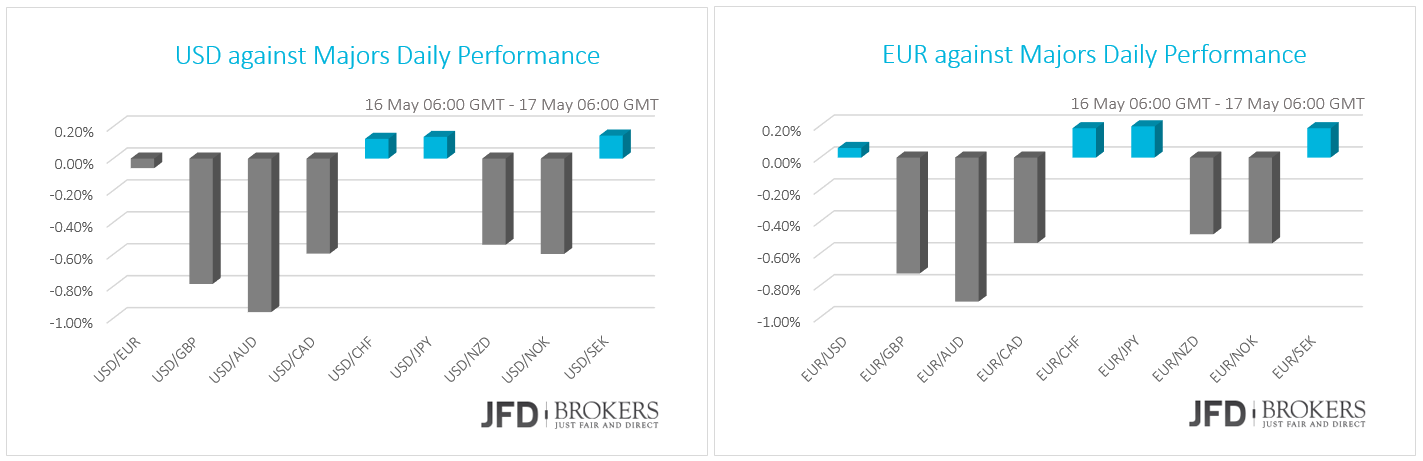

The greenback and the euro were traded lower against most of the G10 currencies while the pound surged versus the majority of its G10 peers. The Aussie rose sharply early on Tuesday, following the publication of the RBA minutes that lowered the possibility of a rate cut in June.Today is CPI day in U.S. and UK and later in the day, two Fed members Williams and Lockhart will speak to the public. In New Zealand, the Fonterra Price auction will take place while during the European night, the Japanese GDP growth will be released.

Euro fell on a quiet session

The euro fell against its major counterparts and remained flat against the U.S. dollar despite the absence of heavyweight economic indicators. In the morning today, Eurozone’s trade balance will be released, as well as the German Buba monthly report. Tomorrow Eurozone’s inflation report will hog the limelight and on Thursday, the ECB monetary policy meeting accounts will be published out of the construction output for March. Finally, on Friday, the Eurozone’s current account for March is coming out.

EUR/USD: Locked Gains at 1.1300!

The EUR/USD pair traded uneventfully for a second consecutive day, ending the day pretty much flat around the 1.1300 region, although it fell intraday down to 1.1280, a fresh weekly low. Many European markets were close due to the Whit Monday holiday, driving to limited price action during yesterday’s session.

However, few days ago, we had suggested the 1.1300 level as a target (http://bit.ly/27uj6Bb). The aggressive rally which started from 1.1615 forced the bulls to lose all the significant battles, including the 1.1500, as well as the 1.1360, as a result, the price to move further down, below the suggested target at 1.1300.

Going forward, according to yesterday’s report, we would expect further movements to the downside. The technical outlook favors the downside as in the daily chart, the technical indicators have turned sharply lower within the bearish territory. In the 4-hour chart, technical readings also favor a downward continuation, with the price extending below the 50-SMA, for the first time since mid-April, and pointing to a continued decline down to 1.1215. In addition, the 50-SMA, as well as the 200-SMA are now acting as a dynamic resistances around 1.1360 and 1.1400. Therefore, for now, we remain bearish targeting 1.1215. From there, a possible rebound should be accompanied with the break of the oscillators above their trend lines to confirm an upward trend and the end of the correction phase. Without that confirmation, we remain strong sellers.

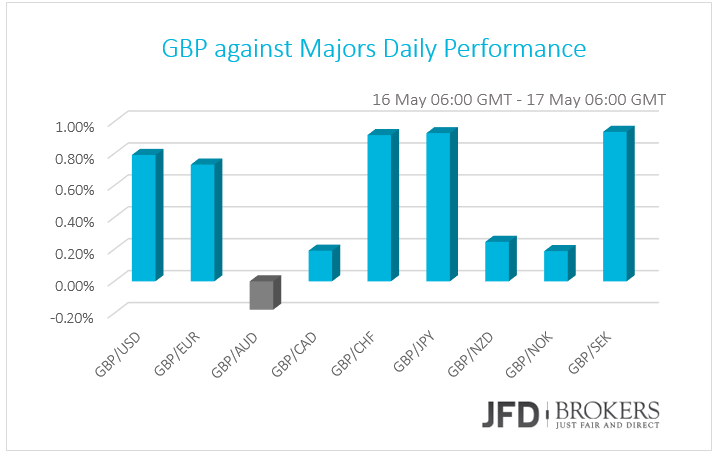

Pound is generally stronger ahead of the CPI report

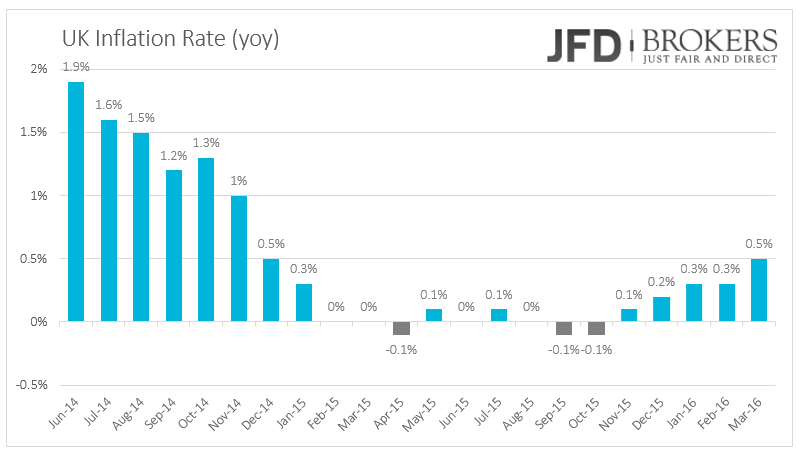

The pound was generally stronger on Monday and early Tuesday ahead of inflation report will be released today. No fundament news affected the currency yesterday and all the GBP traders will eye today the CPI figures for final April and tomorrow the employment report for the three months to March. On Thursday, retail sales indicators are scheduled for release. The inflation report, compared to the year before is expected to remain at the same level at 0.5% while compared to the month before the consumer prices are forecasted to have risen by 0.3% in April from an increase of 0.4% in March.

The GBP/USD pair has bounced modestly from the 23.6% Fibonacci level, near 1.4320, a significant area, as it includes the 23.6% Fibo level, the 4-hour 200-SMA and the ascending trend line which started back in February. Therefore, a near-term rally back to 1.4530 is certainly in play, but as long as sellers step in to defend that level and the top of the channel, the bears will remain in control.

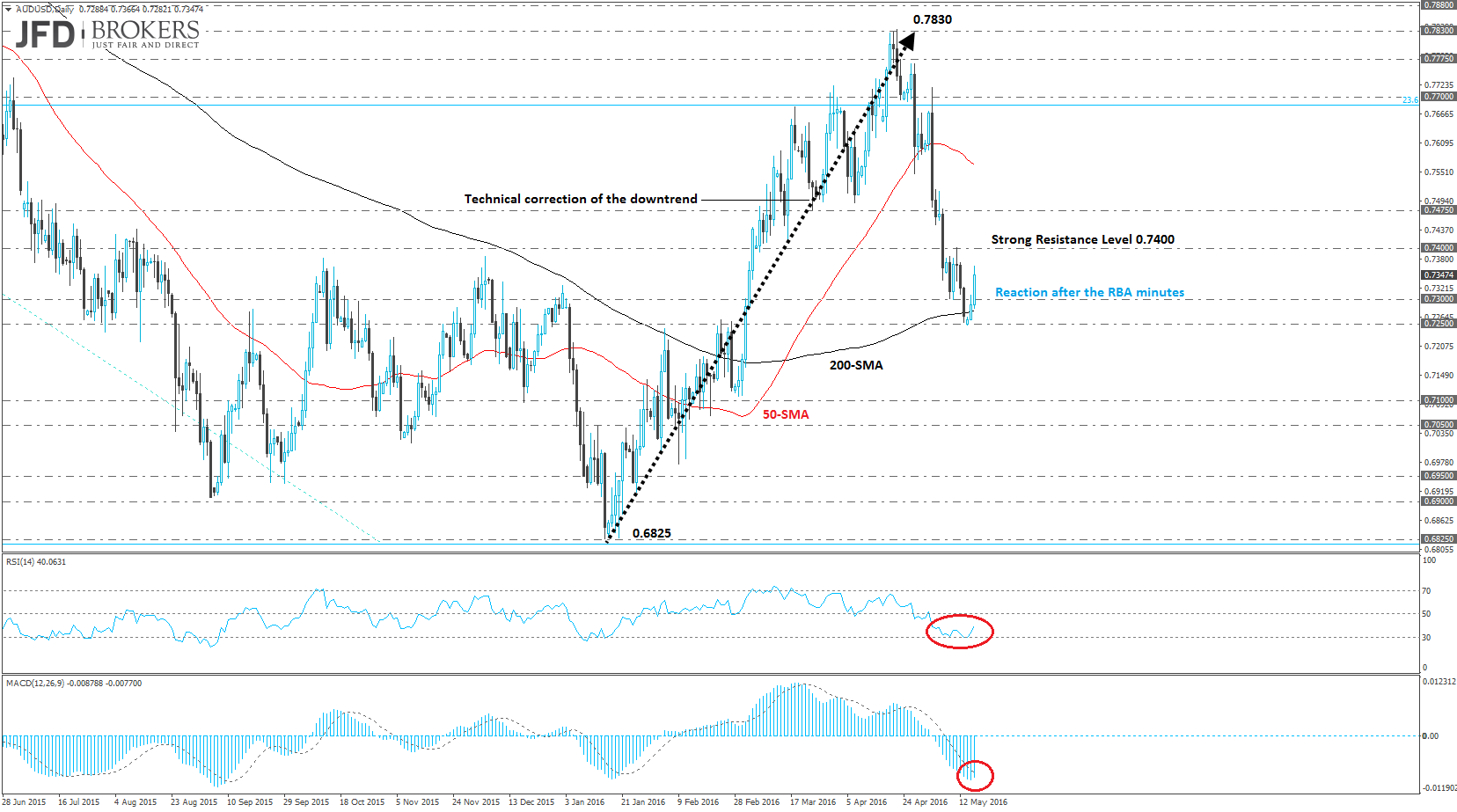

Aussie Surged as RBA Minutes lowers possibilities of a rate cut

The Australian dollar climbed after the release of the RBA Minutes which pushed the odds of another rate cut lower. In the last policy meeting in May, the central bank cut its benchmark interest rate 25 basis points to 1.75%. The minutes of this meeting released early in the morning today and dropped all the weight on the second quarter’s inflation rate for the trajectory of the interest rates.

The Aussie bulls gained some momentum and halted the aggressive rally which started from 0.7830 after minutes from their last RBA board meeting revealed some reluctance by members to cut the cash rate. The AUD/USD pair surged more than 1% after the RBA minutes to end the day above the significant level at 0.7300 and to close above the 50-SMA, near 0.7350.

The pair has an immediate resistance at 0.7400, and further gains above it should open doors for a further incline to 0.7475, a major static resistance. No clear direction on the daily timeframe, so medium-term holders can enjoy their pre-summer holiday’s while the short-term traders should watch the aforementioned levels.

BoJ will continue to make efforts for 2 inflation target; JPY plunged

The Japan’s top government spokesman stated early on Tuesday that if the country escapes deflation through the negative interest rates and the impact they have on spending and housing will benefit the domestic banks. In addition, according to the Chief Cabinet Gold Yoshihide Suga, Bank of Japan will continue to endeavor the 2% inflation target.

The USD/JPY pair has bounced modestly from the 105.52 low posted last Tuesday, however, so far the bulls are struggling to overcome the 50-SMA on the daily chart, near 110.00, a strong technical level. There will be a lot of economic data from the US and Japan in the next 24 hours which is likely to have a significant impact on the direction of the pair, including Inflation data, Industrial Production, Housing data, all from U.S. and overnight we get GDP data from Japan. If we see good figures in the U.S. data, then I expect to be a lot more pressure on the 110.00 level, with the pair currently stuck below it. The 110.80 level seems like a more likely reversal point for now and there I will place my target for interday basis. Also, keep an eye on the 111.80 level.

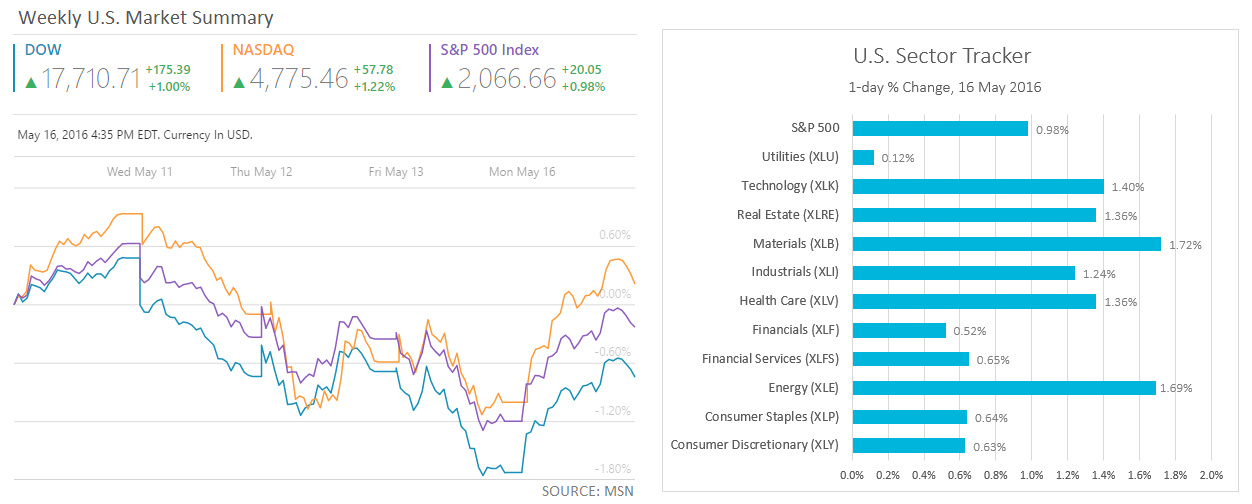

U.S. Indices Surged after Three Consecutive days of declines

Moving to the U.S. indices, the day for the U.S. stocks went pretty as the energy stocks and the tech shares rallied. After three consecutive days of declines, a sharp increase in oil prices and tech shares overshadowed the soft manufacturing data from New York and pushed the three most popular U.S. indices to close the day in green.

The Dow Jones Industrial Average dragged higher by Apple Inc. (NASDAQ: AAPL) after Warren Buffet’s took $1 Billion position in Apple. The blue-chip index added 175.39 points and ended the day 1% higher at 17,710.71 while the best performed blue chip stock for the day, Apple Inc. rose by 3.71%.

The Materials and the Energy related shared led the gains of S&P500 on Monday, as the two sectors rose on average by 1.72% and 1.69% respectively. The U.S. 500 surged by 0.98% or 20.05 points to 2,066.66 and closed above the 50-SMA on the daily chart. The high-tech index, Nasdaq Composite surged 57.75 points or 1.2% to close at 4,775.46.

What to watch today

During the morning, all the attention will be on sterling as the final UK inflation rate for April will be released. Compared to the year before, consuming prices are forecasted to have increased by 0.5% as in March, while compared to the month before the analysts forecasted an increase of 0.3% from 0.4% before.

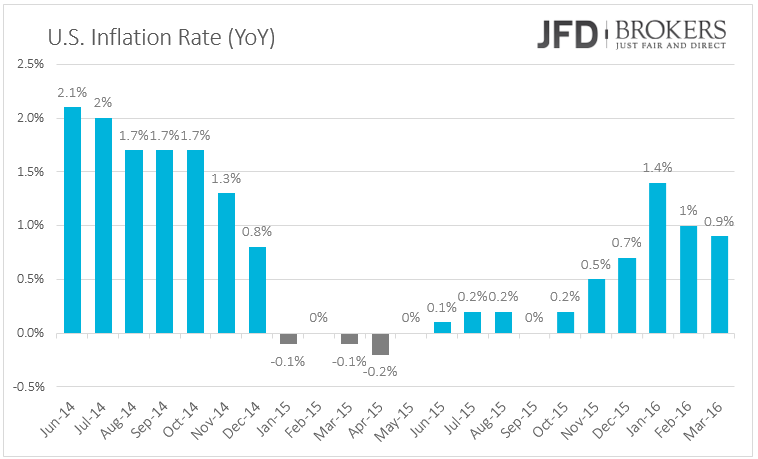

Other important economic indicators coming out are the producer price index input and output and the retail price index for April. In Eurozone, the trade balance for March will be released. Going to U.S., the final inflation rate for April will be published. The year-over-year indicator is predicted to rose to 1% from 0.9% before and month-over-month to jump to 0.4% from 0.1% before.

The U.S. manufacturing and industrial production of April, as well as the capacity utilization, are coming out. Overnight, Japanese economic growth for the first quarter is predicted to show an expansion of 0.1% QoQ against a contraction of 0.3% before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.