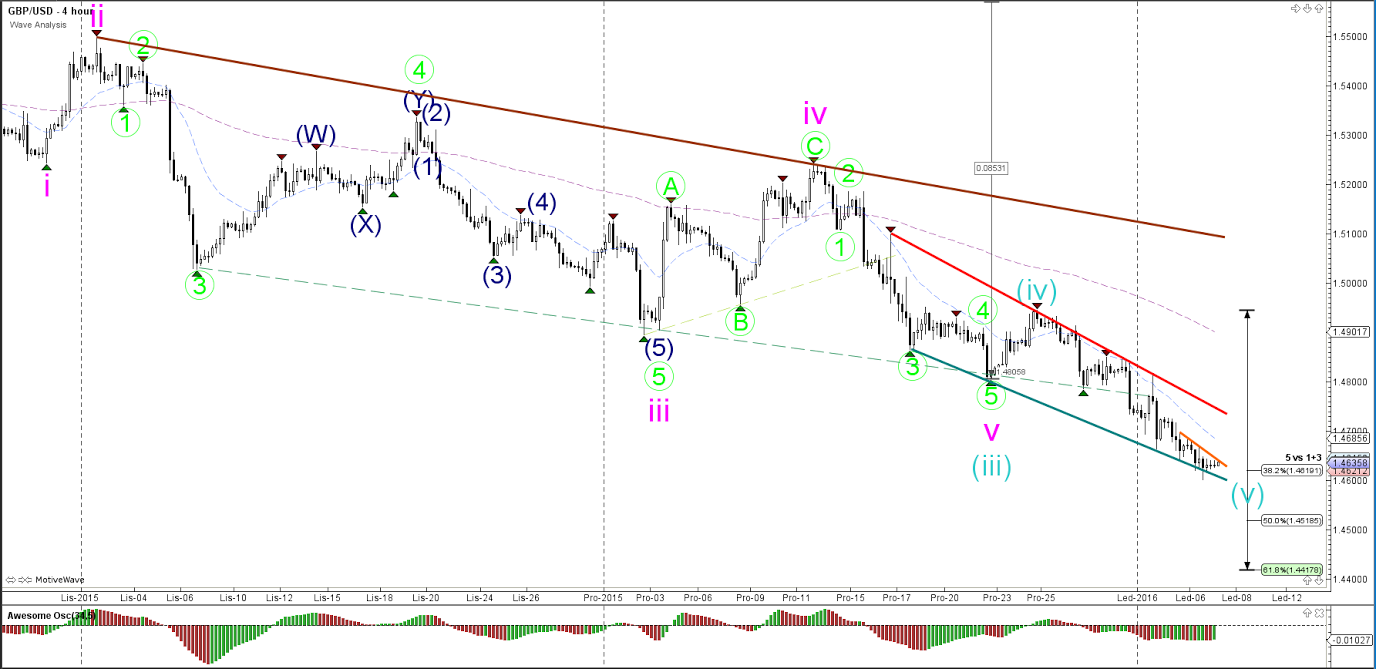

GBP/USD

4 hour

The GBP/USD is at the bottom of the downtrend channel (green/red), which in itself is a bullish bounce or bearish break spot. At 1.4566 is a big daily bottom which could act as support.

1 hour

The GBP/USD posted an ending diagonal formation via the light green waves. Price was not able to break below the support and is now testing the inner resistance (orange).

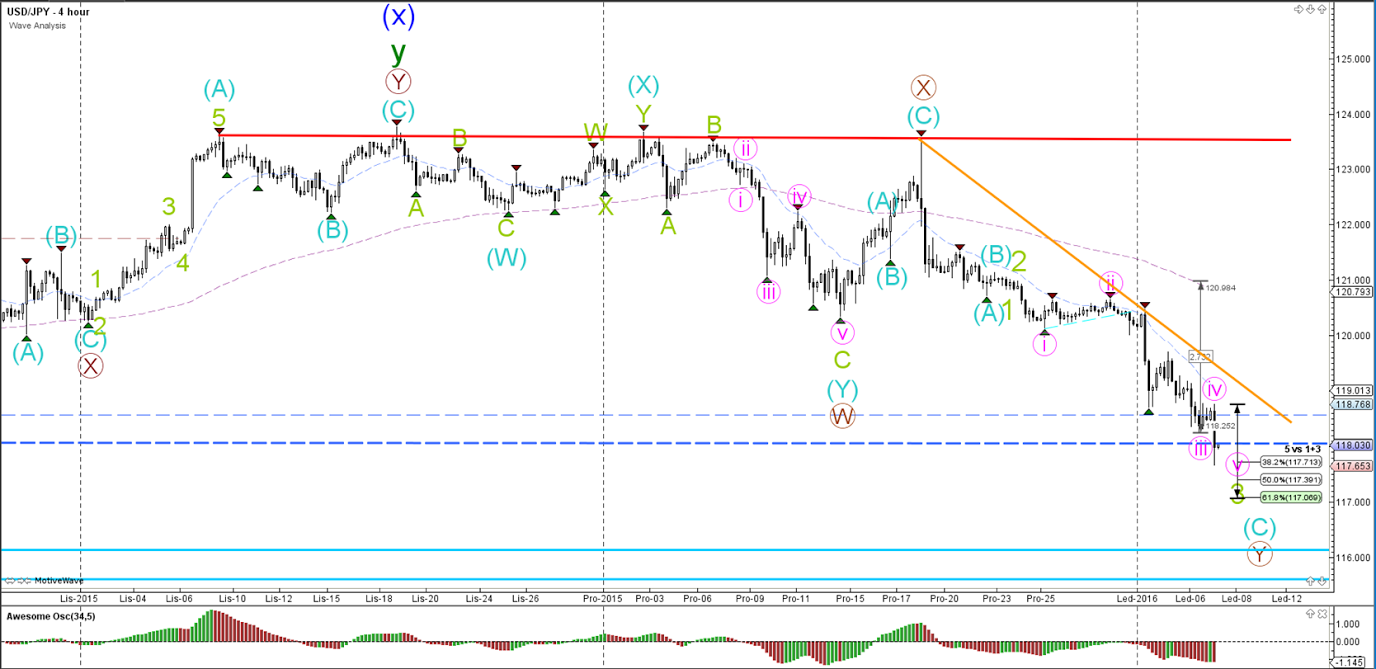

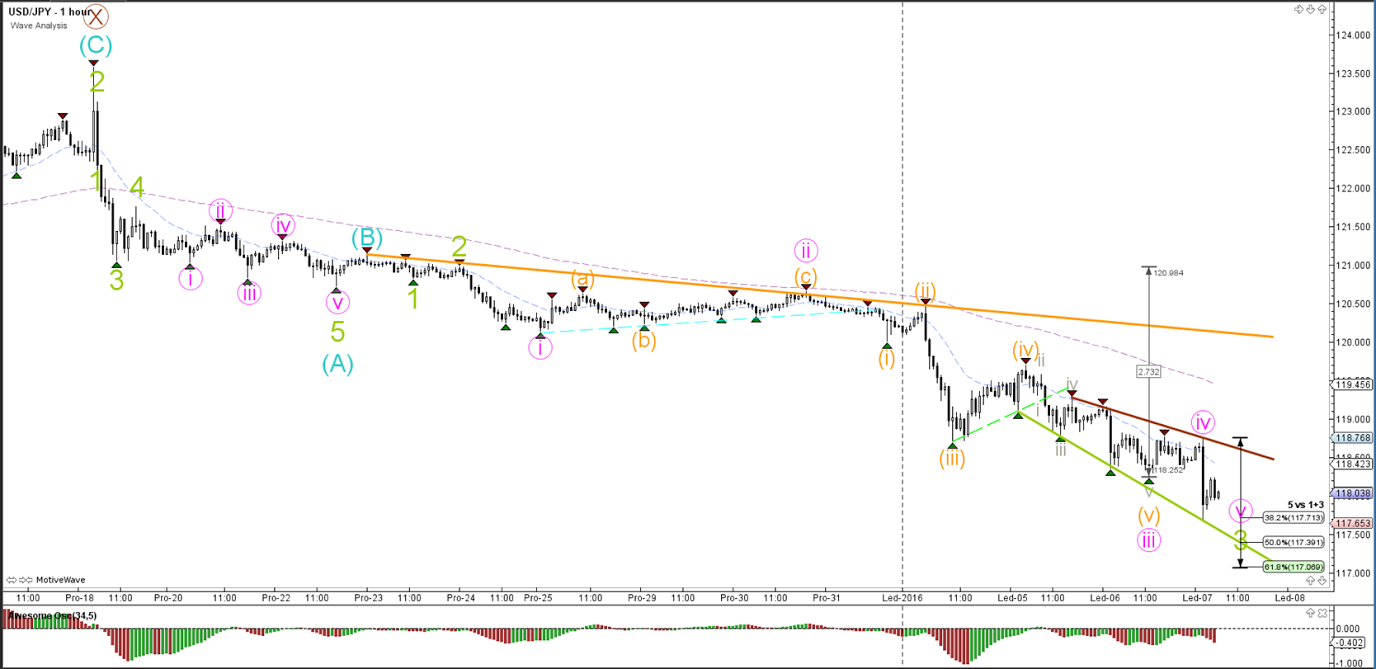

USD/JPY

4 hour

The USD/JPY is attempting to break below the horizontal support levels (blue dotted). If price stays below resistance (orange), then it continue the downtrend and fall towards the next Fibonacci targets or support levels (blue).

1 hour

The USD/JPY keeps posting lower lows and seems to be in a wave 5 (pink) of a larger wave 3 (green). The ABC (blue) formation is vulnerable to be changed into a 123 if price keeps pushing lower and breaks below the 61.8% target.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.