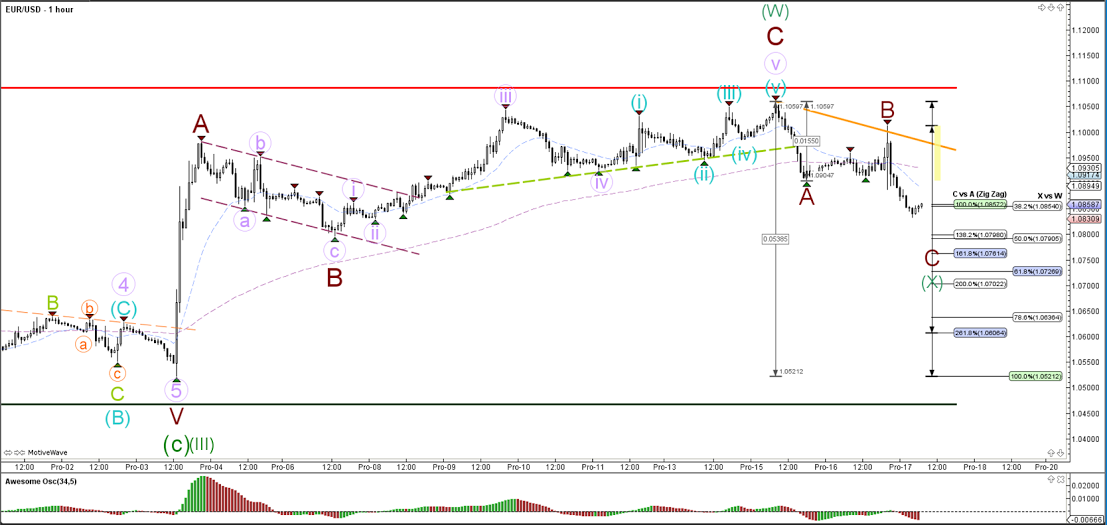

EUR/USD

4 hour

The FED’s decision to increase interest rates in the US caused lots of volatility in the market. The EUR/USD moved lower eventually during the news but price is still far away from the current year low. For the moment I am not expecting price to break below this year’s low (green line) and hence the wave count is now showing a wave X retracement (green).

1 hour

The EUR/USD bearish price action has been slow and therefore the wave count is showing an ABC zigzag rather than a 123 (brown).

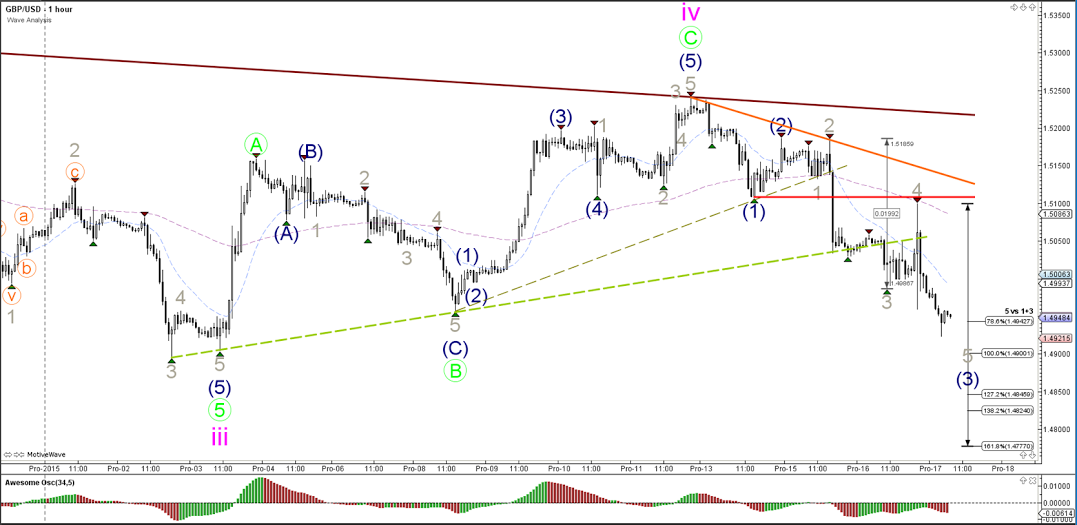

GBP/USD

4 hour

The FED’s decision to increase interest rates in the US caused lots of volatility in the market but the GBP/USD has managed to make a bearish turn at the top of the channel and is now breaking below support within the downtrend channel.

1 hour

The GBP/USD broke below the support trend line (dotted green) and is moving lower to the targets of wave 5 (blue) of wave 3 (grey).

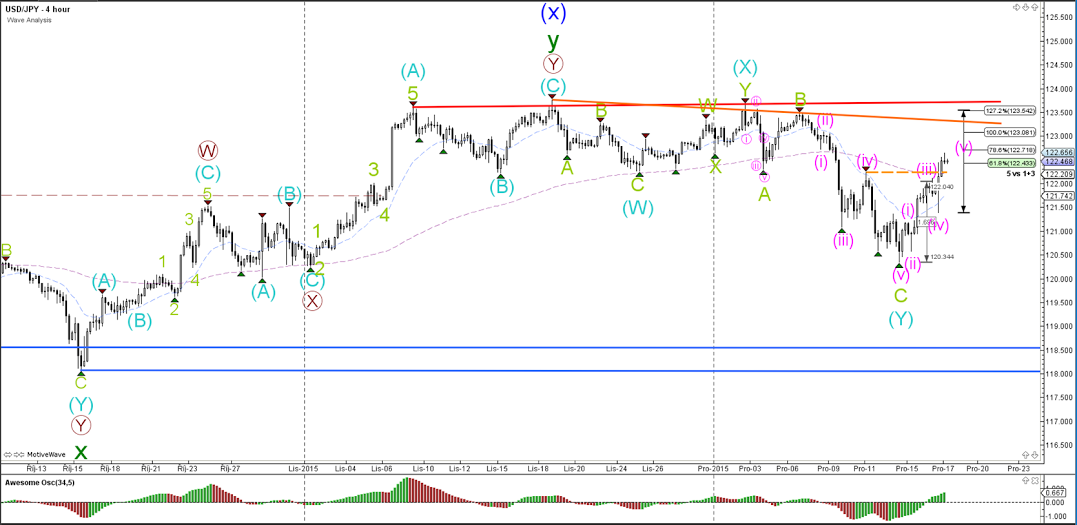

USD/JPY

4 hour

The FED’s decision to increase interest rates in the US caused lots of volatility in the market but in the end a bullish 5 wave pattern emerged (pink). The 5 wave pattern has changed the bearish count from a potential A to the current C (green) of Y (blue).

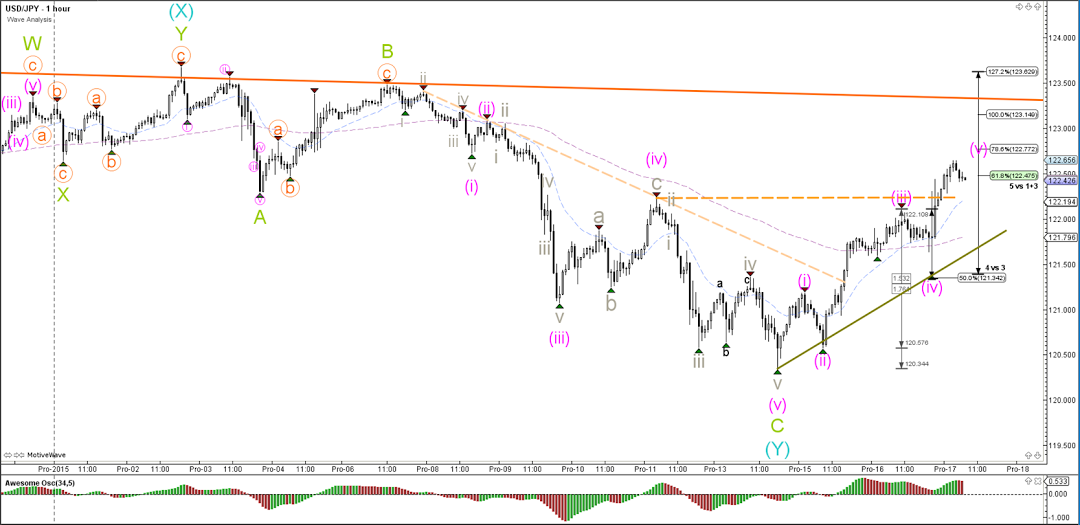

1 hour

The USD/JPY confirmed its bullish momentum via the development of an impulsive 5 wave (pink), which could either become part of a larger wave 1 or A.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.