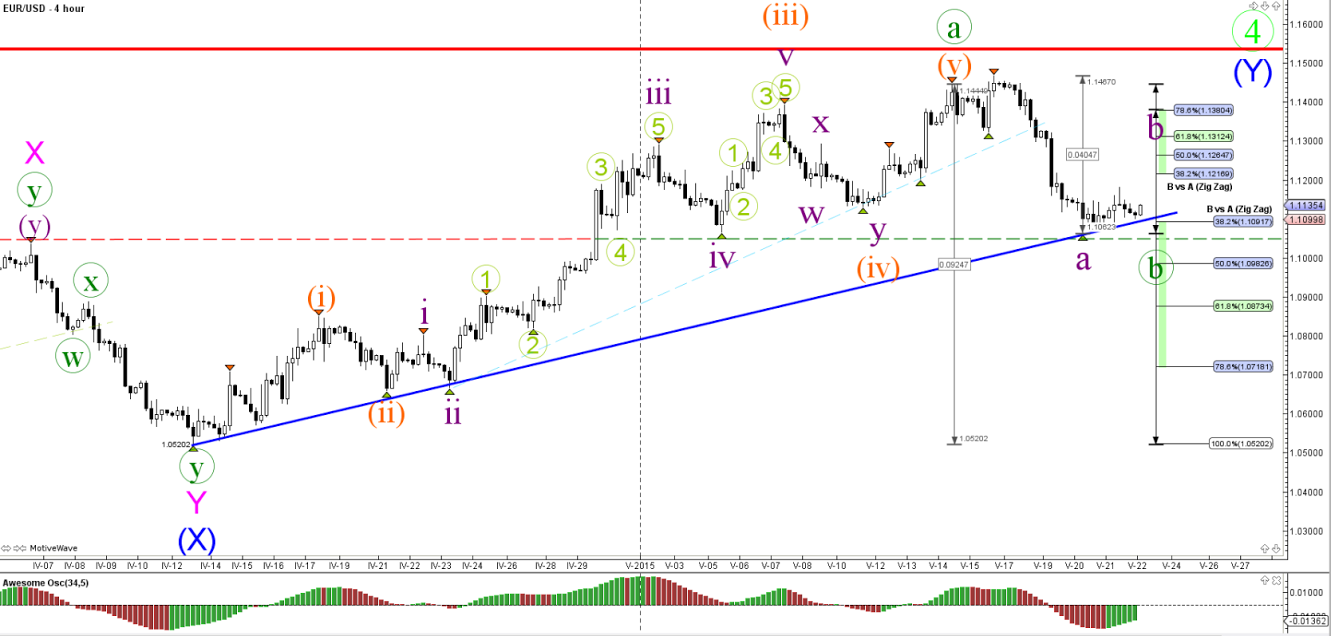

EUR/USD

4 hour

The EUR/USD bearish momentum was strong but price is currently unable to break below the support trend line (blue). This could mean that the wave B (green) has been completed OR that a bearish correction will bring price lower via an ABC (purple). Monday’s wave analysis will tell more about which one of the two seems more likely.

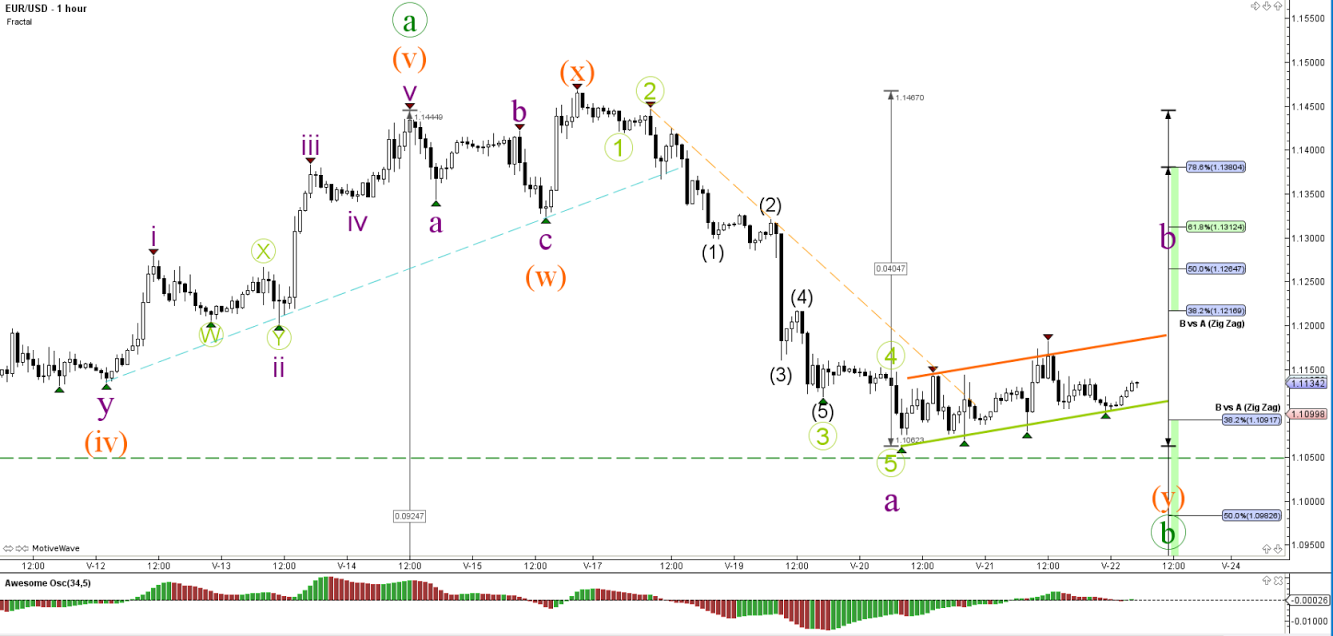

1 hour

A bearish break of support (green) could see price move to lower Fibonacci retracement levels of wave B (green). A bullish break might be choppy as resistance Fibs are nearby.

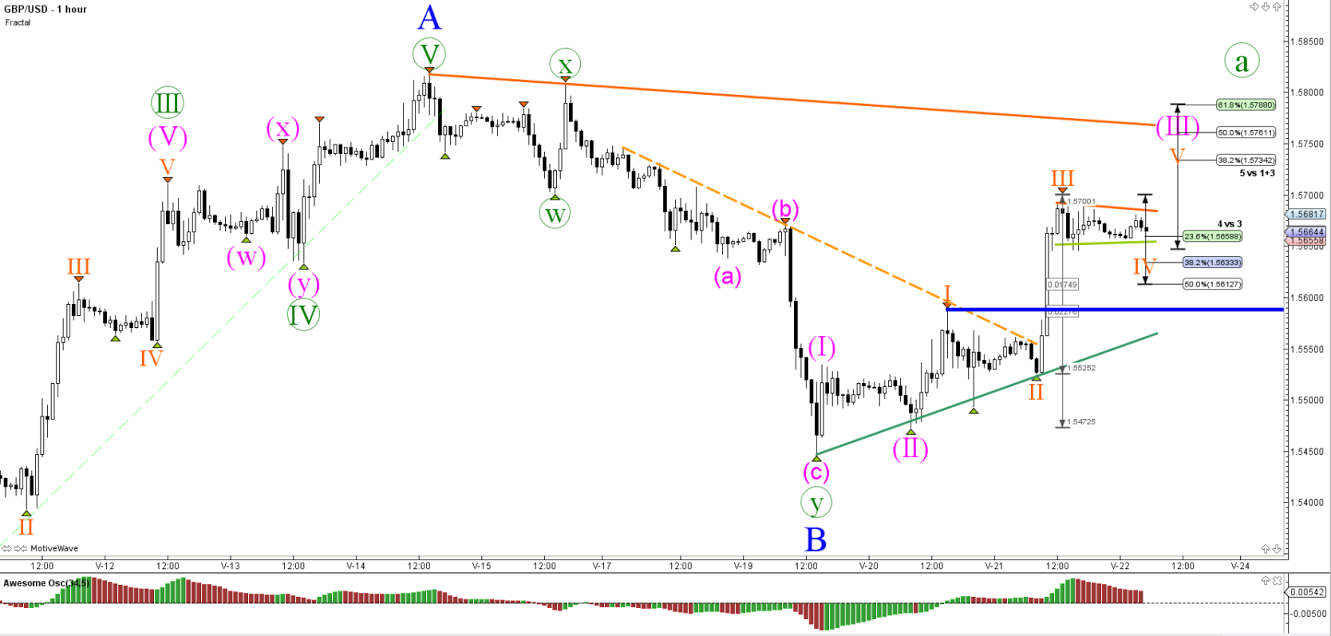

GBP/USD

4 hour

The GBP/USD has a strong bullish candle breaking above resistance (dashed red), which could be part of the wave C (blue).

1 hour

The GBP/USD made a bullish impulse and currently price is moving sideways which could be part of a wave 4 (orange). The impulsive 5 wave count is invalidated if price breaks below the top of wave 1 (blue line).

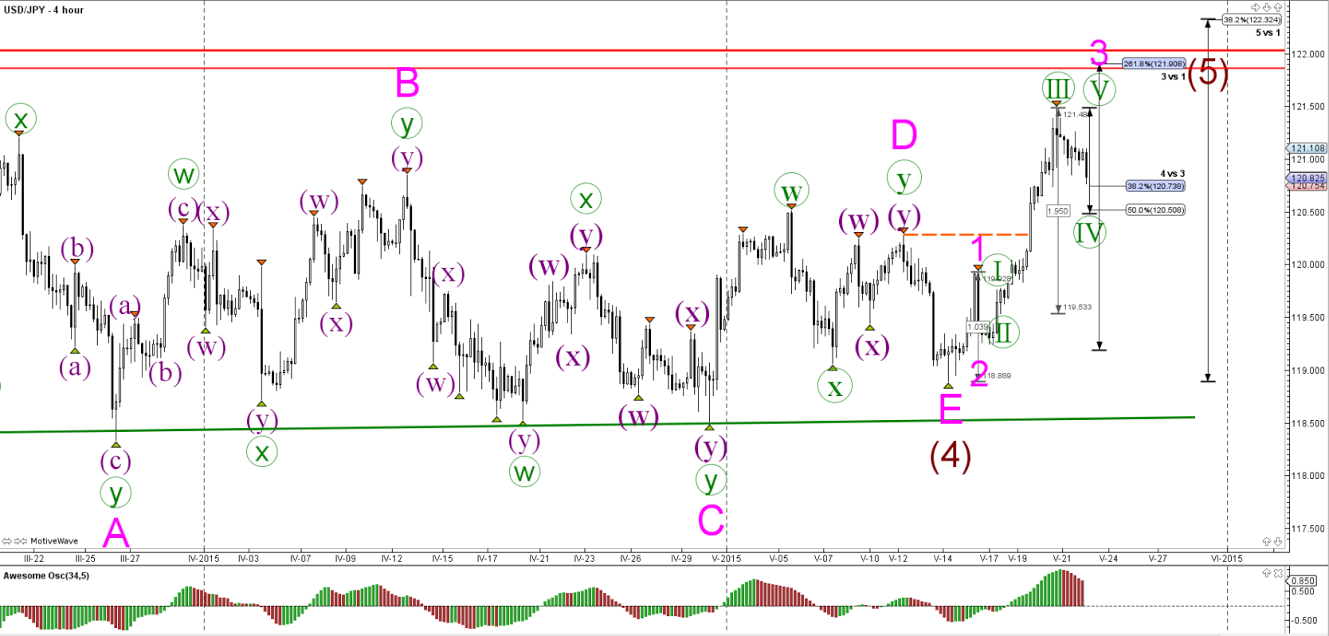

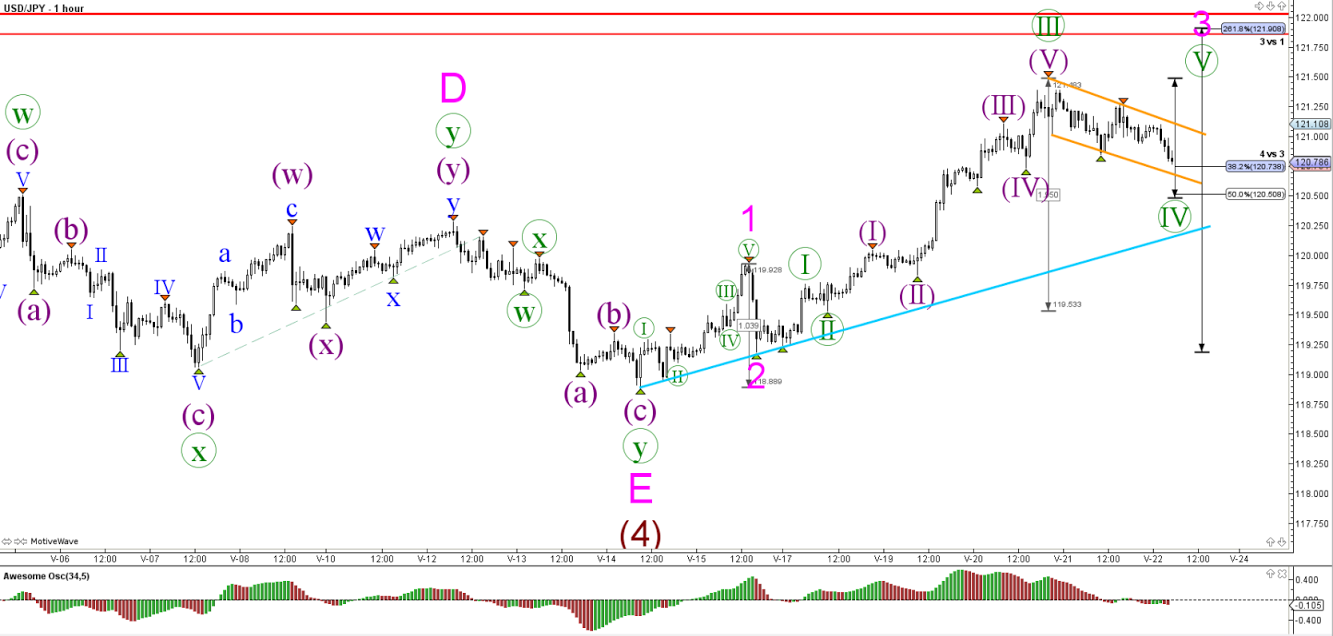

USD/JPY

4 hour

The USD/JPY is approaching strong resistance layers (red lines) and is currently moving lower, but this could be part of a wave 4 (green) which offers support at the 38.2% and 50% Fibonacci retracement levels.

1 hour

A break below the support trend line (blue) and bull flag (orange) invalidates the wave 4 (green).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.