Technical Analysis

EUR/USD faces monthly R1

“The ECB is saying ‘we’re not putting a limit on QE, we’re not stopping until we achieve our objective.’ If they don’t do anything, the balance sheet still expands.”

- Standard & Poor’s (based on Bloomberg)

Pair’s Outlook

The immediate resistance is at 1.14, represented by the upper Bollinger band and monthly R1. The base scenario is EUR/USD bouncing off this level, but we should not rule out a possibility of a rally to the September high, especially considering that the weekly technical indicators continue to give more ‘buy’ signals than ‘sell’ ones. Meanwhile, most of the monthly studies are bearish, meaning in the long run we are likely to see a re-test of the major rising support line, which currently is at 1.11 dollars.

Traders’ Sentiment

The gap between the bulls and bears widens. The difference in favour of the latter increased up to eight percentage points. On the other hand, the share of buy orders rose from 58 to 61%.

GBP/USD attempts to break away from 1.53

“The economy remains on a satisfactory track and ... I see a (rate) liftoff decision later this year at the October or December FOMC meetings as likely appropriate.”

- Dennis Lockhart, Federal Reserve (based on WBP Online)

Pair’s Outlook

Upon reaching the immediate resistance in face of the weekly R3 on Friday, the GBP/USD was pushed back, leading to a fall towards the 1.53 major level. Dips were limited by the anticipated target, remaining a strong support area today, represented by the 20-day SMA, weekly and monthly PPs. However, the 200-day SMA around 1.5319 could limit the Cable’s attempts to appreciate today, while the second resistance area is located out of reach. Nevertheless, the Sterling also risks falling deeper towards the weekly PP at 1.5274.

Traders’ Sentiment

Bullish market sentiment returned to its Thursday’s level of 62%, compared to 57% on Friday. There are more orders to purchase the British Pound today, namely 60% (previously 49%).

USD/JPY in limbo amid bank holidays

“We note that the distance between the upper and lower Bollinger Bands is the narrowest it has been for almost two decades. It suggests that even if the triangle pattern is not longer valid, the dollar is coiling against the yen. It warns that a large move may be on the horizon.”

- BBH (based on FXStreet)

Pair’s Outlook

The US currency behaved in accordance with expectations on Friday. The USD/JPY managed to rebound, but with the upside volatility was slowed down by the 20-day SMA, causing the pair to stabilise at 120.25. The Greenback opened just above 120.14, where the weekly pivot point coincides with the 20-day SMA, forming a rather strong support. Consequently, a decline is unlikely to occur, and with the absence of fundamental market movers, the Buck should edge higher against the Yen, but fail to reach the immediate resistance.

Traders’ Sentiment

Bulls remain strong, as 71% of traders hold long positions today (previously 70%). The number of buy commands, on the other hand, was not so lucky and suffered a decline from 61 to 59%.

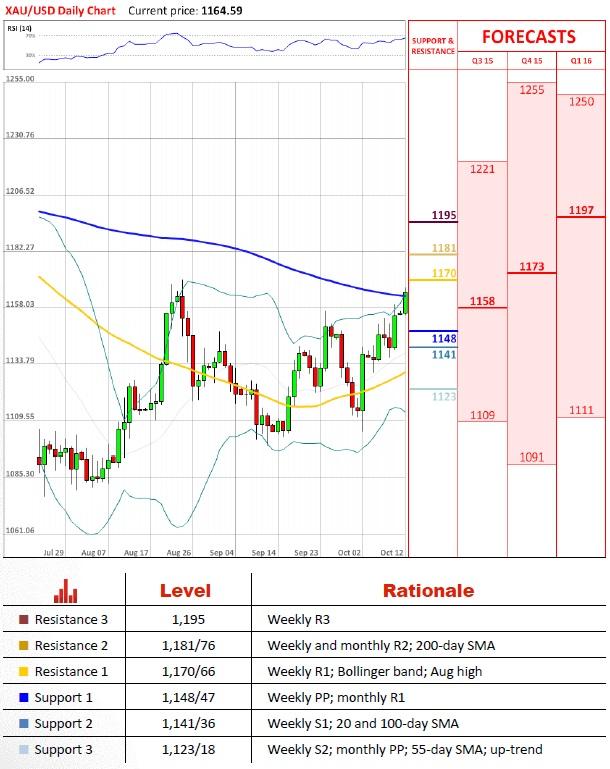

Gold closes in on August high

“There are people looking…and thinking as long as uncertainty is in the global economy and China, the Fed are going to have to hold off.”

- Marex Spectron (based on MarketWatch)

Pair’s Outlook

Gold is about to touch August’s high, which is strengthened by the weekly R1 and the Bollinger band. A close above this level will not imply a bullish outlook, mainly because of the supply zone around 1,180 dollars, where the weekly R2 joins forces with the monthly R2 and 200-day SMA. If the precious metal gains a foothold above this area, however, the next target may well be 1,230, namely the May high and the falling resistance from the weekly chart. In case of a strong sell-off in the nearest future the losses should be limited by 1,120 (monthly PP, 55-day SMA and up-trend), but we can also expect a small rebound from the 100-day SMA at 1,140.

Traders’ Sentiment

The SWFX market remains divided. At the moment 51% of open positions are long and 49% are short.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.