Dollar Fades on Profit-Taking; Pound Recovers; Dow Dives into a Negative Territory

With very little on the economic calendar at the start of the trading week, major currencies have been generally quiet as the dollar saw some modest profit-taking after the gains on Friday. Last week’s surprisingly NFP report, which came much stronger than expected, boosted bets on a December Federal Reserve rate hike. However, the Fed is likely to remain under pressure as long as this month's payrolls gain are not reversed next month.Note that it was the strongest monthly increase in payrolls this year. The unemployment rate plunged to 5% in October from 5.1%, the lowest level since April 2008, while average hourly earnings rose 0.4%, the largest increase since July 2009.Sentiment has clearly shifted towards the dollar bulls, as the EUR/USD pair remains in a very well-defined downtrend, and if the euro buyers fail in the upcoming weeks to support the euro will then call for a EUR/USD parity by 2016 and 0.8000 by 2017. For now, and for the next couple of weeks the significant and psychological zone of 1.0460 – 1.0500 zone will be in focus.

Dollar slightly down in early trading as investors take profits

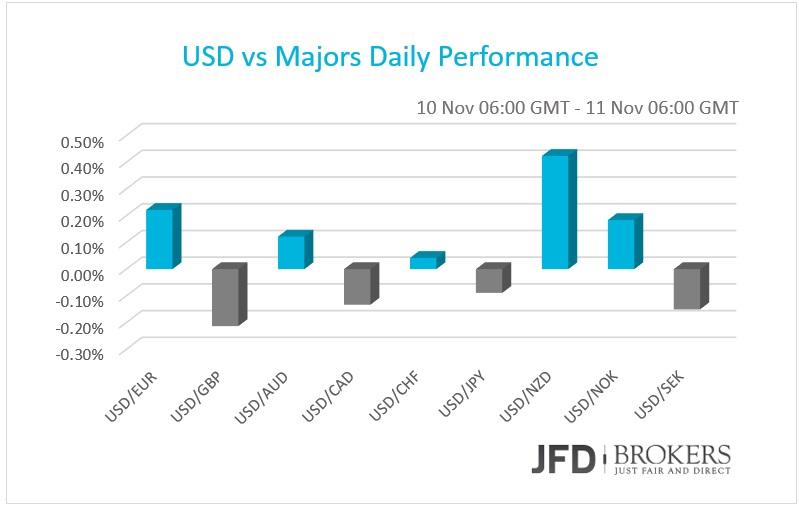

The dollar traded mixed against its other G10 counterparts as it was significantly higher against the NZD, EUR and NOK, but in early-morning it had lost some of those gains against the latter currency. On the other hand, the USD fell slightly against the GBP, CAD, JPY and SEK. The JPY fell during the Asian session against the dollar after Japan recorded a current account for a 15th consecutive month while its current account surplus more than quadrupled in the six months to September.

Euro remains under pressure; Pound recovered above 1.5100

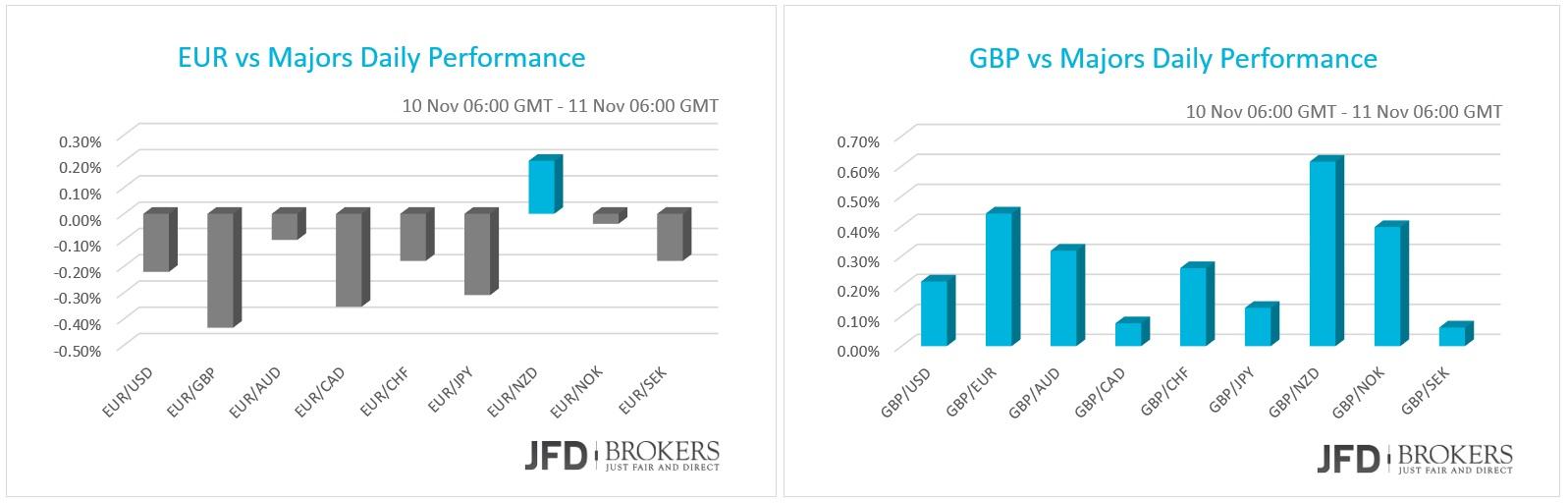

The single currency plunged Monday and early Tuesday, falling more than 0.2% against the greenback and more than 0.4% vs the pound, with only NZD showing any significant weakness vs the euro. During yesterday’s trading day, the euro appreciated against the U.S dollar, but the rise in the currency rate of EUR/USD has not been significant. The bulls were even unable to pressure the prices towards the resistance at 1.0800. We expect during the today’s session the pair to continue its declines towards the key support level of 1.0700.

On the other hand, the pound strengthened against its G10 currencies, recording its biggest gains against the NZD, EUR and NOK. Traders are now looking forward to UK employment data due tomorrow. Better than expected numbers could lead to a short squeeze in GBP/USD, with 1.5240 being the key level to the upside while the 1.5030 is the level to watch to the downside. Moreover, the 50-SMA on the 1-hour chart is providing a significant support, for the time, slightly below the psychological level of 1.5100.

German trade surplus shrinks in September

In other news, Germany, the largest economy in the Eurozone, continues to post soft numbers.Germany’s trade surplus narrowed to 19.4 billion euros in September from a revised 19.6 billion euros in August. Ina sign of solid domestic demand, imports grew by 3.6% while the exports surged by 2.6%, after suffering their steepest drop (-5.2%) in almost seven years in August. The current account balance showed a surplus of 25.1 billion euros in September; above economists' forecasts of 21.9 billion euros.There was no market reaction to the news. The EUR/USD held relatively steady above the psychological level of 1.0700, as well as above the key support level of 1.0730 – an intraday level.

OECD cuts world growth forecast

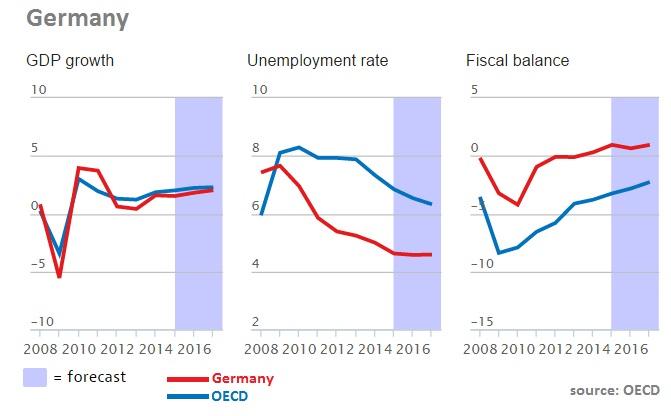

The Paris-based Organization for Economic Cooperation and Development (OECD) slashed its global economic outlook for 2016 amid 'deep concern' over slowdown. Global GDP is now expected to grow by 2.9%, down from 3% forecast in September, but will hit 3.3% in 2016. China was one of the few countries to collect a growth upgrade from the OECD as it raised its 2015 to 6.8% from 6.7% while is expected to remain unchanged at 6.5% in 2015 and to slow by 0.3% to 6.2% in 2017.

OECD key 2015 growth figures:

Global GDP 2.9% | 2% in world trade | US GDP 2.4% | China GDP 6.8% | UK GDP 2.4%.

European stocks ended the first trading day of the week in the red after the OECD slashed its global growth forecast. It expects the German GDP to remain stable in 2015 and to jump to 1.8% and 2.0% in 2016 and 2017, respectively. German unemployment is expected to continue to decline in 2016.

USD/JPY Bullish momentum is still strong

The dollar is looking bullish against the yen over the last couple of days, following the aggressive buy above the key level of 121.75. The Japanese yen was already under pressure after the pair found a strong support at the psychological level of 120.00, where the daily 50-SMA has provided a strong support to the bulls! The pair saw significant gains following the break above the 200-SMA, adding roughly around 200 pips in 2 days. The daily chart shows that the bulls are under strong momentum driving the price back above the 123.00 area. With the above in mind, I would expect the buying pressure to continue and the bulls to challenge the next resistance level at 123.70, in the next few hours.

DXY in consolidation!

The DXY has started the week with a slight decline below the 99.00 support level, however, in early Tuesday the ICE US dollar index gained momentum and is now trading above the latter level. The bullish trend remains, but we believe that the prices will consolidate or even retrace some of the last week gains before the rally continues. Probably we will see a trading range between the 98.80 and 99.45 as a breakout above 99.50 will be a sign that bulls will continue to pressure.

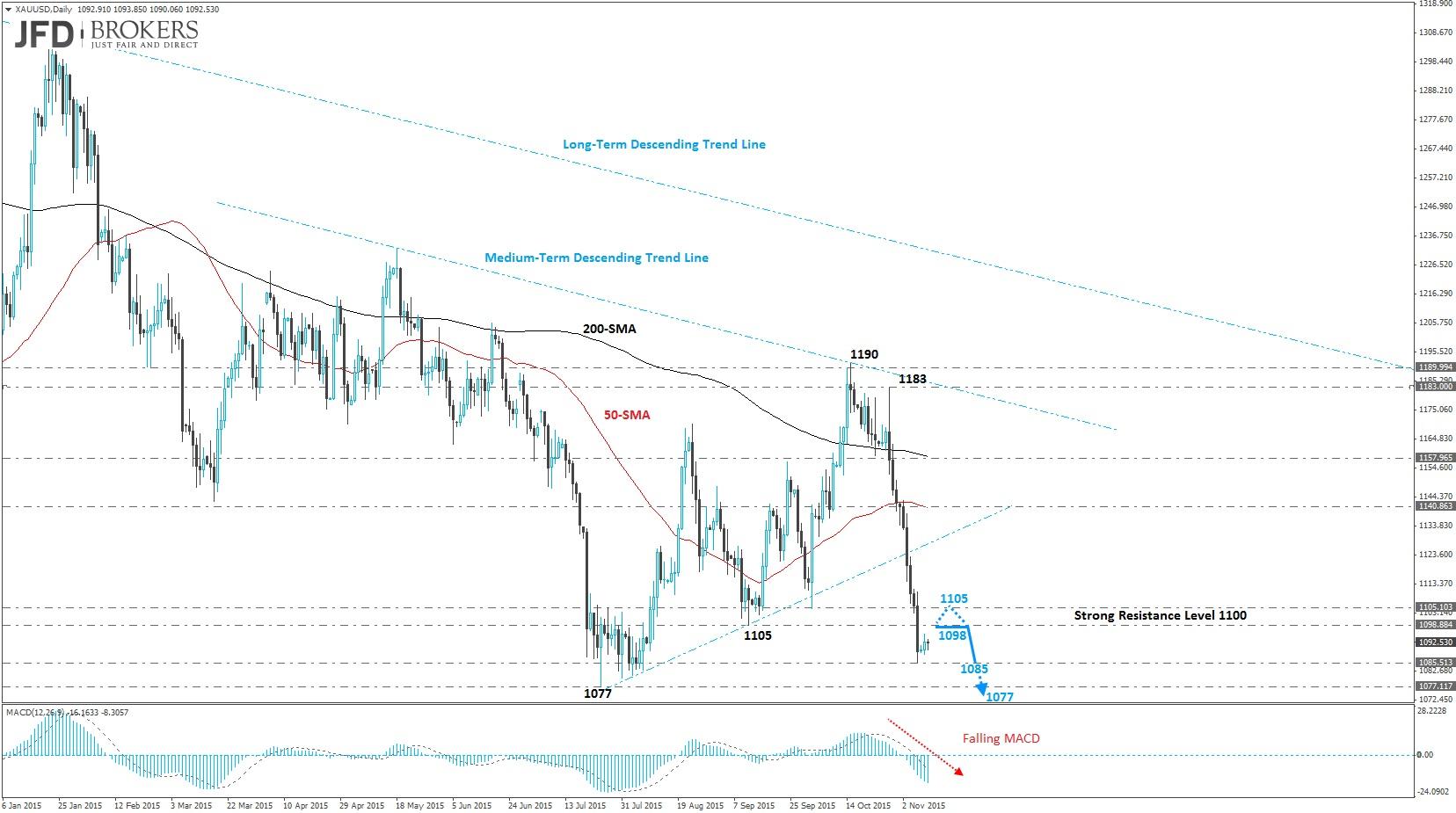

Gold plunged more than 4% during yesterday’s session

Gold has been traded in a very rapid downtrend during the last couple of weeks as it plunged more than 7% since mid-October. The bearish move in the yellow metal has correlated with the rise in the USD/JPY pair, technically, and fundamentally on expectations that the Fed will raise interest rates before the end of the year following the US employment report on Friday. The precious metal is likely to go for some retracement, but first we believe that the prices will head towards and test the main support zone at $1,080 and then the key support level of $1,077, a 5-year low. However, given the price structure we believe that the strong downtrend will remain intact after a consolidation.

WTI Crude has been unable to keep up a bullish stance!

The WTI Crude has not been able to keep up the rally and the prices rebounded from the main descending trend line. We expect the prices to continue depreciating towards the key support level of $43.00, which also coincides with the lower boundary of the sideways channel which started back in mid-August. A daily close below that level will be a sign that further declines are going to take place towards the support level at $40.00 per barrel. The 50-SMA adds to the bearish picture since is moving below the 200-SMA on the daily chart, as well as on the 4-hour chart.

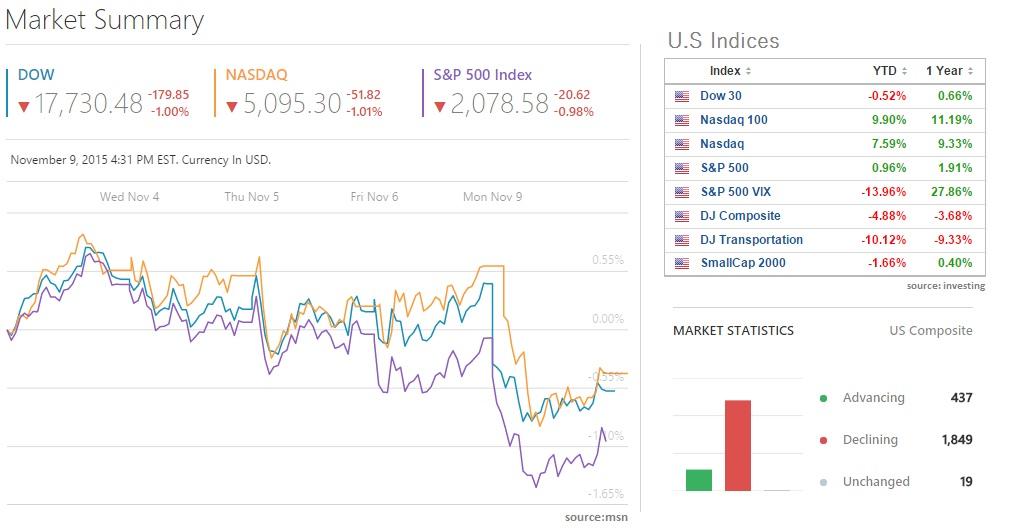

Dow Jones dives into a negative territory for 2015

U.S. stocks edge lower in yesterday’s session with Dow falling more than 179 points (-1%), while Nasdaq and S&P 500 also fell about 1%. All of the U.S indices plunged more than 1% as investors worried about a potential U.S. interest-rate rise and the health of the global economy. After Monday’s session, the Dow Jones index is down 0.5% for the year.If yesterday’s buying pressure continues, I expect the index to challenge the 17500 level, which coincides with the daily 200-SMA. For now, the 17965 – 18000 zone is proving a significant resistance to the bulls and it will need a lot of effort from the bulls to break above there.

Economic Indicators

Today, a Eurogroup meeting will take place. In the morning, the UK inflation report hearings is expected to confirm the slashed forecasts of the BoE quarterly inflation report that released the week before.

In US, the NFIB Business Optimism index will be out as well as the export and import price indices for October. Moreover, the Wholesale inventories for September will be released and forecasted to have grown steadily by 0.1%.

Later in the day, the RBNZ Financial Stability Report will be followed from a press conference from the RBNZ Governor Graeme Wheeler and may have a significant impact on the local currency.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.