Technical Bias: Bearish

Key Takeaways

Euro remains under immense pressure against the US dollar and might head lower.

1.2400 is a major barrier for the Euro buyers which might continue to halt upside.

German import price index is the only low-risk event lined up today during the London session.

EURUSD remains a sell until it manages a daily close above the 1.2400 resistance area in the near term.

Technical Analysis

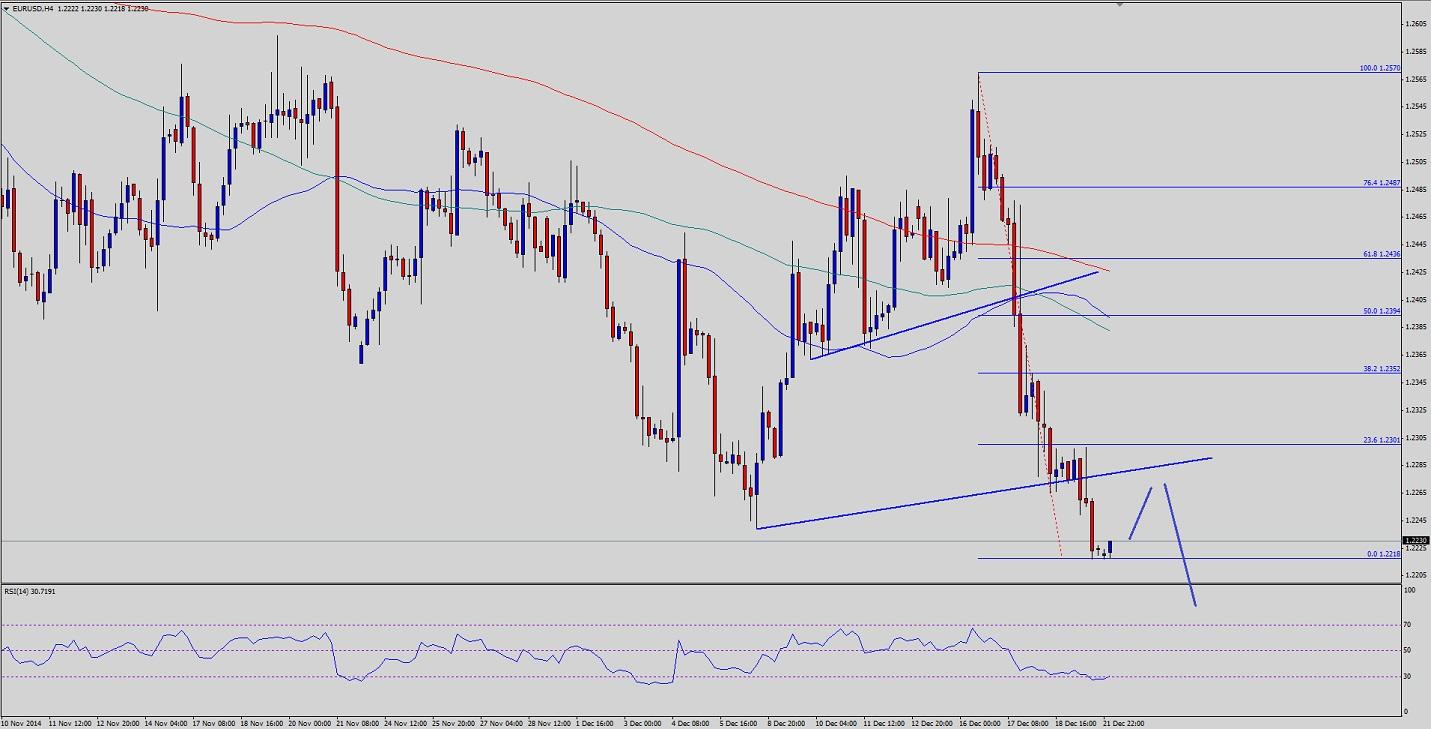

The Euro sellers managed to clear a couple of important support trend lines on the 4 hour chart, which ignited sharp downside in the EURUSD pair. The pair traded as low as 1.2218 recently and looks set for more downside moving ahead. There is a chance of a minor correction in EURUSD if the 1.2200 support manages to protect the downside. The first immediate resistance is seen around the 23.6% Fibonacci retracement level of the last drop from the 1.2570 high to 1.2218 low. However, the broken trend line might also act as a resistance and stall any rallies moving ahead. The only encouraging sign for the Euro bulls is the fact that the 4H RSI is around the extreme levels, which might help the EURUSD pair for a short-term correction. However, any major rally can be considered as a selling opportunity.

The EURUSD pair is trading below all three important moving averages (100, 200 and 50), which is a strong bearish sign in the near term. On the downside, in the recent low of 1.2218 might act as a support moving ahead. A break below the same could take it towards the 1.2180 swing area.

German Import Price Index

Today during the London session, the German Import price index will be released by the Deutsche Bundesbank. The forecast is slated for a decline of 0.5% in November 2014, compared with the preceding month. Any major miss in the forecast might put more pressure on the Euro bulls moving ahead.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.