The Apple stock (NASDAQ: AAPL) lost more than 7% of its value in June and July while it is remarkable that the stock is running 2.36% negative in just the first trading day of the August. Apple fell to the third place in China’s rankings, the world’s largest smartphone market, according to data recently released by two market research firms.

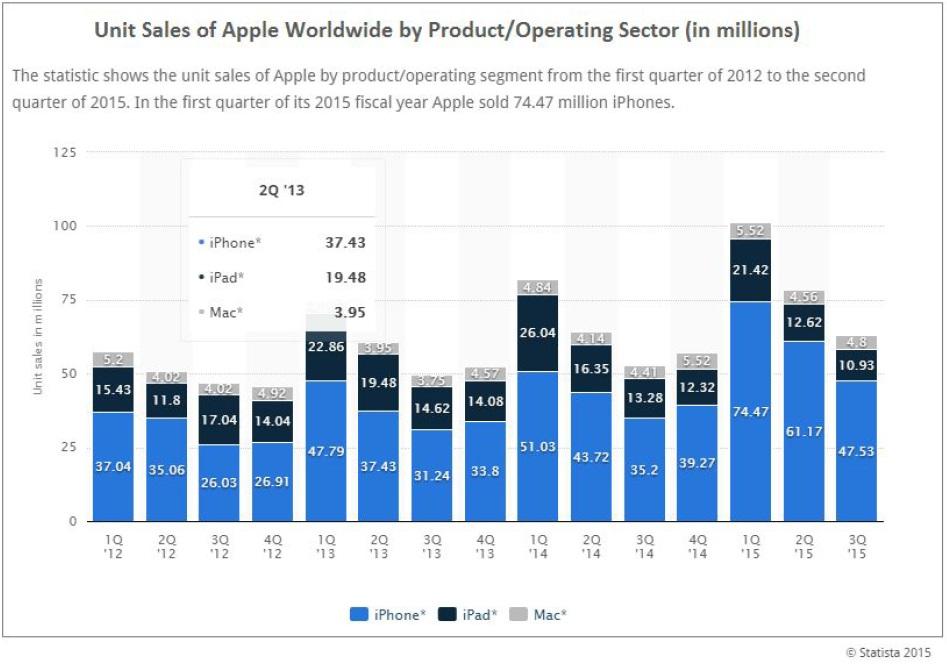

Apple Inc. used to have revenues increasing on a steep pace year by year raising the expectations even higher. But, at the last quarterly report the company missed forecasts causing a severe decline to the stock. The company missed its forecast for the iPhone shipment and revenues in the third quarter of 2015. The Revenues for its fiscal third quarter was $49.6 billion below of the average estimate of the company to be $49 billion to $51 billion driven again from the company’s cornerstone, the iPhone. However, the total revenues were 33% above the corresponding quarter in 2014. The Apple smartphone recorded sales of 47.5 million devices in the three months, April to June, by far above the sales recorded during the same months in the last year of 35.2 million iPhones. The company’s newest addition, the Apple Watch was unable to reach the break‐even point while its possibilities were “enormous” according to the CEO Tim Cook.

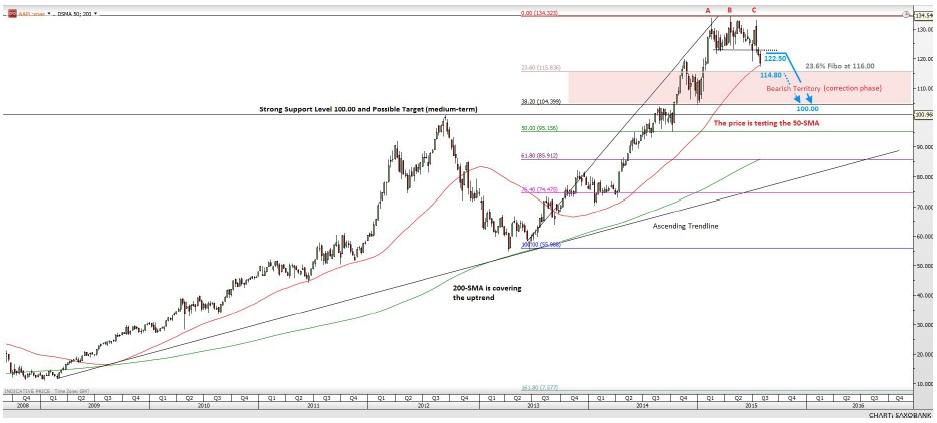

Bearing the above in mind, the stock came under pressure and fell below the 200‐SMA on the daily chart. At this point, it’s worth noting that the stock is trading below the ascending trend line which started back in mid‐October 2014 and the price is also below both the 50 and 100‐SMAs. In addition, the stock has been firmly capped below $135.00, having made several failed attempts at breaching that critical level. These failed attempt could be translated as a triple top formation which is a reversal pattern. However, we could see the bulls testing some significant levels, like $122.50, and then to start the downside/correction phase.

To confirm the reversal and the possibility of starting a correction the bears need to go through the 50‐SMA on the weekly chart as well as the 23.6% Fibonacci retracement level around the psychological level of $116.00. Such a move could easily spark a more aggressive run towards the ultimate price target and historical level at $100.00. Moreover, if we drop down to the 4‐hour chart, the bias turns negative since all of the momentum indicators are in a falling mode. In addition, the 50‐SMA dropped below the 200‐SMA suggesting a weaker stock in the near term.

Alternatively, if the share price starts to edge higher, having failed to break below the aforementioned levels, then I would be looking for a more aggressive move higher towards 133.00 which will trap the stock inside the previous range as highlighted.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.