Last Friday, the base consumer price index in the USA made it clear to investors that the economy still has started to recover from the recession in the first quarter again, on these news traders reacted immediately with the sell of the euro against the dollar USA. Also at the weekend Greece doubted whether it will be enough money to pay off the I Also at the weekend Greece doubted whether it will be enough money to pay off the IMF in the next month. Let me remind you that Greece has to make a payment to IMF in the amount of 1.6 billion euros from 5 to 19 June. On Monday, there was a weak volatility due to the fact that the markets in Germany, the UK and the US are closed for the holidays.

Today publication of important US data is planned, if the economy will continue to grow, is guaranteed a further decline of the currency pair.

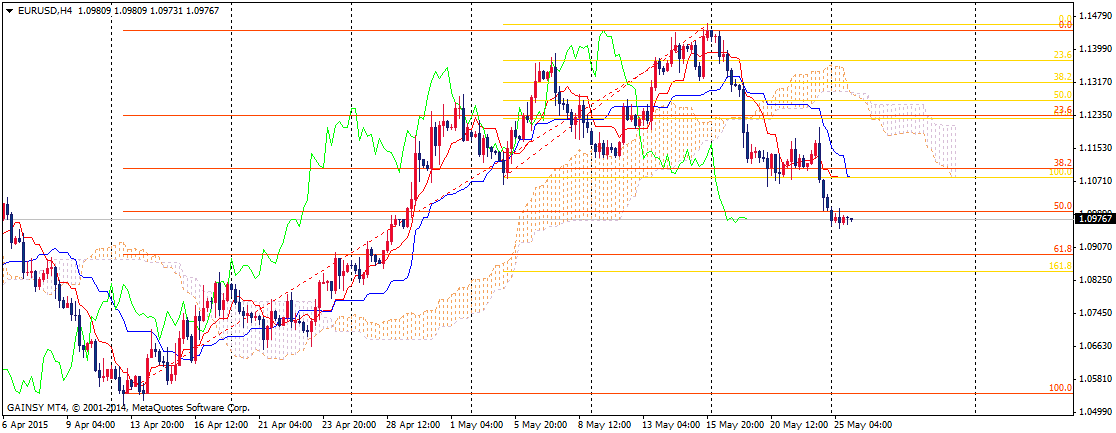

Sell couple should be from the resistance level 1.1000, profit target set at support levels 1.0955; 1,0900; 1.0860.

If the currency pair can break and consolidate above 1.1000 resistance, it is possible to buy with take profit at the following levels 1.1060; 1.1100.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.