EUR/USD

4 hour

The EUR/USD has bounced at the support trend line (green) but the rebound has been relatively slow which has created a triangle. A break above resistance (red) or below support (green) could trigger more momentum.

1 hour

The EUR/USD completed an ABC rally (purple) after breaking above resistance (orange). After that it made a deep pullback which probably belongs to a bigger bullish correction like a wave X retracement (purple).

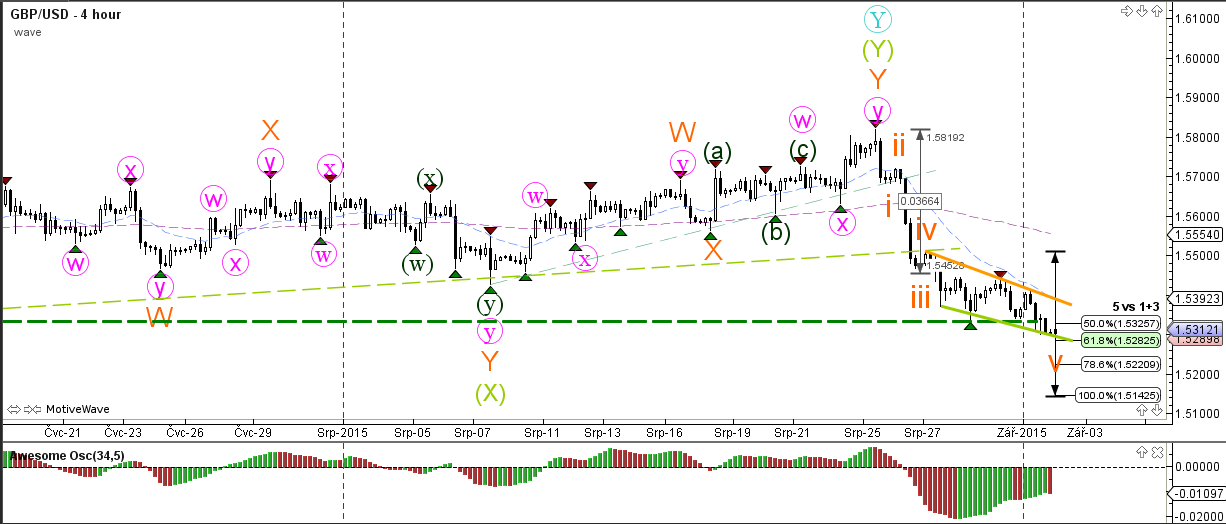

GBP/USD

4 hour

The GBP/USD price action is captured by a neat downtrend channel but it has reached the 61.8% Fibonacci target of wave 5 (orange). A break above resistance (orange) or below support (green) could trigger more momentum.

1 hour

Divergence is still present with the recent break of the bottom (purple).

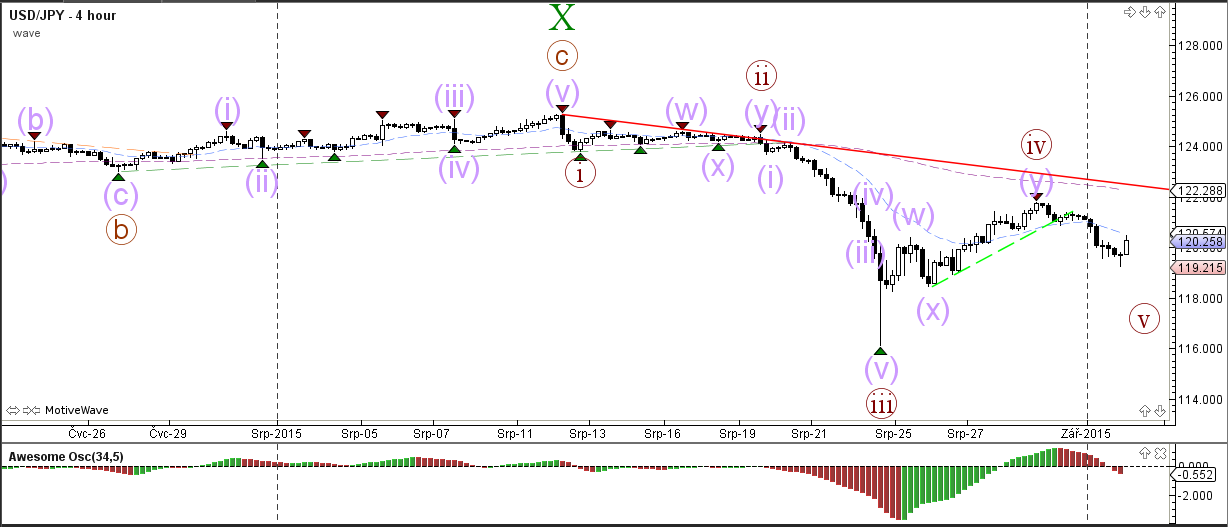

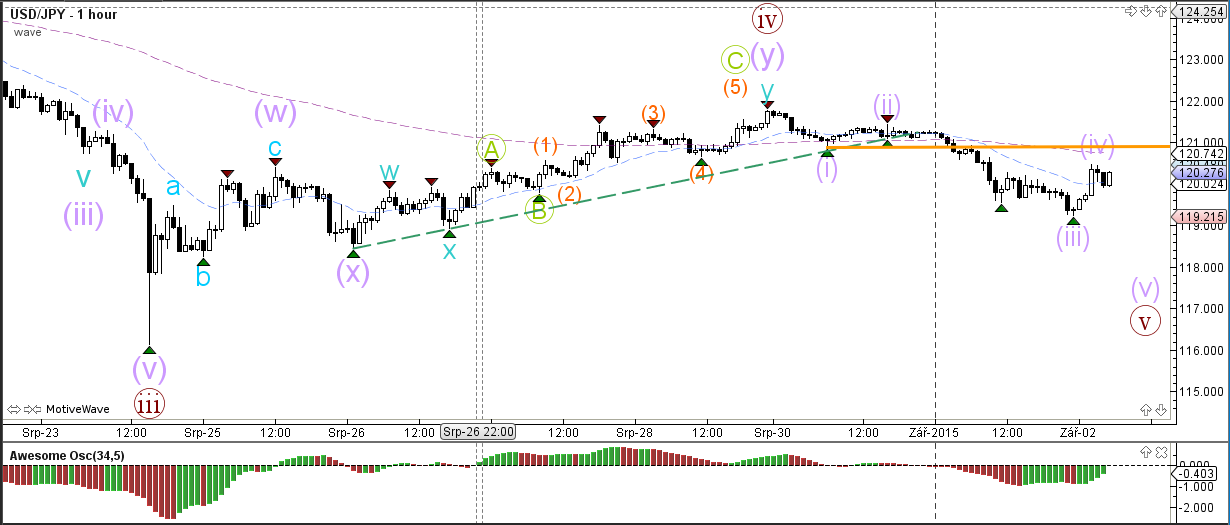

USD/JPY

4 hour

The USD/JPY had a strong bullish rebound which increases the chance of wave 5 (dark red) failing to break the bottom - especially when one considers the big wick on the bottom of the last week’s weekly candle.

1 hour

A break of the resistance (orange) indicates that a wave (blue) is invalidated. The alternative is a corrective wave pattern or a truncated wave 5 (failure to break the bottom).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 after the data from the US showed that private sector employment rose more than expected in April. The Federal Reserve will announce monetary policy decisions later in the day.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar holds its ground after upbeat ADP Employment Change data and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold consolidates losses below $2,300, eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to hold the policy rate unchanged amid stubborn inflation.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.