The epicenter of the markets during yesterday’s Asian session was the Australian and the Canadian dollar that both plunged versus the U.S. dollar and most of the other majors. The retracement of the oil prices led the commodity currencies to trade lower. Going to Europe, the single currency was traded broadly higher while the pound has been traded mixed against the majors.

Commodity Currencies Plunged Severely

The commodity currencies plunged during yesterday’s session after the U.S. dollar regained some ground after six straight days of declines. The U.S. dollar index was up 0.22% at 92.73, off the session’s 16-month low of 91.89. Meanwhile, the news came out for the economies of the three countries Australia, Canada, and New Zeland, in combination with the drop in the oil prices led the three commodity currencies lower.

The AUD/USD plunged more than 2% its biggest decline since August 2015. The RBA surprised markets on Tuesday by lowering its benchmark interest rate to 1.75% from 2.00%. Commenting on the decision, RBA Governor Glenn Stevens said the rate cut was based on last week's surprisingly weak inflation reading. The pair plunged below the daily 50-SMA, as well as below the key support level at 0.7550. Following yesterday’s drop, I will now be more confident about the continuation of the correction as soon as a break below the 0.7480 occurs. Nonetheless, the bias remains to the downside since the price lies below the 50-SMA and the daily MACD lies below both, its trigger and the zero lines.

The Canadian dollar was heavily affected negatively from the fall of the oil prices that last few days. The USD/CAD pair surged more than 2% during yesterday’s session following the strong rebound from the 1.2470 area. The pair gained more than 200 pips in a single day and it seems that it will gain more. The MACD is moving above its trigger and the RSI crossed above its mid-level suggesting further pressure to the upside. The 1.2770 level will be the level to watch for now as a break above there will open the way towards 1.2900. This is a significant level since it coincides with the 50-SMA on the daily chart.

The New Zealand dollar also plunged due to the drop in the oil prices but mainly due to the sharp drop in the dairy prices of 1.4% from an increase of 3.8% at the last auction. Moreover, the unemployment rate figure released overnight increased more than anticipated by the market adding further pressure to the currency’s exchange rate. NZD/USD collapsed during yesterday’s session following the failed attempt above the 0.7050 barrier, a level that has been retested in the past but failed to move above it. On the 4-hour chart, the price managed to escape from the 50-SMA and found support at the 200-SMA, around 0.6900. At the same time, the MACD turned bearish as it fell below its zero line while the RSI is moving aggressively lower suggesting further losses. The next level to watch, in case of a further selling pressure, will be the 0.6830 barrier, which I think we could take out easily.

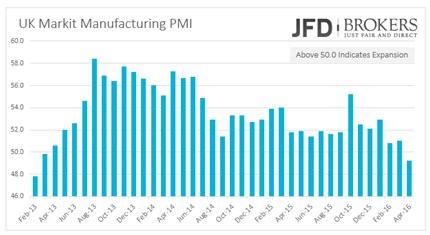

UK Manufacturing Activity Contracted for the first time in 3 years

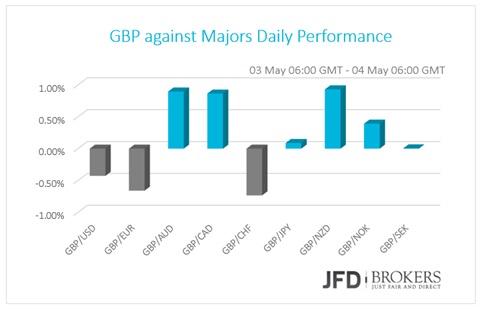

The UK manufacturing activity declined for the first time in three years according to the Markit PMI Survey. The figure came out at 49.2 for April, below 50.0 that indicates falling output, adding to fears over the economy’s strength. Despite the disappointing data came out, the British Pound has been traded mixed against the other currencies on Tuesday and early Wednesday.

The GBP/USD pair suffered an aggressive fall yesterday, and if we include the decline that was seen in the post NY noon trading session, the slide in prices from peak to trough within the past 48 hour period would be greater than 300 pip drop - a significant decline by any measure. The pair fell more than 0.8% during yesterday’s session the biggest fall since April 01 when the pair experienced a fall of 0.90%. Yesterday’s drop matches well with the bearish risk trend that was seen during the early Asian session which was carried into the European and American trading sessions which saw European stocks falling yesterday – finished at the lowest level the last 3 months –, suggesting that the decline may be inspired by the loss of market confidence. Near the 1.4800 area, the 50-SMA on the weekly chart has provided a strong resistance to the price action, preventing any moves above that area during yesterday’s session. At the moment writing, the price is increasing the attempts to break below the key support level at 1.4520. Having in mind the above, I would expect the price to fall further and to test the 1.4320 area, where the descending trend line and the 200-SMA could provide some support for now.

USD/JPY – Technical Outlook

The USD/JPY pair continued moving higher, breaking above the 107.00 level this morning. Following the aggressive sell-off which started from the 111.00 area and the aggressive rebound from the 105.50 barrier, it seems that the pair has entered the correction phase. If that’s true then we should see a further buying pressure in the near term which could push the price higher and towards the 108.00 area. There, the 50-SMA on the daily chart could provide some resistance to the bulls, but I do not expect the pressure to be strong. Therefore, we remain USD bulls, targeting the ultimate level at 108.00.

U.S. Dollar Soared; Euro Broadly Higher

There was limited news out yesterday to affect the shared currency however, it was traded broadly higher while the U.S. dollar has recorded significant gains against all of the G10 currencies following Fed members statements and better than expected Economic Optimism for May.

The EUR/USD pair has been trading within an upward formation over the last couple of months or so, following a strong start to 2016. It is very significant that the bulls managed to maintain the pair above the ascending trend line and the 50-SMA on the daily chart. During yesterday’s session, the pair gained some momentum and surpassed the psychological level at 1.1600 but failed to sustain its gains and retraced to end the day negative. The 1-hour chart in the pair shows price limited below a slightly bearish 50-SMA while indicators are pointing lower in positive territory, keeping the pressure to the downside. Any move to the downside will be seen as a technical correction of the recent uptrend. Therefore, the next level to watch to the downside will be the 1.1400 – 1.1410 zone.

Nevertheless, the 1.1600 level continues to prove strong, since it coincides with the upper boundary of the upward sloping channel and only a clear break through it should favor a continued slide towards 1.1700.

Oil Prices Extended their Losses

Oil prices extended their losses on the news that production has increased in the Middle East and the North Sea. West Texas Intermediate (WTI) futures were at $44.14 following the failed attempts higher above $47.12 while Brent crude was at $45.10 in early trading. Both had fallen more than 40 cents from their previous closing price. Technically, following the aggressive fall below the $45.00 level we would expect the oil prices to stabilize for a while and then to continue south. Looking on the daily chart, the indicators are turning negative, even though in positive territory, and the next area to watch for the WTI will be the $40.00. This is a significant area since it coincides with the 50-SMA and the 200-SMA on the daily chart.

Economic Indicators

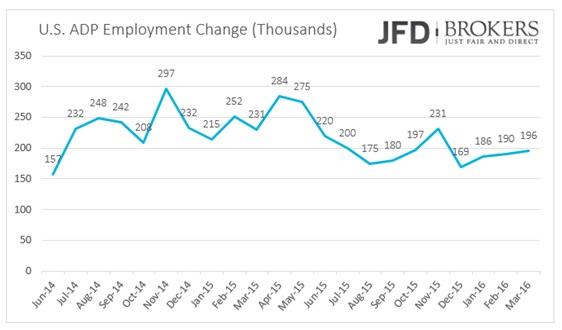

Today, the Markit Services PMIs for numerous countries including U.S., UK, Germany, France and Eurozone as a whole will complete the Markit Composite PMIs for the respective countries for April. Eurozone’s Retail Sales for March will be released as well.

Going to U.S., the ADP Employment Change for April will be closely eyed, two days ahead of the Non-Farm Payrolls report. In addition, the Trade Balance and the Factory Orders for March as well as the ISM Non-Manufacturing PMI for April will be out. Overnight, Australian Retail Sales for March and Trade Balance as well as Export and Imports for March are coming out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.