US Stocks Extend Losses; Gold more than 1% Lower; China Eased Monetary Policy

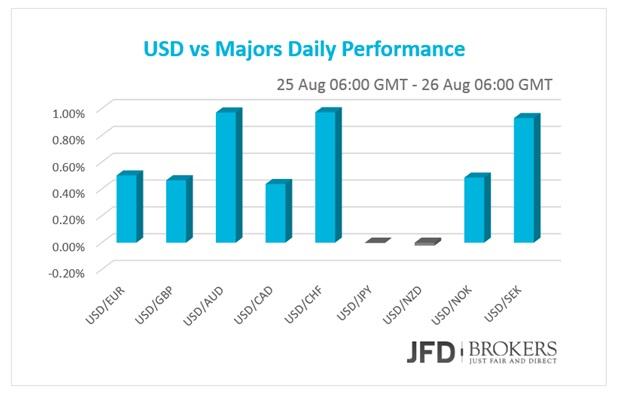

The dollar pared gains on the back of the US stock markets that erased advances after China’s interest rate cut following the unprecedented losses of Monday’s stocks and equities plummet. The greenback rose versus all of the other G10 currencies while the Japanese Yen and the New Zealand dollar were virtually unchanged.The Japan’s currency as the Ministry of Finance official stated gained momentum sharply and hit a seven-month high. The New Zealand’s dollar covered some of its earlier losses created against the buck after the release of the country’s Trade Balance that reached a nine-month low. The NZD/USD pair moves sideways hovering around 0.6500 level.

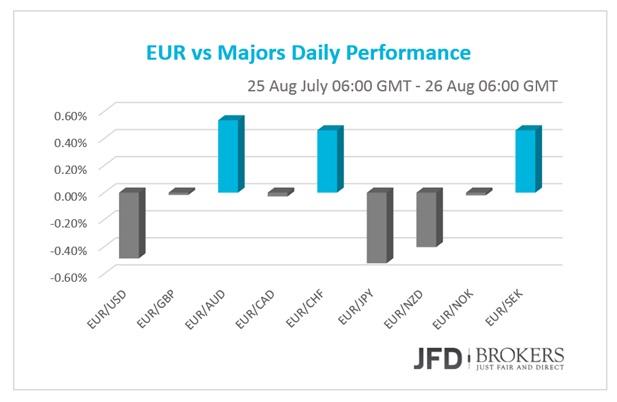

Euro mixed vs the majors

The shared currency was traded mixed against the major currencies on Tuesday and early Wednesday with Germany’s GDP growth in the second quarter meeting estimations and IFO Survey being optimistic. The German economy advanced by 0.4% quarter over quarter as anticipated. The IFO Survey revealed that August’s Business Climate, Current Assessment, and Expectations surpassed initial forecasts. The EUR/USD pair had a side way session within a fairly range between 1.1400 and 1.1600. More choppy trade looks set to be in store, where the topside is currently remains capped by the 50-SMA, slightly below 1.1600, on the weekly chart.

A similar picture prevails in EUR/GBP. Following the aggressive buy, after it rebounded from the 0.7050, which coincides with both the 50-SMA and the 200-SNA on the 4-hour chart, the pair gained more than 3% the last couple of weeks. On the downside, the 200-SMA is ready to provide a significant support to the price action near 0.7260 in case of a pullback while the 50-SMA on the weekly chart is preventing the bulls for moving further up.

GBP failed to sustain its earlier gains

The dollar did manage a recovery after the pound touched the psychological level of 1.5800, but it has been unable so far to sustain its strength as the pound recovered some ground early Wednesday. The GBP/USDpair found a strong support near 1.5680, where the 50-SMA on the 4-hour chart provided a strong support to the bulls, at least for now. The medium outlook though remains mildly positive, so eventually a return to 1.5930, July high, would not surprise. Going forward, it is a quiet week with regards to UK economic releases, with hardly any major updates that have the potential to trigger volatility in the sterling against its G10 peers.

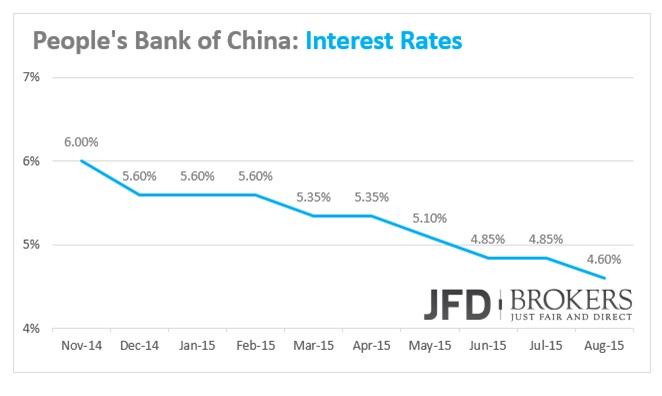

China cut Interest Rates

The newspapers headlines continues to be dominated from China’s Central Bank eased its monetary policy for the fifth time in less than a year to calm down the Stock’s Market free fall. However, the People’s Bank of China governor is under pressure to ease monetary policy further. After the announcement of the rate cut the Shanghai Composite index picked up by 0.68% for the first time after four days but the index’s performance since Monday. However failed to sustain its gains and continues to extend its losses.

Japanese Yen affected severely from China’s rate cut

The USD/JPY pair came back above the psychological level of 119.00 as demand for safe haven diminished, following the Chinese rate cut. The pair rose 0.39% on Tuesday and is trading 0.60% up early Wednesday. A weaker yen means investors are seeking more risk as the currency is seen as a safe-haven asset, held in times of uncertainty. The pair is attempting to break above the key resistance level of 120.40, which could be a key level to watch out for today. On the downside, the psychological level of 118.00 will be a key level for the next few days.

Other news from US

The other news released on Tuesday from US surprised the market on the downside. The first Markit PMI estimate for the expansion in the services sector in August was smaller than the awaited increase. The preliminary Markit Services PMI market was expected to rise to 56.0 from 55.7 before, but the survey results disappointed and came out just 55.2. The Richmond Fed Manufacturing Index fell to four-month low at 0 in August while it was anticipated to ease to 9 from 13 the preceding month.

The economic indicators that came out on Monday revealed a strong improvement in the Housing Sector but less than the anticipated estimates. The New Home Sales advanced by 5.4% to 507K in July following a soft performance of -7.7% before. The Case-Shiller Home Price Index rose by 5.0% in June below forecasts of 5.1% while the Housing Price index for the same month is at a nine-month low of 0.2% missing expectations to have risen by 0.4%.

GOLD plunged more than 1%

The precious metal plunged more than 1% the last 2 days after a recovery in global equities following China's move to cut interest rates. On early Wednesday, the precious metal booked a second consecutive day of declines after recording a one-month high above the key resistance level of $1,160. Looking at the intraday chart, I would expect the sellers to push the price further down and totes the key support level at $1,127, slightly above the 50-SMAon the 4-hour chart. On the GOLD plunged more than 1% The precious metal plunged more than 1% the last 2 days after a recovery in global equities following China's move to cut interest rates. On early Wednesday, the precious metal booked a second consecutive day of declines after recording a one-month high above the key resistance level of $1,160. Looking at the intraday chart, I would expect the sellers to push the price further down and totes the key support level at $1,127, slightly above the 50-SMAon the 4-hour chart. On the upside, the next obstacle for the bulls will be the key level of $1,160. A break above here, then it could open the way towards the psychological and critical $1,200 level.

U.S. Indices

The Dow Jones industrial average and the S&P 500 closed lower after rallied 3% up earlier, recording the biggest rally reversal since 2008. The Dow Jones ended down 1.3% at 15,666.4, 205 points down, with the S&P 500 dropping 1.4% to 1,867. 6 and the tech-heavy Nasdaq losing 0.4% to 4,506.49. The Walt Disney Co (NYSE: DIS) and the Apple In (NASDAQ: AAPL) were the two blue-chip stocks that achieved to close the trading session up by 0.72% and 0.45% respectively.

Technically speaking, the Dow Jones index found a strong support from the 200-SMA, on the weekly chart, near 15257 and pared back some gains. On the downside, the index is currently supported by the 15579 level. A decisive break below the latter level would be very bearish and potentially prompt a more aggressive move towards 15257. A close below here would have suggested that the index had entered a new downtrend.

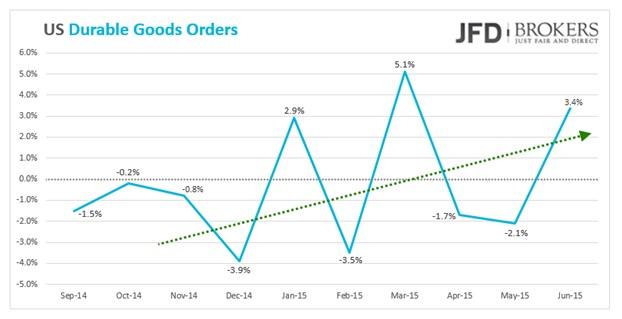

Economic Indicators

Today, the economic calendar is very light with the only noteworthy indicators are the UK Nationwide Housing Prices for August that will be released early in the morning and the US Durable Goods for July that will attract a lot of attention.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.