UP NEXT:

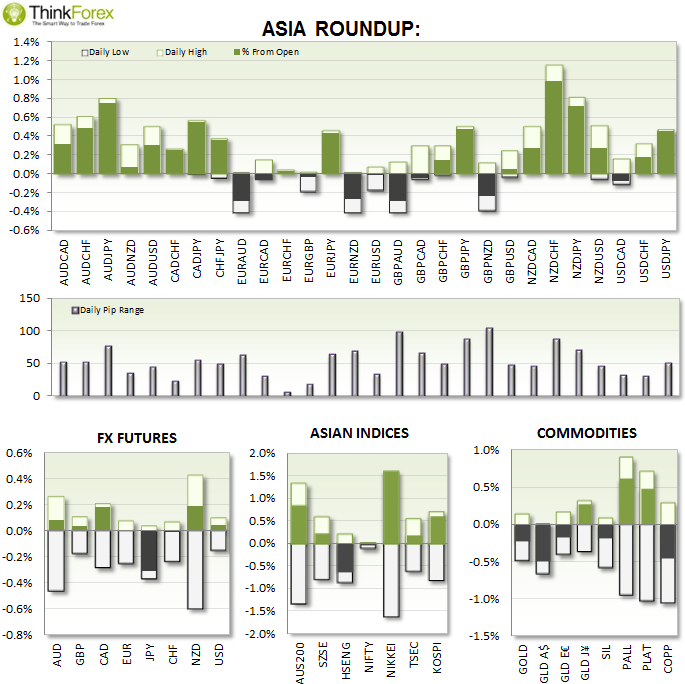

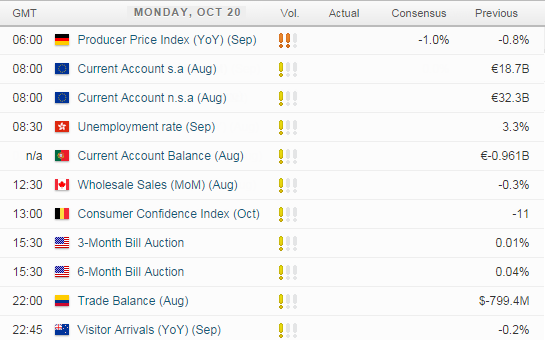

No 'red' news today so I expect price action to trade within ranges with potential for whipsaws between key levels. The markets are waiting to Central Bank speeches and minutes to be released to may be better to trade intraday timeframes and not outstay your welcome.

TECHNICAL ANALYSIS:

USDCAD: Seeking bullish setups above 1.12

With a lack of news tonight the risk is for choppy trading across the board. USDCAD is meandering around the weekly pivot and coiling up within a potential bullish wedge pattern.

Technically I suspect we'll get a move towards 1.12 support where we could then seek bullish setups in hope of the bullish wedge. However for this to materialise we do require a USD bullish catalyst, so be prepared for limited moves and to remain within ranges.

We are currently trading near the annual highs so we may find any bullish moves quite limited as we lead up to US inflation data later this week.

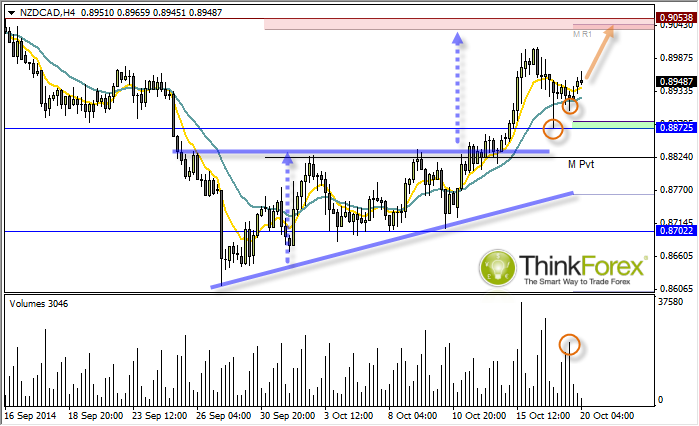

NZDCAD: Intraday targets 90c

The original analysis called for 0.8860 to hold as resistance for a swing trade short. It was not to be. Instead we saw an upside break of this level which confirmed an Ascending Triangle, projecting an approximate bullish target around 0.90.

Intraday timeframes favour the bullish momentum and provides higher highs and lows. We have also seen a spike low at 0.8872 to suggest a swing low, which was then accompanied by higher volume on low-range candles to suggest another swing low has formed.

Therefore the idea is to seek bullish setups above these swing lows to target 0.90.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.