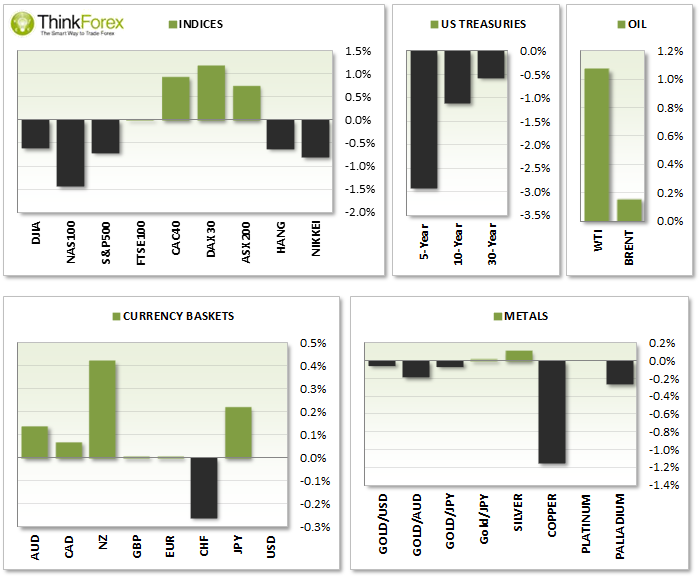

MARKET SNAPSHOT:

ASIA HANDOVER:

FX:

NZD Trade balance beat expectations to see exports at their highest level in nearly 3 years. However with the NZD being the biggest G10 currency the higher Kiwi Dollar will begin to hurt exporters. AUDNZD at 4-week high USDCNH within a whisker of the 1--month highs and currently trading at 6.207

INDICES:

AUS200 and Nikkei opened lower following the lead from Wall Street. Nikkei sold off by 1.6% with the added weight of being ex-dividend day but recovered losses to trade to a 6-day high

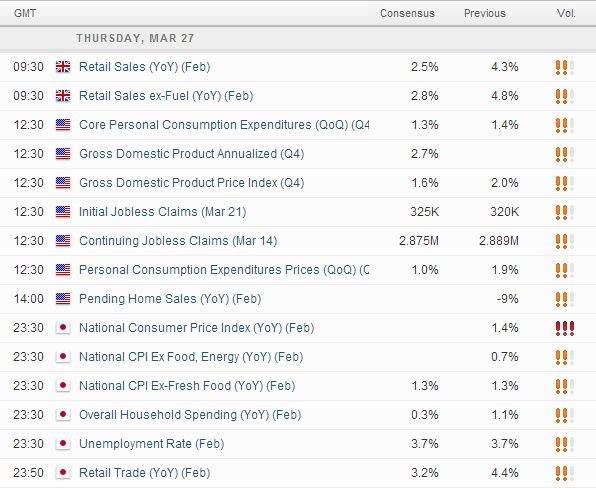

UP NEXT:

CHART OF THE DAY:

EURAUD: Targeting 1.48

Patterns (such as head and shoulders) can take a long time to evolve, and tricky to analyse, let along trade. This is why I prefer to use patterns to provide anticipated direction and price objectives only.

The original analysis was posted on the 25th Feb when I raised the possibility of a Right Shoulder to form, only to see it break to a new high before taking another dip lower.

There are two barriers this has now overcome to turn bearish - 1: Broken trendline and 2: Now trading beneath 1.50

Whilst the overall price objective is down near 1.420 I doubt very much to get there this week! However any retracement towards 1.50 accompanied with bearish setups could provide a decent entry to trade down to 1.48.

A break above 1.50 invalidates the analysis

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.