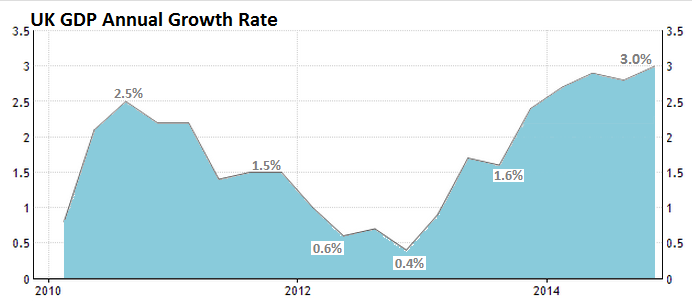

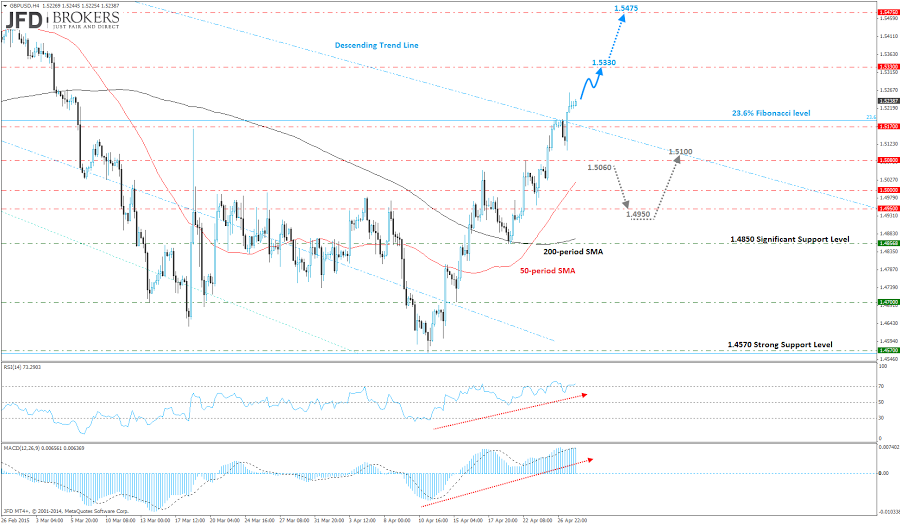

The British pound rose to its strongest level versus the greenback since beginning of March with yesterday’s rally taking the GBP/USD pair above the suggested target of 1.5170 (Daily Technical Analysis and Forecasts on 23rd April). This level is very significant as it includes the 23.6% Fibonacci level as well as the descending trend line which started back in June 2014. The move was largely driven by U.S. dollar weakness as demand for the greenback was limited. The dollar traded lower against almost all of its G10 peers during yesterday’s session and early Tuesday. All eyes will now shift to tomorrow’s Q1 UK GDP report as well as to Wednesday’s US monetary policy decision which could determine the medium and long term outlook for the pair.

From a technical point of view, the pound has been holding an upward trend against the dollar since mid-April. The GBP/USD pair has added more than 600 pips to its value following the strong rebound from the strong support level of 1.4570. The pound booked a second-consecutive week of inclines following the break above the 1.5170 level.

Bearing the above in mind, I remain bullish on GBP/USD, however, considering that a sharp volatility is expected within the upcoming short period, I will adjust my levels from a higher timeframe. Therefore, I will await for the price to test the 1.5330 level (probably triggering some more stops) before getting out of the market.

From thereon, I would expect the buyers to push hard, and if they manage to win the battle then they could send the price aggressively higher towards the psychological level of 1.5400. On the other hand, if we see the pair turning lower, which I do not foresee at the moment, support should be found around 1.5170, a previous resistance and a 23.6% Fibonacci retracement level. Going forward, if the 1.5330 level is broken, it would suggest that the pair is looking a lot more bullish (for further correction), prompting a more aggressive move towards the 1.5475 level.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.