Technical Bias: Bearish

Key Takeaways

Euro was hammered against the US dollar during this past week, which might continue this week as well.

EURUSD pair looks like heading towards the 1.2620-00 support area.

EURUSD support seen at 1.2620 and resistance ahead at 1.2780.

The Euro sellers enjoyed the ride recently, but any major losses from the current levels against the US dollar look tough moving ahead.

Technical Analysis

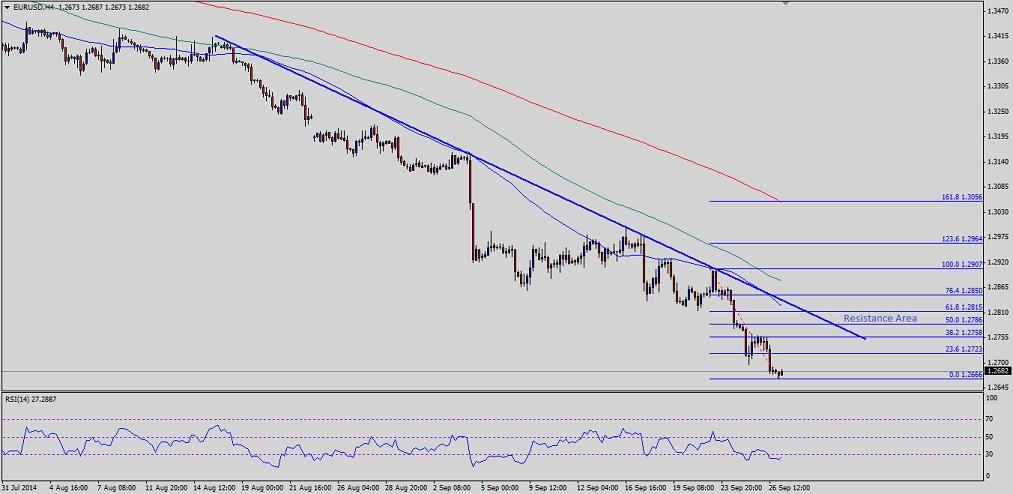

There is a bearish trend line on the 4 hour timeframe of the EURUSD pair, which acted as a resistance for the Euro buyers on a number of occasions. The highlighted trend line is currently coinciding with the 50 simple moving average (SMA) – 4H. Moreover, the 100 SMA (4H) is also sitting above the bearish trend line. So, if the pair retraces from the current or a bit lower levels, then it might find a lot of sellers around the 1.2800-10 area. The mentioned area also acted as a support recently, so it might turn as a strong barrier in the near term. Moreover, the 50% Fibonacci retracement level of the last leg from the 1.2907 high to 1.2666 low also sits around the mentioned resistance area.

However, there are strong signs of exhaustion emerging, as the 4H RSI is well around the extreme levels which might cause a pullback in the short term. If at all the EURUSD pair slides further, then the next level of interest is around the 1.2620 area. Any additional downside should be limited considering oversold readings.

Euro Zone Consumer Confidence

The Euro zone consumer confidence data will be published later during the London session today. The forecast is slated for a decline from -10 to -11. If the outcome is on the positive side, then there is a chance that the Euro might recover some ground moving ahead.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.