ASIA ROUNDUP:

NZD saw the most action following RBNZ decision to increase rates by 25bps to 3%. NZDJPY jump 0.4%. The markets had already priced in the rate hike but the following statement was also hawkish, with the consensus being a further 0.5% increase this year, with some speculating June as the next rate rise.

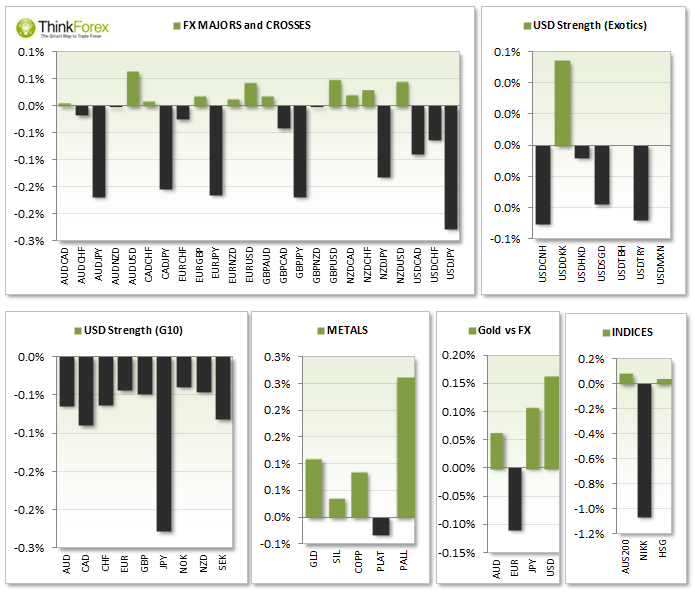

A$ sheepishly held onto yesterday's lows with mild gains of 0.1% early Asia trading as the markets await the next catalyst.

UP NEXT:

German IFO Business climate survey edged lower from its 3-year high last month but overall looks strong, although this month's forecast is 0.2 lower than last month at 110.50. Whilst we can expect some movement on EUR crosses it is likely to be overshadowed by...

ECB President, Mario Draghi, speaking about 'Central Banking in the Next Two Decades'. A lot of attention will be paid to his words for any clues regarding possible QE from the exchange rate and deflation.

US Core Durable goods is a volatile release (in term of the actual release itself) as it can swing wildly between positive and negative. Durable goods are those built to last over 3 years so are a good indicator for economic outlook.

US Unemployment claims come out at the same time so expect some volatility across the markets, particularly USDCAD and USDJPY as they are main trading partners with the US.

Pairs to Monitor: EURUSD, USDCAD, USDJPY, AUDUSD,

TECHNICAL ANALYSIS:

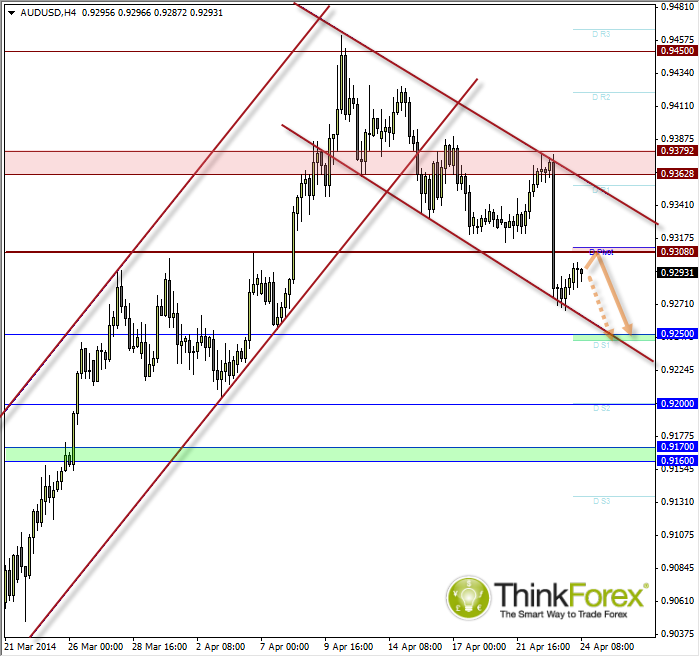

AUDUSD: Dead Cat Bounce targets 0.925 (Below 0.93)

Dead Cat bounce has to be my favourite setup, not only because the name is slightly comical but also because it is easy to identify and relatively reliable.

Indeed here we have a solid bearish bar followed by 'sheepish' retracement price action floating towards a resistance zone. Regardless of the outcome as a price action set-up I find it very appealing for a short position.

Options to enter are live at market with stop above the resistance area (up to you where). Alternatively you can set up a sell-limit order closer to the pivot line to anticipate 'one last gasp' before the losses resume.

A break above 0.9308 invalidates the analysis.

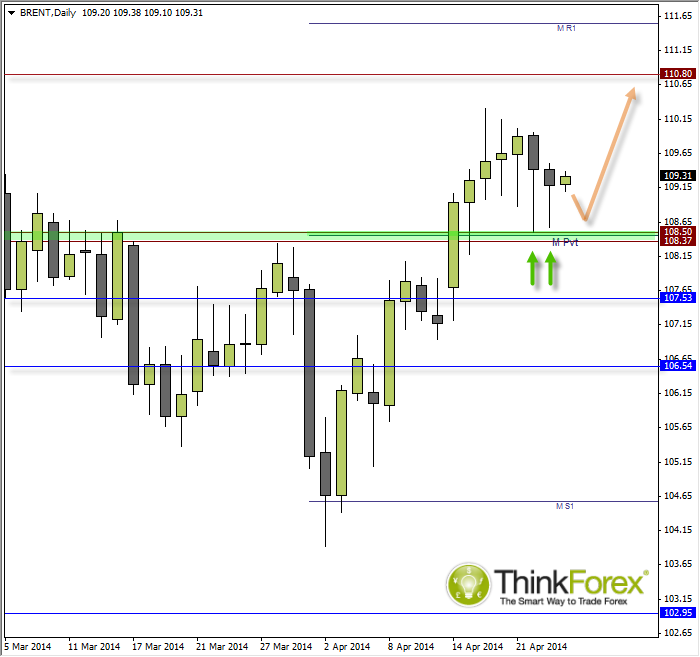

BRENT: Tweezer Bottom above Monthly Pivot

5 trading sessions ago we saw a Shooting Star Reversal followed by a Spinning Top/Rikshaw Man Doji, followed by 3 Hanging Men Reversals.

Just because the name states (or implies) 'reversal' or it doesn't mean it has to be one. It could just be a temporary weakness to a movement and sideways trading. As long as we remain above the Monthly Pivot then I suspect we are nearing the end of a correction and the 'Hanging Man Reversal' will turn out to be bullish hammers.

Also notice that the past 2 trading sessions have produced a 'Tweezer Bottom' with yesterday's inside bar showing a reduction of volatility whilst also respecting the Monthly Pivot.

The next target remains $110.80 and bullish setups on lower timeframes (H4, H1, and H15) could be considered above $105.80 with a break below $108.30 confirming the analysis invalidated.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.