EUR/USD

4 hour

The EUR/USD has retraced back to the long-term support trend line (green). This could be a hook back for another bullish bounce as indicated in the current wave count. A break of the support trend line would indicate a potential bearish breakout and change the wave structure.

1 hour

The EUR/USD is in a triangle chart pattern with resistance (red/orange) and support (green) marking the break zones. A bearish break would invalidate the current WX (purple) wave count.

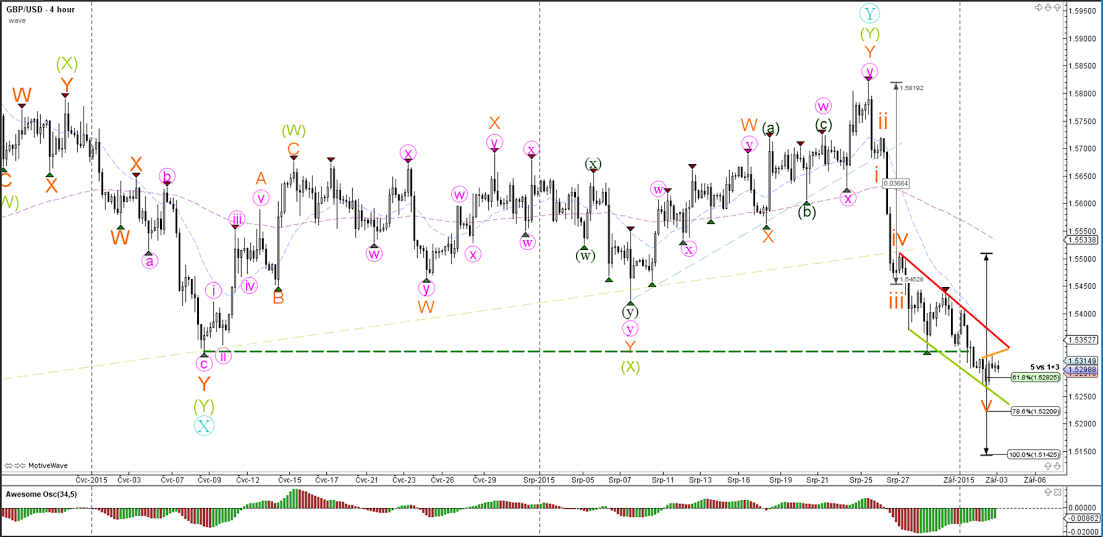

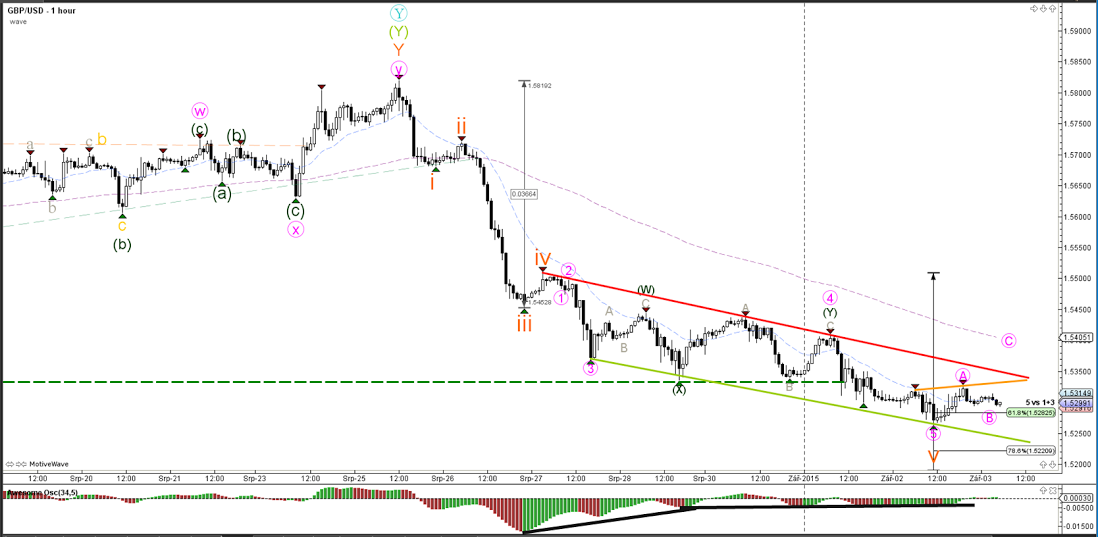

GBP/USD

4 hour

The GBP/USD pushed lower yesterday but the oscillator has made a clear turn and is retracing back to the middle point, which means that the currency pair is in retracement territory.

1 hour

The GBP/USD is still moving to lower levels in the neat downtrend channel. However, a correction back to the top of the channel or long-term moving average is a decent possibility with the presence of double divergence and a small opposite momentum (wave A - magenta).

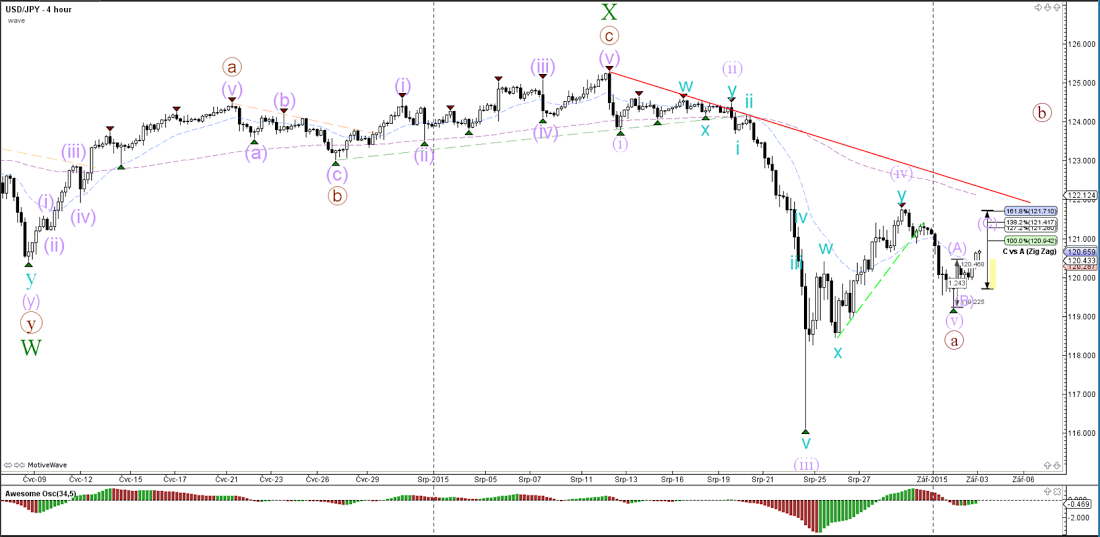

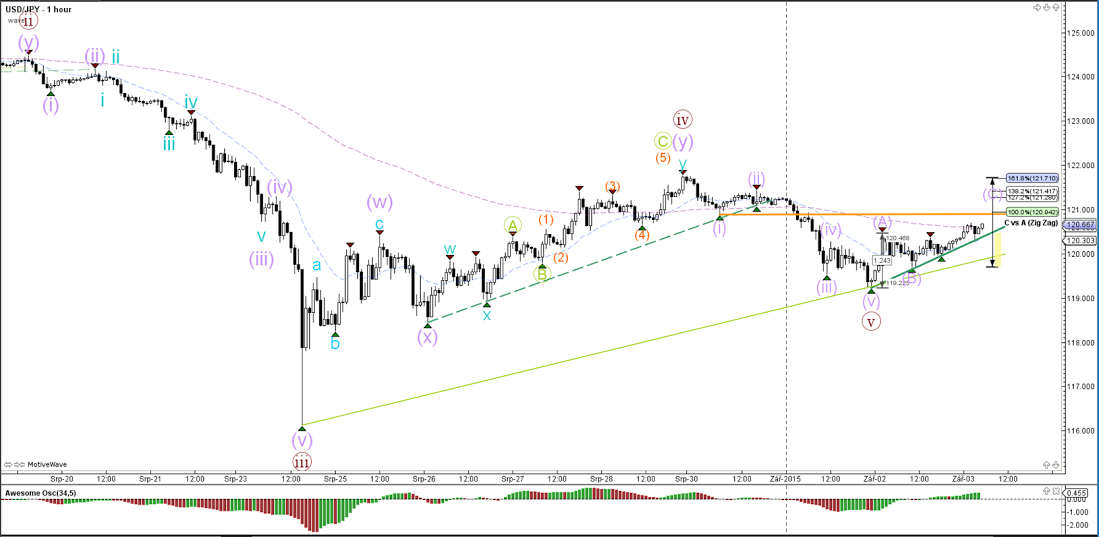

USD/JPY

4 hour

The USD/JPY seems to have completed 5 waves for a truncated wave 5 (purple) due to the failure to break the bottom of wave 3.

1 hour

The USD/JPY seems to be building an ABC correction (purple).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.