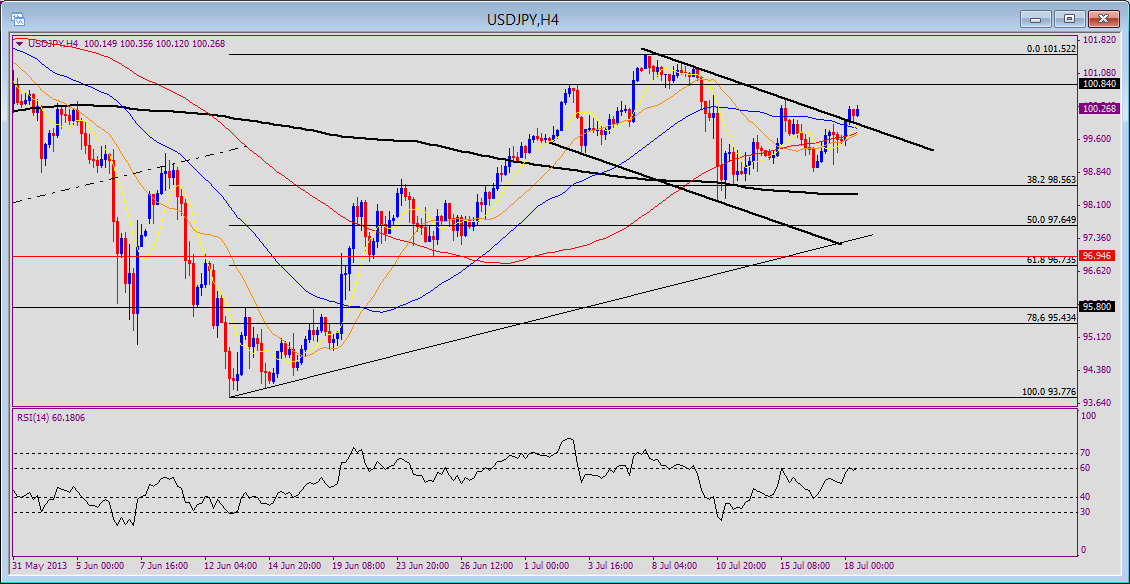

USD/JPY 4H chart 7/18/2013 8:45AM EDT

Consolidation: The USD/JPY has been in consolidation since hitting a high early July, at 101.52. The market retreated almost to the 98.00 handle before finding support. This consolidation has been held below a falling trendline that goes back to the 101.52 high. However price action going into the 7/18 US session appears to have broken this line, exposing the 101.52 high.

RSI, SMA: The RSI shows some initial bearish momentum as the reading fell below 30. This bearish momentum is being challenged now as the the reading tries to break above 60. If it can hold below 60, or come right back below 60 after a brief violation, the bearish momentum can be considered maintained.

The 200-4H SMA is flat, reflecting a sideways market in this time-frame. Price is above this 200SMA so there is a slight bullish bias. The other MAs are all converged, reflecting the consolidation so far in July.

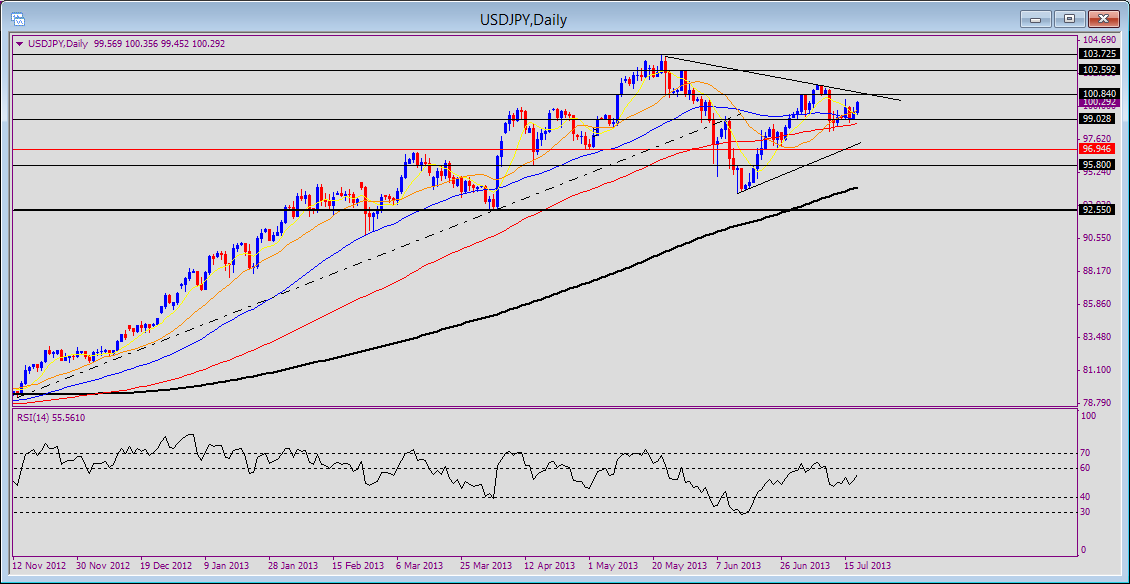

Upside: Because of non-trending conditions, we can anticipate some resistance around 101.50, but only for the very short-term. If you look at the daily chart, we can see that there is still some further upside toward the 2013-high around 103.73, especially because the bullish mode in the daily chart is still strong, though it has flattened relative to the pace before April, back to Oct. 2012.

USD/JPY daily chart 7/18/2013 8:50AM ET

The information used by ForexMinute.com including any opinions, charts, prices, news, data, Buy/Sell signals, research and analysis is provided as general market commentary and does not constitute any investment advice. ForexMnute.com is not liable for any damage or loss, including but not limited to, any loss of investment, which may be based either directly or indirectly on the use of or reliance on such information. Before deciding whether or not to take part in foreign exchange or financial markets or any other type of financial instrument, please carefully consider your investment objectives, level of experience and risk appetite. Do not invest more money than you can afford to lose.

Note that the high level of leverage in forex trading may work against you as well as for you. Please seek advice of an independent financial advisor if you are not fully aware about the risks associated with foreign exchange trading. Forex trading on margin involves considerable exposure to high risk, and may not be suitable for all investors. Global Invest does not endorse any companies, products or services which are represented on Forexminute.com The information on this website is subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure from RBA rate decision

AUD/USD spiked lower by more than 20 pips following the RBA rate announcement to test the key psychological support at 0.6600. Losing this key level could see the currency pair trek lower towards the 100-hour EMA support near 0.6580.

EUR/USD edges lower to near 1.0750 due to the upward correction in the US Dollar

EUR/USD snaps its four-day winning streak, trading around 1.0760 during the Asian hours on Tuesday. However, the Euro found support from higher-than-expected Eurozone Purchasing Managers Index data released on Monday.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.