Good morning from beautiful Hamburg and welcome to our first Daily FX Report for this week. Greece voted against yielding to further austerity demanded by creditors, leaving Europe’s leaders to determine if the renegade nation can remain in the euro. With 85 percent of votes counted, 62 percent of voters backed Prime Minister Alexis Tsipras and his Coalition of the Radical Left, or Syriza, by voting “no” to the latest proposals for spending cuts and tax increases. Thirty-eight percent voted “yes,” less than opinion polls predicted, according to results from the Interior Ministry. The verdict turns the tables on German Chancellor Angela Merkel and her counterparts across Europe, who must decide if a financial rescue of the region’s most indebted country is still possible. It significantly raises the chances of a Greek exit from the single currency, as the country’s banks run out of cash and its economy staggers toward all-out collapse.

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

The euro fell with high-yielding currencies, while U.S. stock futures and crude oil slid as the shock waves from Greek voters’ rejection of austerity started moving through financial markets. Demand for haven assets fueled gains in Treasury futures and gold. The euro fell 1 percent to $1.1009 by 7:26 a.m. Tokyo time, retreating against all 16 major peers. The Australian dollar broke below 75 U.S. cents for the first time since 2009, even after China stepped up efforts to arrest a stock selloff. Standard & Poor’s 500 Index futures slid 1.4 percent and Japanese index futures also dropped. U.S. oil tumbled 3.5 percent and copper futures fell. Ten-year Treasury futures rose to the highest level since June 1 as gold added 0.4 percent. With more than 95 percent of the ballots counted, Greeks have voted 61 percent against austerity measures required to win another bailout package, according to figures posted on the Interior Ministry’s website. German Chancellor Angela Merkel and French President Francois Hollande called for a summit of euro-area leaders to be held July 8. The result of the referendum is “to be respected,” the German government’s press office said in an e-mail. European Union President Donald Tusk confirmed a meeting will be held Tuesday in a Twitter post. Gold rose to $1,173.09 an ounce in the spot market, while silver added 0.3 percent to $15.7470 per ounce. The yen, also regarded as a haven, gained against all major currencies Monday, rising 0.3 percent to 122.38 per dollar.

Daily Technical Analysis

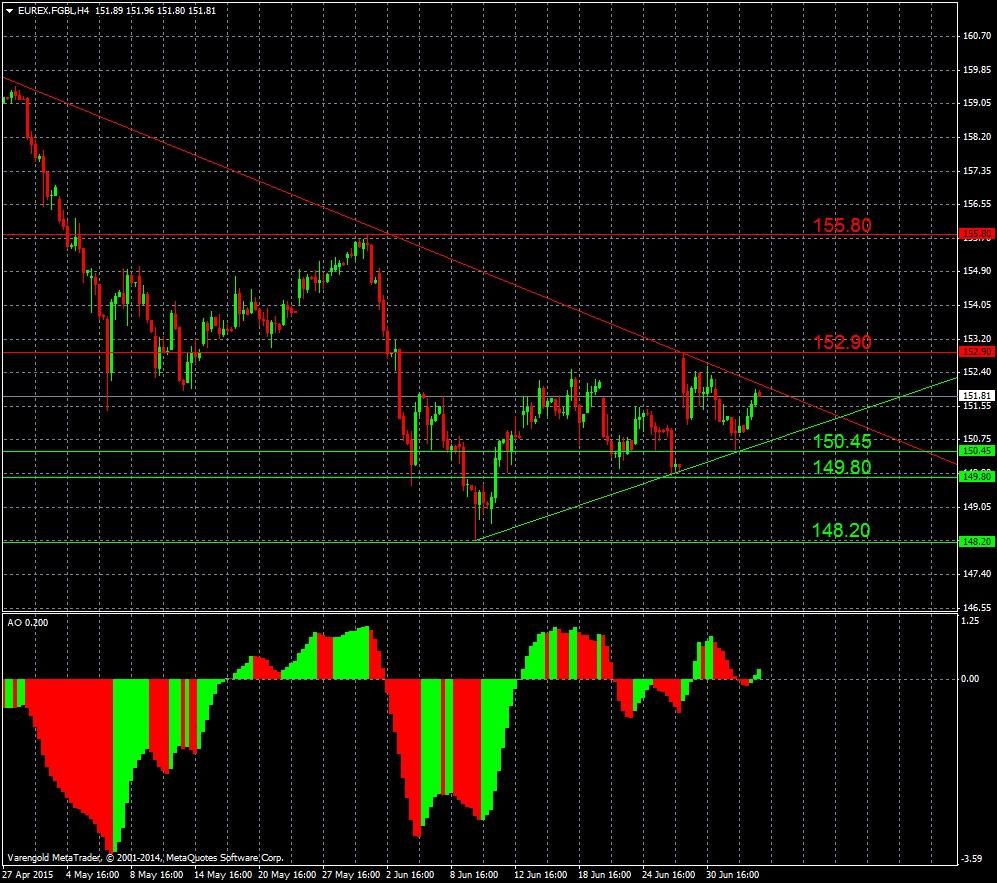

EUREX.FGBL (4 Hours)

The Bund Future was able to recover some losses of the last months. After reaching the downward trend line the second time the Future open’s opportunities for buyers and sellers. In short term the Awesome Oscillator Indicator shows an upward movement which might be possible to continue. Today’s opening after Greek’s decision should be considered.

Support & Resistance (H4)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.