UP NEXT:

I suspect there is further upside potential for Euro crosses if it sniffs even a hint of 'OK' data judging by previous reactions. Selling Euro is not exactly a new idea and we have seen relatively good gains from OK data already this week, to suggest short covering and buying from brave bulls at multi-year lows. Going into tonight’s session momentum favours continued Euro gains, so assuming data back the trend up then the upside should (in theory) provide the higher probability.

TECHNICAL ANALYSIS:

EURJPY: Allowing for deeper correction to 144

Despite what I have mentioned above on I suspect there is room for a dip lower on EURJPY. However this analysis could serve into next week whilst we find the end of wave 'B'.

At present I think we are witnessing a bearish wedge / sideways correction in the making but this does leave room for now highs. If we remain above yesterday’s lows then there is certainly an argument for a trip up to the 61.8% retracement level.

However a break below yesterday's low can be taken as a resumption of the bearish move from the 149 highs.

The target around 144 is assumed form wave A-C equality and confluence of support from bullish trendline, Monthly Pivots and 144.7 support.

EURUSD: Potential for another leg higher

With no US news tonight it will be Euro news which drives the crosses. I am still using exactly the same S/R levels from last Friday as they have continued to serve me well.

Intraday price action is clearly bullish and within a bullish channel, forming higher highs / lows. Until this pattern breaks I see no case for going short until just yet.

For that I would prefer to see a break of a bullish trendline and support.

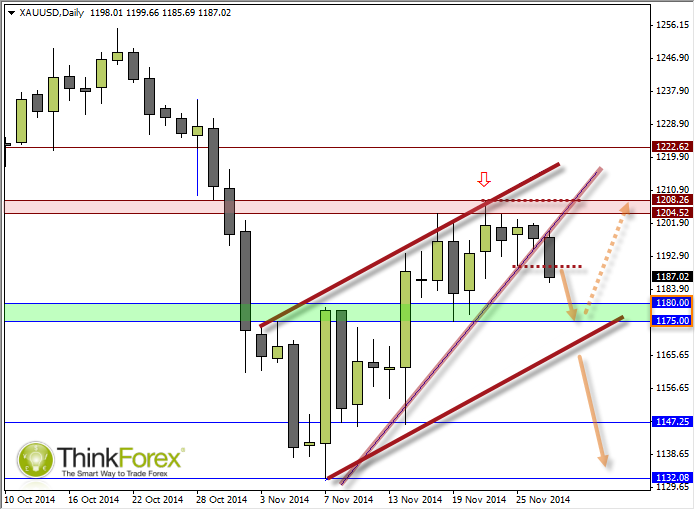

GOLD: Let the sell-off begin (and continue...)

In the past hour we have just seen Gold finally break out of its range and beneath the Hanging Man Reversal candle formed 2 days ago.

I have been following these candles closely and now have to assume the top has been seen.

If you have not entered already we can seek to enter short on a retracement to the breakout line (lower dotted) with stop above $1208.

Alternatively we can refer to lower timeframes to trade in the anticipated bearish direction.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.