Forex News and Events

RBA shift tone

As expected the RBA August Board meeting retained the cash rate at a record low of 2.00%. The central bank continue to see the current accommodative policy as “appropriate.” The policy outlook was generally balanced as, “further information on economic and financial conditions to be received over the period ahead will inform the Board's ongoing assessment of the outlook and hence whether the current stance of policy will most effectively foster sustainable growth and inflation consistent with the target.”

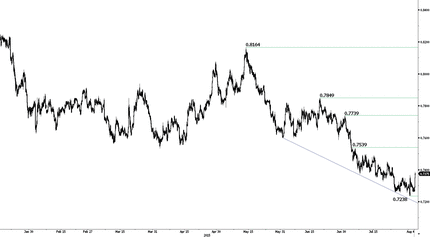

Yet the accompanying statement took a hawkish turn when members stated that AUD was adjusting to declines in commodity prices, sheading the language for more depreciations. In reference to the currency the statement said it was "the Australian dollar is adjusting to the significant declines in key commodity prices." This change in commentary indicates that the RBA has greater comfort in the current level of the AUD. The newly developing confidence in AUD pricing suggests that less verbal intervention or easing bias geared toward weakening the AUD will be required (baring no negative change in fundmentals). Local AUD yields jumped 3bps on the statement. Heavily sold AUDUSD quickly ran to 91.39 from 90.10 as shorts were squeezed. On the data front, Australian retail sales hastened 0.7% m/m in June, above estimates of 0.4% m/m and revised higher 0.4% m/m read in May. Finally, Australia’s trade deficit came in at A$2933mn in June slightly below expectations of deficit of A$3000mn. We will be watching developments in China carefully but favor carry based trades in AUDJPY and AUDCHF. The positive AU economic data specifically strong housing data combined with today’s slightly neutral statement (shift from dovish) indicates that it’s unlikely that the RBA will cut rates further. However, the SNB and BoJ are not tightening anytime soon.

Russia‘s inflation eyed:

“Today will be released the Consumer Price Index for Russia. This data represents a major concern for the Central Bank of Russia as it has prevented a larger downside change for the key rate last week. Indeed and as we expected, it has moved to 11% from 11.50% amid negative growth that printed at -2.2% year-on-year for the first quarter. Furthermore, the ruble is trading very low and as we are still thinking, a monetary policy must absolutely be cautious as there is a massive downside risk for the ruble coupled with a major inflation risk.

Traders will carefully watch the today’s CPI release, which is often interpreted as a monetary policy outcome. However, any key rate move takes at least a few months before being truly reflected in the economy. As a result, what really matters is the trend. Estimates for today’s data are about at 0.9% m/m while June figure printed at 0.2% m/m.

In its last week meeting, the CBR reiterated its inflation forecast for June 2016. The CPI is targeted to reach 7% before going lower to 4% in 2017. We think that those forecasts seem too optimistic as long as there is no sustainable growth trend. For the time being, easing rates has only supported high inflation. Nonetheless, we remain confident as there is still room for the CBR to act.

The USDRUB is set to increase again as long as the data are not fully supporting a pick-up in growth. We target a pair above 64 ruble within the next few weeks.”

Yann Quelenn – Market Analyst

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.