Technical Analysis

EUR/USD to bounce off July 2015 low

“Standard monetary policy strategy says a little less inflation, maybe a little less growth ... argue for just a smidgen slower process of normalizing rates.”

- John Williams, San Francisco Fed President (based on Bloomberg)

Pair’s Outlook

EUR/USD moved in a wide trading range on Friday, following relatively unsurprising US GDP data. Now the bears are attempting to confirm a two-month triangle pattern. They need to keep the pair below a resistance at 1.0862 (weekly PP; 20-day SMA), in order to shift medium-term expectations strongly to the downside. The bulls, however, are hoping to receive momentum from a new monthly pivot point at 1.0841 and 55-day SMA at 1.0836, which are reinforced by July 2015 low at 1.0808. In the meantime, technical indicators on all time frames are currently pointing to the South.

Traders’ Sentiment

SWFX bears remain in the majority of 55% for open positions. Meanwhile, short-range commands to acquire the Euro are positive again in 55% of all cases, up from 47% on Friday.

GBP/USD to fall under 1.42

“Carney’s conditions for raising interest rates -- which include growth looking strong enough to eliminate the remaining slack in the economy -- are probably still not met. The recovery still looks very unbalanced.”

- Capital Economics (based on Bloomberg)

Pair’s Outlook

The British currency experienced another slump last Friday, reaching a daily low of 1.4150, but stabilising at 1.4246. Even though the GBP/USD was seen mostly consolidating during the previous week, this trend has fallen under the risk of getting broken today. Technical indicators retain bearish signals, while the supply at 1.4269, namely the weekly PP, is rather tough. Furthermore, an even stronger cluster is located just under the 1.44 major level. The closest support, however, is located at 1.4125 and represented by the weekly S1.

Traders’ Sentiment

There was no change in the bullish sentiment, as 63% of all open positions remain long. The share of sell orders slid from 54 to 51%.

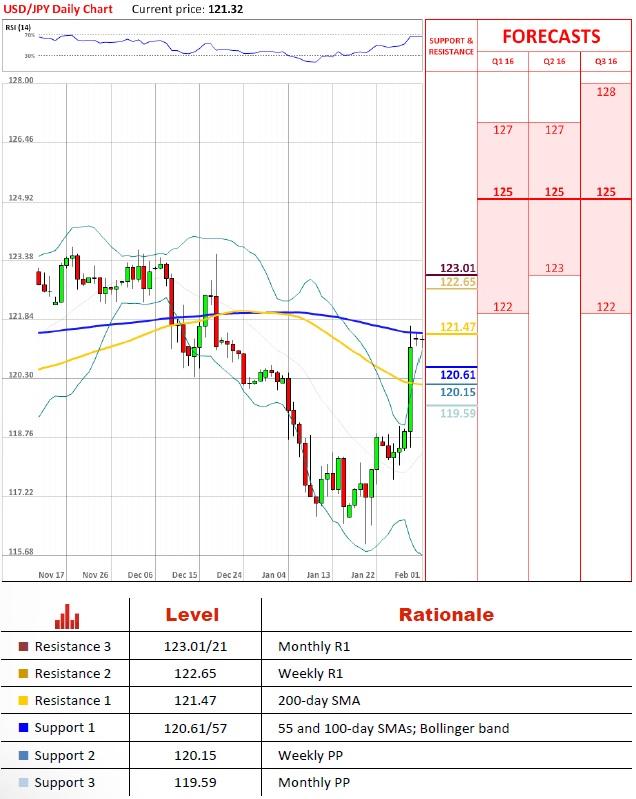

USD/JPY probes 200-day SMA

“The BoJ decision will have a lasting negative impact on yen because speculative positioning was the wrong way.”

- Westpac (based on Business Recorder)

Pair’s Outlook

The USD/JPY currency pair’s rally, triggered by the BoJ’s decision, was only prevented by the 200-day SMA circa 121.46 last Friday. The same SMA keeps providing formidable resistance today, increasing the chance of the Buck turning around and inching lower against the Yen. Meanwhile, immediate support is represented by the Bollinger band, the 55 and the 100-day SMAs around 120.57. The 55-day SMA is also on the edge of crossing the 100-day one to the downside, which is a signal to sell the US currency. Other technical studies, on the other hand, are unable to confirm the bearish scenario.

Traders’ Sentiment

Today 73% of traders are short the Greenback, whereas the portion of purchase orders barely changed, sliding down from 57 to 56%.

Gold to hover between 1,105 and 1,130

“The fact that it [Chinese PMI] is lower than expectations, that might just give gold a bit of a safe-haven.”

- Fat Prophets (based on Bloomberg)

Pair’s Outlook

Two formidable technical areas are highly likely to put both upside and downside pressure on gold at the same time. Support is located around 1,100/05, represented by 100/20-day SMA, monthly PP, weekly S1 and Oct/Sep 2015 lows. Any possible slide below here will see sentiment deteriorating, and new targets will be set at 1,080 (55-day SMA/monthly S1). The first and foremost supply is represented by 200-day SMA and upper Bollinger band at 1,129/30. They are immediately followed by weekly R1, and a spike above them will proclaim a break-out from the bullish pattern.

Traders’ Sentiment

Traders in the SWFX market are holding a slight majority of bullish open positions, namely 54% of them. It means that sentiment has been largely flat over the last 72 hours, which puts the gap between the bulls and bears at eight percentage point so far.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.