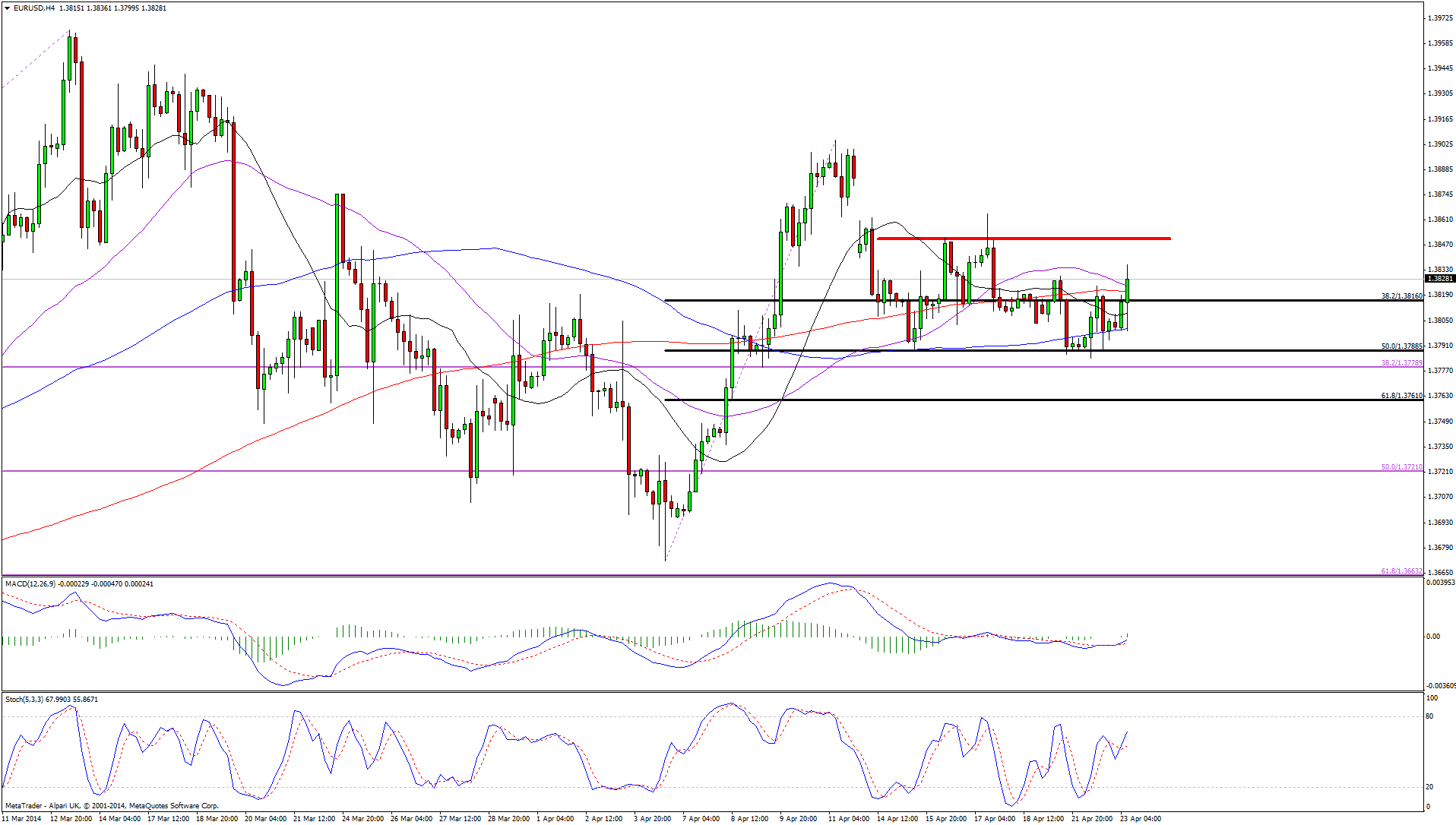

EURUSD

The euro is looking a little more bullish against the dollar again, but the lack of momentum is a concern. Not only did the pair fail to make a new higher during the previous rally before correcting, the bounce off the 50 fib level wasn’t very convincing. Clearly 1.40, not far above the current level, is a major psychological level and is making traders a little cautious as we approach it. Should we break above that level, we could then see more aggressive buying. For now I expect the caution to continue with mild gains being made. The 4-hour chart shows an imperfect double bottom forming with the neckline around 1.3850. A close above this level could prompt the next surge in buying with the target being just above 1.39, based on the size of the formation. This coincides roughly with the previous resistance found on 11 April.

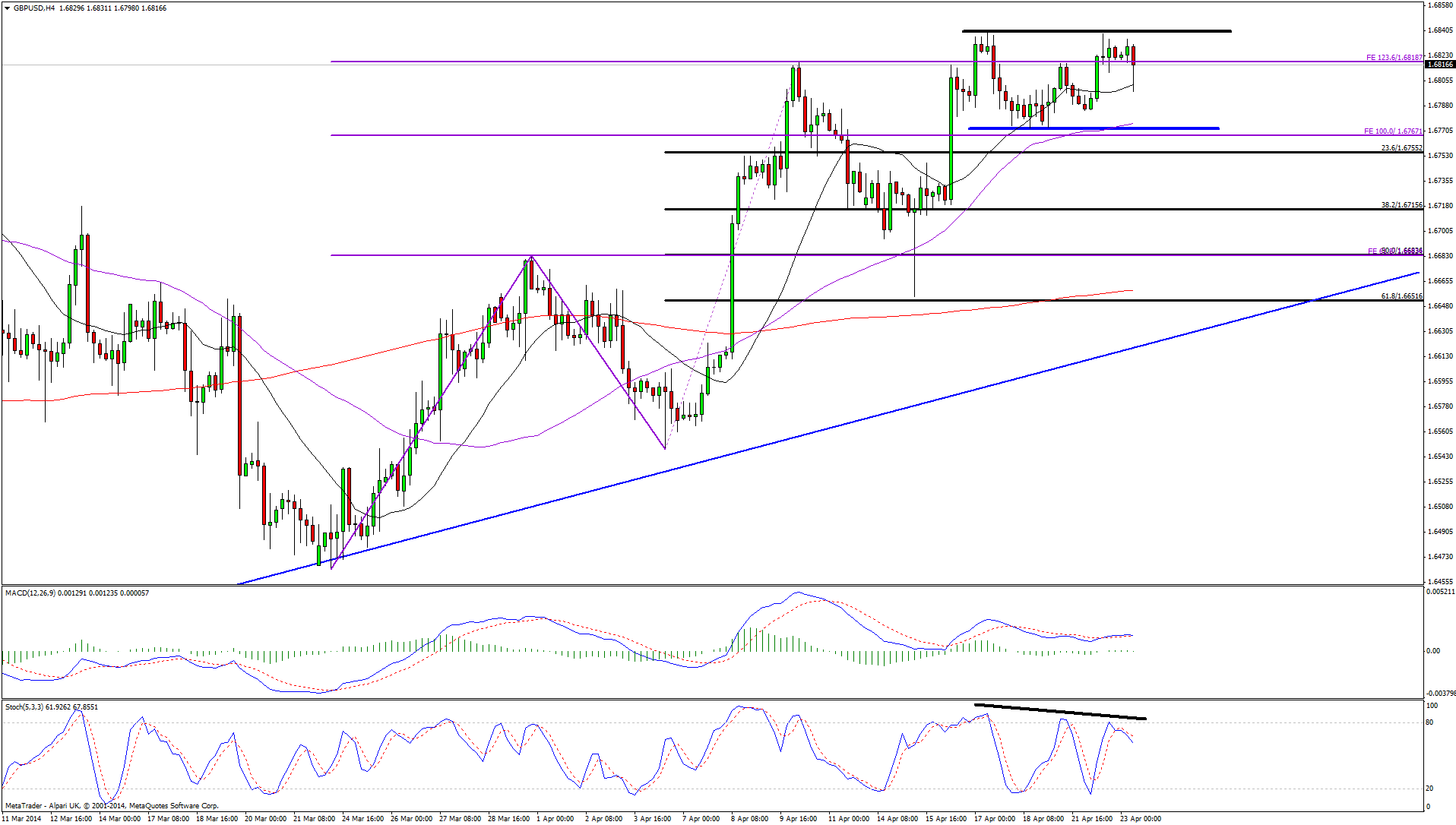

GBPUSD

Sterling is really struggling around 1.6820 right now having reached the 123.6 fib expansion level, which happened to coincide with a previous resistance level, dating back to 17 February. Numerous attempts to significantly break through this level have failed which suggests the bullish move may be running out of steam. This can also be seen on the 4-hour chart where the pair has been testing previous highs while momentum, as seen on the stochastic, is being lost. This bearish divergence could be an early warning of a more significant correction in the near term, although as always this is only a secondary indicator so further confirmation of this will need to be seen. This could come from the pair breaking through the previous support around 1.6772, with further confirmation coming from the pair making lower highs and lower lows. For now though, the pair appears stuck in a tight range between 1.6772 and 1.6840.

USDJPY

This pair remains range bound at the moment and yesterday’s doji candle at the top of the range suggests this is not going to change. The ADX continues to hover around the 20-level which supports the continuation of this range bound trading. We’ve already seen some selling early in the session which suggests once again that we’re going to see another move back towards the bottom of the range. That said, it may not reach the support that it has previously, with an ascending trend line having now penetrated the trading range. Significant support could now be found around 101.60. Should we see this it could point to a breakout to the upside over the next month or so, with further resistance then being found around 103.50, previous resistance. For now, the pair appears to have formed a small double top on the 4-hour chart and is currently finding support along the neckline. A break of this should prompt a move towards 102.25 based on the size of the formation.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.