The British pound has edged strongly higher over the past few days but could under risk ahead of the initial GDP estimates for Q1, which could see some pullbacks across GBP crosses. Following the GDP data, the markets will no doubt be waiting for this evening's FOMC statement.

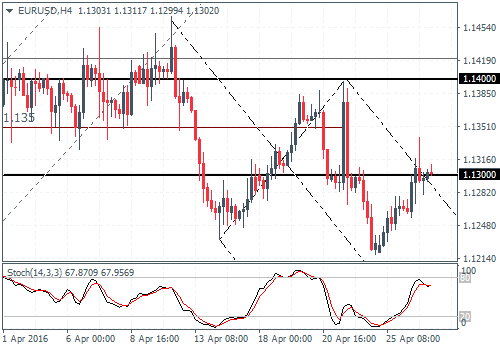

EURUSD Daily Analysis

EURUSD (1.13): EURUSD is bouncing back with prices closing near the 1.13 handle yesterday. However, this is a level of minor resistance which could see prices struggle to break higher, but in the event of a close above 1.130, further upside could be extended towards 1.140, which could be seen if EURUSD attempts to breakout higher from the outer median line. To the downside, 1.120 is a clear support level which could hold prices in the near term.

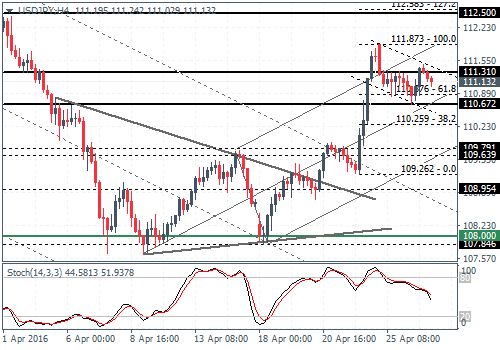

USDJPY Daily Analysis

USDJPY (111.0): USDJPY price action was muted yesterday, but the bias still remains to the downside. A daily close below 110.67 could see further declines to 109 - 109.5 region. However, on the 4-hour chart, there is a potential bullish flag taking shape, where an upside breakout above 111.31 - 111.50 could extend gains to 112.50 initially followed by a rally to the previous resistance level at 114.7 - 114.35. The bullish bias could be invalidated if USDJPY drops below 110.67 in which case we can expect a test of previous support at 109.

GBPUSD Daily Analysis

GBPUSD (1.45): GBPUSD continues to surge ahead with prices briefly trading near 1.4635 yesterday, having cleared the 1.4425 resistance, which could be tested for support in the near term. On the 4-hour chart, price action continues to trade within the evolving rising wedge pattern, a breakout of which could see a dip to 1.4312 - 1.43 on a break below 1.443 - 1.4425 higher support. Alternately, clearing the resistance above at 1.4635 could see further gains in store.

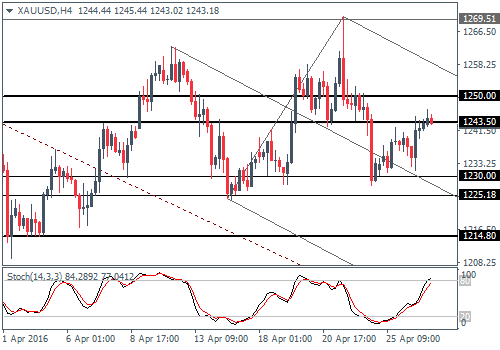

Gold Daily Analysis

XAUUSD (1243): Gold prices are backing attempting to recover the lost ground with minor support at 1231 being established. Resistance is identified at 1250 - 1243 levels and with the hidden divergence currently on the 4-hour chart, Gold prices are likely to dip lower in the term ahead of further moves to the upside. Above 1250, gold could test the 1260 resistance which could see a potential start of a new bearish trend.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.