Good morning from Hamburg and welcome to our first Daily FX Report of this week. Asian shares began the week on a plaintive note amid losses on Wall Street and worries over China, while investors braced for a Federal Reserve meeting that might take another small step toward lifting U.S. interest rates. Japan's Nikkei slipped 0.5 percent, while MSCI's broadest index of Asia-Pacific shares outside Japan lost 0.8 percent. In China, the CSI300 index of the largest listed companies in Shanghai and Shenzhen fell 1 percent, with sentiment still soured by a poor PMI survey on manufacturing. Australia's main index fell 0.2 percent as mining stocks struggled with the slump in global commodity prices.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The U.S. dollar flagged against the euro and yen on Monday after a drop in U.S. shares and bond yields dimmed its allure, with markets focused on whether the upcoming Federal Reserve policy meeting can shore up the greenback. The euro rose 0.2 percent to $1.1000, having gained about 1.4 percent last week. Overall the euro has lost as much as 5 percent against the dollar since mid-June on Greek debt worries and the divergence of U.S. and European monetary policies, but a technical correction to the dollar's rally gave the euro a breather last week. The dollar faced a similar predicament against the yen, having surged to a six-week high of 124.48 early last week only to retrace its advance. It was last down 0.2 percent at 123.56 after plumbing a near two-week low of 123.49.

Aside from the Fed, focus remained on sliding commodity prices an their potential impact on currencies. The impact from lower commodity prices has been felt by currencies of commodity exporters such as Canada, Australia and Norway. But commodity-importer currencies such as the yen were also expected to feel the effect. The Australian dollar struggled near six-year lows versus the dollar, faced with the prospect of its central bank taking the opposite step and easing further. The AUD declined further late last week on weak factory data from China, Australia's main trading partner and stood just above Friday's trough of $0.7260, its lowest since May 2009. The NZD fared a little better, climbing 0.3 percent to $0.6599 to extend the distance between the six-year low of $0.6498 struck mid-month. The NZD was helped last week when the Reserve Bank of New Zealand eased its cash rate by less than some had anticipated.

Daily Technical Analysis

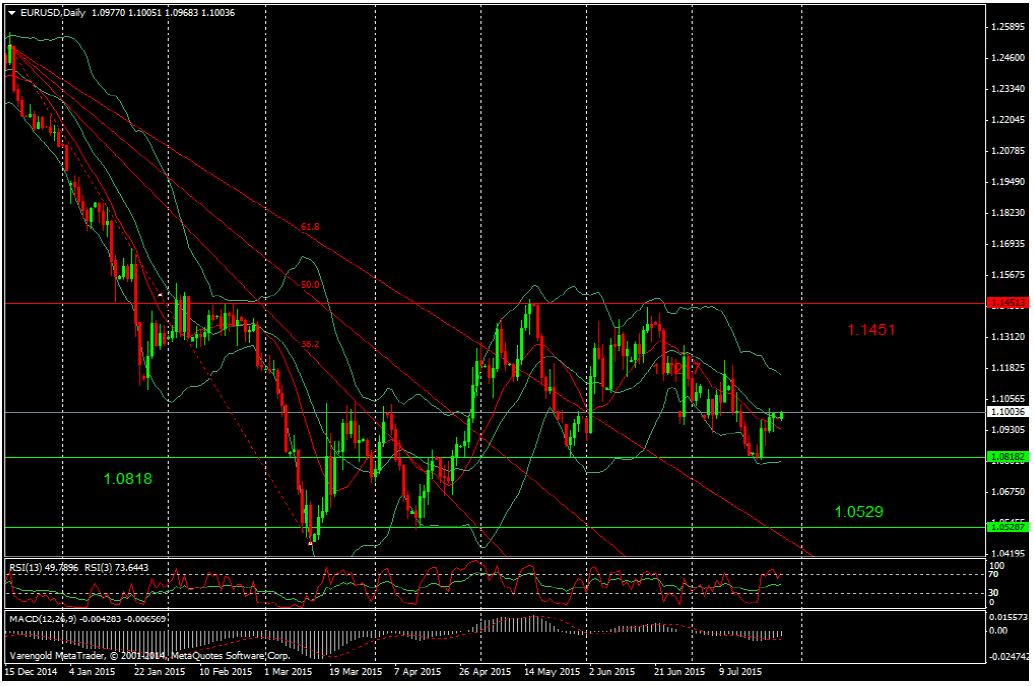

EUR/USD (Daily)

Since January 2015 the EUR depreciated versus the USD and even reached its lowest level for more than 10 years. After touching the level at $1.04 the EUR was able to appreciate and rebounded to a level of $1.14 which was the new high in April. At this level the upward movement of the shared currency stopped and the bears took control over the pair. The EUR is now traded at $1.1004 per EUR and we may even see a further appreciation of the shared currency in the short run since the indicators do not provide any clear signals for a trend reversal and the USD is weakening at the moment.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.