Good morning from rainy Hamburg and welcome to our Daily FX Report. U.S. health officials said yesterday that the first patient infected with the deadly Ebola virus had been diagnosed in the USA. The patient had flown from Liberia to Texas and is a new sign of how the outbreak can spread globally. A handful of people, mostly family members, may have been exposed to the patient after he fell ill. There shouldn’t be any threat to any passengers who had traveled with him.

However, we wish you a much luck in trading today!

Market Review – Fundamental Perspective

Yesterday the Dow Jones index of shares declined 0.2 percent and the Standard & Poor’s index fell 0.3 percent. The EUR had its worst quarter since 2010 amid the Erupean Central Bank’s moves to swell its balance sheet and cut borrowing costs to spur growth. The EUR dropped to the lowest level in two years versus the USD as slowing inflation boosted the case for the ECB to add further monetary stimulus to avert deflation. Data yesterday showed that consumer price index in the euro area fell to 0.7 percent. Furthermore reports yesterday showed too that retail sales in Germany rose 2.5 percent in August and unemployment rate remained low at 6.7 percent. In europes second biggest economy data showed that France’s national debt hit a record high in the second quarter underlining the country’s struggle to rein in public finances before today the 2015 budget will be presented. In addition another report yesterday showed that U.S. consumer confidence declined in the past month for the first time in five months and home prices in July climbed less than forecasted from a year earlier, underscoring the unsteady nature of U.S. growth. Consumer confidence depreciated to 86.0 from a upwardly revised 93.4 in August and the Institute for Supply Management-Chicago business barometer fell to 60.5 in September from 64.3 in August. The EUR/USD decreased 0.4 percent to 1.2631 and tumbled already 3.8 percent in September. The EUR/JPY weakened 0.3 percent to 138.49. The USD/JPY advanced 0.1 percent to 109.63. The JPY sank versus most major counterparts and lost 7.6 percent versus the USD in the third quarter 2014. The Bank of Japan is going to meet next week and the ECB will meet tomorrow but further rate cuts are not expected.Daily Technical Analysis

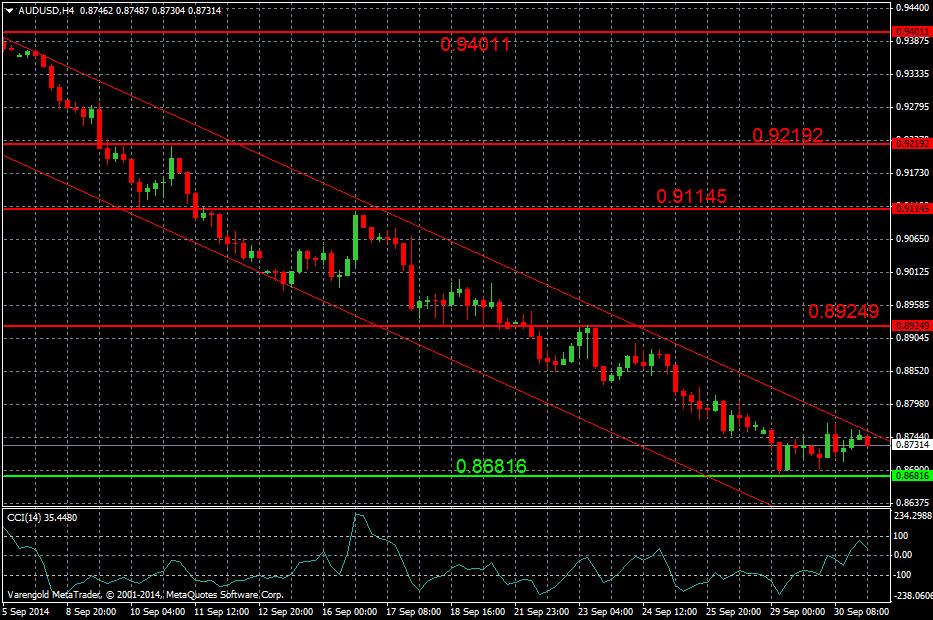

AUD/USD (4 Hours)

For almost four weeks now the currency pair is decreasing inside a bearish trend channel and reached an eight month low around the support line 0.8681. And a trend reversal is not foreseeable yet while the CCI is on high level and indicates further losses.

Support & Resistance (4 Hour)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.