The dollar was stronger against all of its G10 peers during Monday’s session and early Tuesday. The Australian dollar was the main loser followed by the New Zealand dollar.

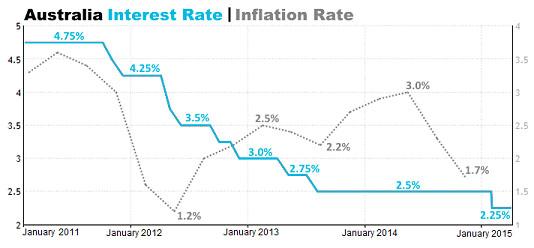

Australian dollar continuous to fall after the Reserve Bank of Australia minutes release since the Central Bank suggested a rate cut. The minutes justified the earlier decision taken in the month to keep interest rates on hold, saying that is done to achieve sustainable growth and to have inflation consistent with the target as the economy need some time to adjust to the earlier changes. The Aussie weakened further after the RBA Governor Glenn Stevens said he expects the currency to fall further. The Aussie bulls failed to hold their gains made the previous week against the dollar with the AUD/USD pair currently trading near the strong support level of 0.7680. This level is very significant since it coincides with the 50-period SMA as well as the 200-period SMA on the 4-hour chart. A dip below the latter barrier, could add further pressure on the strong support level at 0.7650 and thus, would open the way towards the psychological level of 0.7600. The Australia’s CPI for Q1 will be released overnight but is not expected to change significantly from the already low levels. However, the fall in the Australian dollar is likely to show up in the inflation rates soon.

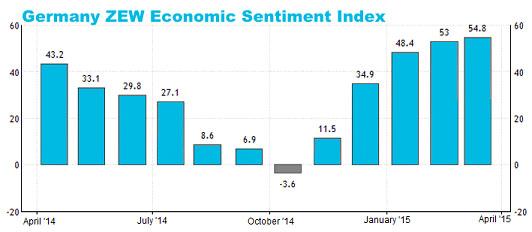

The shared currency was slightly lower against the greenback Monday and early Tuesday, after ending the week higher 1.91 percent against the buck, as the negotiations between Greece and its creditors remain at a standstill ahead of the crucial meeting on Friday. The EUR/USD pair violated the strong resistance level of 1.0710 few days ago, but the rise was halted by the 1.0850 level as well as the 50-period SMA on the daily chart. For the week ahead, investor sentiment data and PMI releases from Germany and the Eurozone as a whole will attract attention.

The pound is trading lower against the dollar this morning -0.08% adding yesterday losses -0.39% following the failed attempt above the psychological level of 1.5000. Technically, we have said that a close above the psychological level of 1.5000 would be a very bullish development for the pound, as we have not seen a daily close above that level since early March. The GBP/USD pair is now approaching the strong support level of 1.4870, which coincides with the 200-period SMA on the 4-hour chart. Below there, the 50-period SMA is ready to provide a significant support to the price action around the psychological level of 1.4800 in case of a further fall. We also had a soft start for economic releases from the UK, with no major indicators scheduled in the U.S. today.

The Canadian Dollar was stronger 2.48% against the U.S. Dollar the previous week following the BoC policy meeting. However, the CAD surrendered most of its gains against the greenback despite the absence of market-affecting news for the currency. The USD/CAD pair is trading below the psychological level of 1.2300, which includes the 23.6% Fibonacci retracement level. However, I would expect the pair to pick up some momentum and to test the 1.2300 and 1.2350 levels before resuming downwards again.

The ICE U.S. Dollar Index (DXY), a measure of the U.S. currency against a basket of six major rivals, was up 0.60% to 98.16. The dollar index rebounded from the strong support level of 97.15 and is now moving for a third consecutive positive day as the index is already positive at 0.07% in early European trading.

The U.S. stocks closed positive the yesterday’s trading session following the generally stronger dollar and the higher U.S. Dollar Index. The Dow Jones Industrial Average rose +1.17% to 18,035, the NASDAQ added +1.27% to its value, ended up at 4,995 and the S&P 500 index gained +0.92% closing at 2,100.

The economic calendar was very quiet yesterday with only a smattering low-level data out of Germany, Greece and Australia. Meanwhile, this week's lighter US economic calendar is unlikely to provide any meaningful direction for the market. Investors, however, will look for additional clues to gauge the strength of broader U.S. economic recovery from the housing sector. Also, Durable Goods Orders data from the U.S. could possibly generate some momentum in the market.

Today, a notable economic event is the release of ZEW Survey that will show Current Situation and Economic Sentiment in Germany, as well as Economic Sentiment in Eurozone all of them for April. In Canada, the monthly Wholesale Sales for February are due. Overnight the traders’ attention will be turned to Japan and Australia. In Japan, the Ministry of Finance will release the Total Merchandise Trade Balance, the Imports and Exports change in the amount of transactions in March. In Australia, the CPI and the RBA Trimmed Mean CPI, like the CPI without food and energy prices as well as any unusual changes in the month, both for the first quarter will be announced and keenly eyed

In Canada, the monthly Wholesale Sales for February are due. Overnight the traders’ attention will be turned to Japan and Australia. In Japan, the Ministry of Finance will release the Total Merchandise Trade Balance, the Imports and Exports change in the amount of transactions in March. In Australia, the CPI and the RBA Trimmed Mean CPI, like the CPI without food and energy prices as well as any unusual changes in the month, both for the first quarter will be announced and keenly eyed from the traders, especially after the recent events.

In Canada, the monthly Wholesale Sales for February are due. Overnight the traders’ attention will be turned to Japan and Australia. In Japan, the Ministry of Finance will release the Total Merchandise Trade Balance, the Imports and Exports change in the amount of transactions in March. In Australia, the CPI and the RBA Trimmed Mean CPI, like the CPI without food and energy prices as well as any unusual changes in the month, both for the first quarter will be announced and keenly eyed form the traders, especially after the recent events.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.