Good morning from Hamburg and welcome to our Daily FX Report. Iranian Foreign Minister Zarif is optimistic after talks with European Union foreign policy chief Ashton yesterday about a nuclear agreement. Beyond that Ukrainian President Poroshenko accused Russia yesterday of direct and undisguised aggression. Ukraine’s military said it pulled back from defending a vital airport in the east of Ukraine, where troops have been fighting a Russian tank battalion.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

Yesterday the US market was closed due to labor day. Yesterday German Chancellor Angela Merkel said that Moscow’s behavior in Ukraine must not go unanswered, even if sanctions hurt the German economy, heavily dependent on imported Russian gas. So europeans could be barred from buying new Russian government bonds. Nevertheless yesterday data showed that euro zone manufacturing growth slowed more than estimated in August. The Purchasing Mangagers’ Index fell at 50.7 in the euro zone, which is the lowest in over a year and below July’s 51.8. Reading below the 50 line are indicating contraction. In France, which is europes second largest economy, manufacturing activity even dropped at the fastest speed in 15 months to 46.9. The factory PMI for Germany also decreased to an 11-month low of 51.4. Data yesterday also showed gross domestic product in Germany, Europe’s biggest economy, shrank 0.2 percent in the past quarter. The German Bundesbank has cast doubt on a second-half rebound and suggested its estimates may prove too optimistic. The EUR is 0.1 percent away from its lowest level in almost a year before data tomorrow might show weaker regional retail sales and services, boosting the case for additional monetary stimulus. Furthermore economists predicted that today data will show the producer price index in the euro zone weakened 0.1 percent in July. The EUR/USD was nearly unchanged at 1.3130. The EUR bought 137.02 JPY and the USD/JPY was at 104.35. Yesterday French President Hollande and ECB President Mario Draghi agreed that deflation and weak growth were threatening the European economy. Australia’s currency has been surpisingly resilient in light of disappointing surveys that showed growth in its largest trading partner, China may be faltering again. The AUD/USD traded at 0.9333.

Daily Technical Analysis

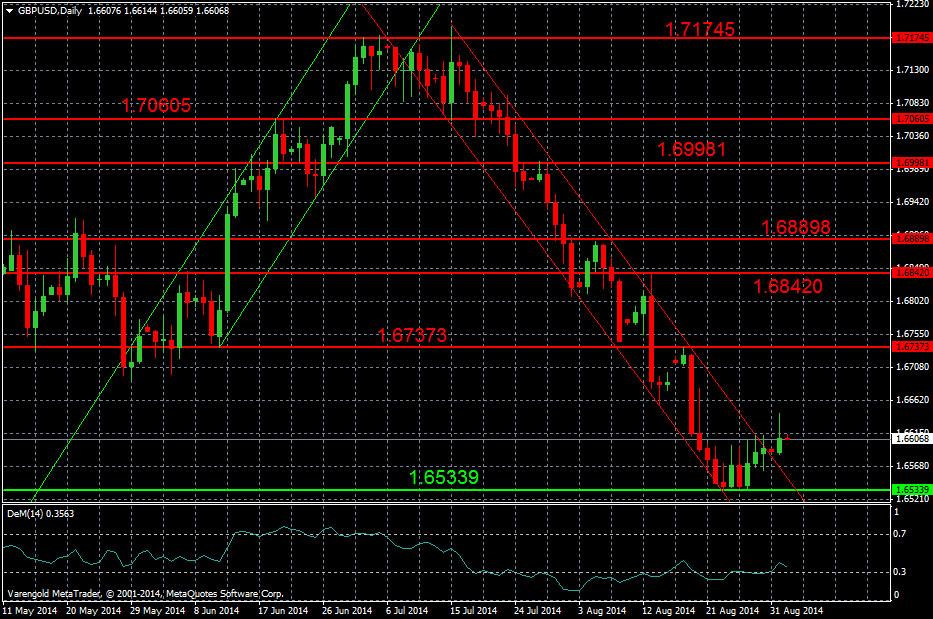

GBP/USD (Daily)

For nearly two months now the currency pair was trading in a bearish equidistant channel but the decreased has been recently stopped at the support level around 1.6533. The chart indicates a trend reversal by moving slightly out of the channel while the Demarker is on a very low level.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.