Good morning from beautiful Hamburg and welcome to our latest Daily FX Report. Yesterday, the unexpected star of the World Cup finals, James Rodriguez, has signed for Real Madrid for a reported £63m. He follows Toni Kroos who joined for a bargain £20m. Rodriguez passed a medical in Madrid on Tuesday and has agreed to a six-year deal with the club. The fee makes him the fourth most expensive transfer off all time after Real`s £86m for Bale and £80m for Cristiano Ronaldo. At the World Cup finals, Rodriguez scored six goals to finish as the leading scorer of the tournament.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

Due to a divergence in borrowing costs and monetary policies between Europe and the U.S., the USD reported additional wins versus the EUR and advanced to the highest in eight months. The USD appreciated 0.4 percent to 1.3466 per EUR. It also appreciated versus the JPY by 0.1 percent to 101.46 JPY per USD. The EUR depreciated versus the JPY by 0.4 perccent and is now traded at 136.63 yen. The EUR alos declined against the majority of its peers and a quick improvement is not in sight as analysts expect that consumer sentiment remains subdued. The AUD rose to the most since November against the EUR after the central bank chief said he was content with the monetary policy. Overall, the AUD was able to record gains versus most of its 16 major peers due to positive news regarding Australia`s monetary policy. Annual price gains were in the top half of the central bank`s target range. The AUD rose 0.6 percent to 1.4335 AUD per EUR and even touched 1.4312, which marked the strongest level since November 12. It gained 0.2 percent to 93.94 U.S. cents after dropping 0.2 percent the day before. The positive development of the AUD makes it the best performer among 10 developed-nation currencies tracked by Bloomber Correlation Weighted Indexes. The same Indexes also indicate that the NZD has lost 0.3 percent along with the EUR. Meanwhile the USD was able to gain 0.2. percent. For tomorrow, it is expected that the Reserve Bank of New Zealand will raise its borrowing costs for a fourth time this year.

Gold declined in the last two weeks caused by strong economic data in the U.S. which streghtened the USD and boosted demand for equities. Gold for immediate delivery is traded at $1,306.96 an ounce. On July 10, the price for ounce was at $1,345.17.

Daily Technical Analysis

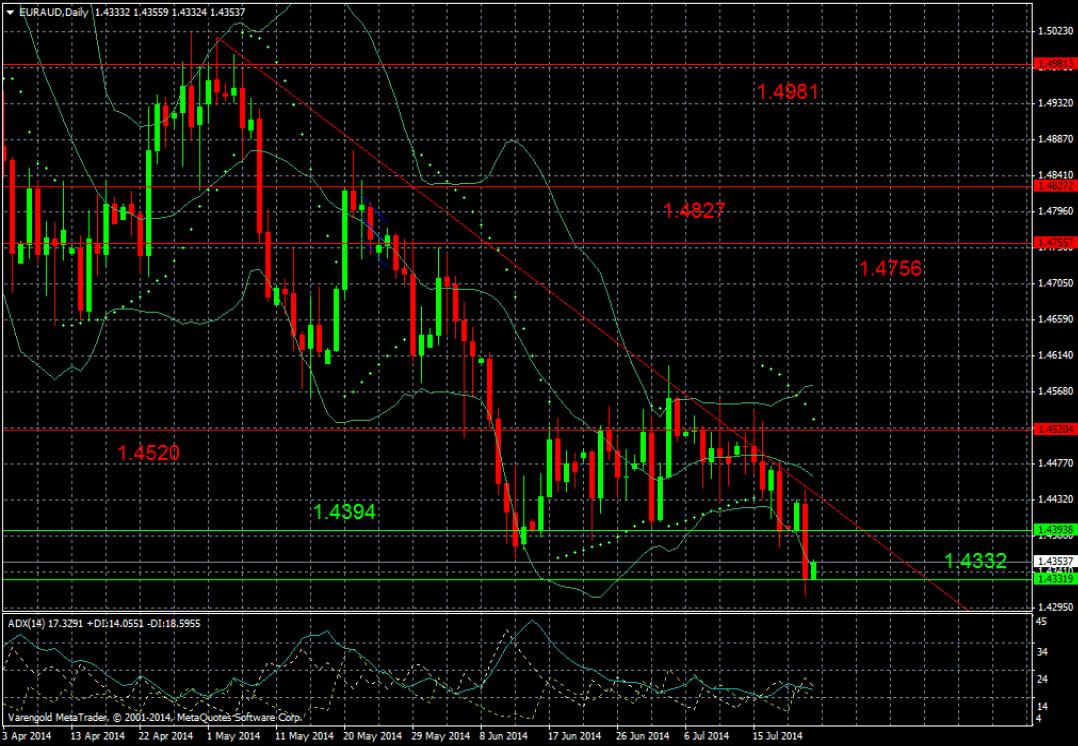

EUR/AUD (Daily)

Since the beginning of May, the chart shows a strong bearish trend. Although, the currency pair showed signs for a trend reversal, the resistance levels at 1.4827 and 1.4756 were too strong. At the moment the pair is traded a 1.4332. It remains to be seen whether we will experience a further downward movement. The ADX under the mark of 25 indicates that the bearish trend lost in strength. Moreover, the course also touched the lower Bollinger Band what could be the initiation of a reversal.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.