Good morning from beautiful Hamburg and welcome to our first Daily FX Report for this week. Asian shares got off to a lackluster start on Monday, after rising inflation and a hawkish tone from the U.S. Federal Reserve Chair rekindled expectations that the Fed is on track to hike interest rates. Activity was likely to be thin this session, as UK and U.S. markets are shut on Monday for the Spring Bank Holiday and Memorial Day respectively. European centers such as Germany will be observing the Whit Monday holiday. MSCI's broadest index of Asia-Pacific shares outside Japan was down about 0.1 percent in early trade. Japan's Nikkei stock index added 0.3 percent, getting a tailwind from a weaker yen and trade data released before market open showed a better-than-expected rise in April exports.

However, we wish you a successful trading day and a great week!

Market Review – Fundamental Perspective

Greece cannot make debt repayments to the International Monetary Fund next month unless it manages to reach a deal with its lenders, its interior minister said on Sunday, in the most explicit remarks so far from Athens about the likelihood of default if talks fail. That kept pressure on the euro, which was down about 0.2 percent at $1.0996, pushing to its lowest levels since late April. The common currency reached a three-month peak of $1.1468 as recently as May 15, along with a surge in euro zone bond yields and lessened pessimism towards the European economy. The dollar was slightly higher against its Japanese counterpart at 121.56 yen, trading at its highest levels since mid-March. The dollar traded near a two-month high of 121.70 yen after jumping from a low of 120.64 on Friday, helped by a rise in U.S. Treasury yields triggered by the CPI data. A rise above 122.04 would take the USD to an eight-year high against the yen. Data on Friday showed the core U.S. CPI increased 0.3 percent in April amid rising shelter and medical care costs. It was the largest rise in the core CPI since January 2013 and followed a 0.2 percent gain in March. The pound was little changed at $1.5483 after shedding more than one percent overnight against the bullish dollar. The Australian dollar, which also suffered big losses overnight, traded near a three-week low of $0.7808. Oil futures steadied after skidding ahead of the long U.S. holiday weekend, giving up about 2 percent on Friday as a rallying dollar and profit-taking took their toll. U.S. crude added about 0.3 percent to $59.88 after eking out a small weekly rise to extend its weekly gains for a 10th straight week.

Daily Technical Analysis

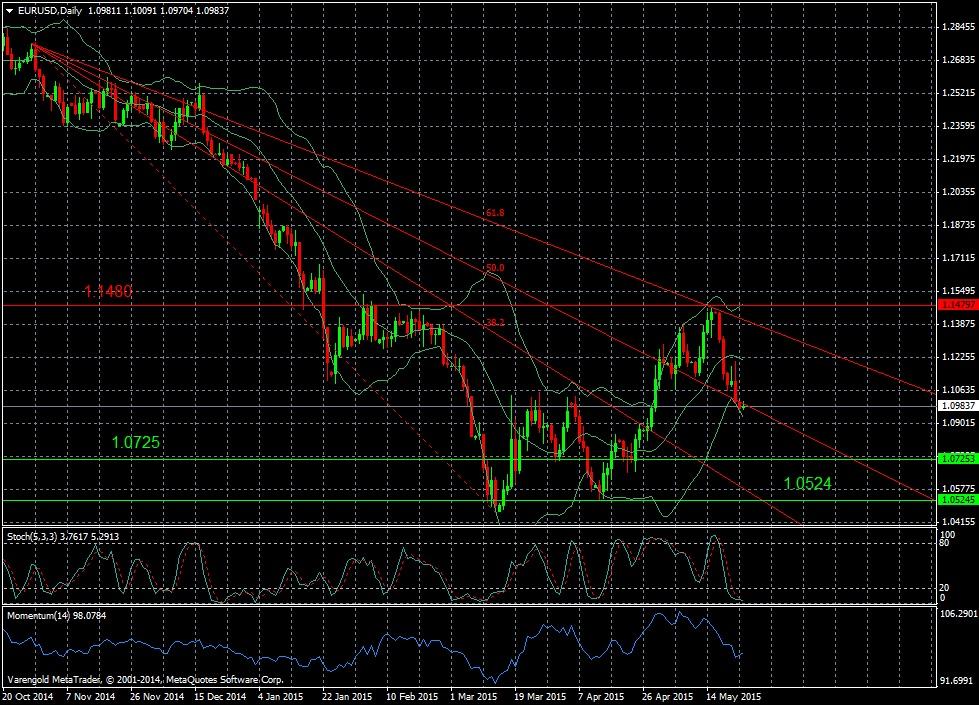

EUR/USD (Daily)

Since October 2014 the EUR depreciated versud the USD and even reached its lowest level for more than 10 years. After touching the level at $1.04 the EUR was able to appreciate and rebounded to a level of $1.14 which was the new high in April. At this level the upward movement of the shared currency stopped and the bears took control over this currency pair. The EUR is now traded close to the Fibonacci Level 50.0 and should the pair brek through this level, we may see a further significant decline of the EUR. The trend remains bearish.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.