Following the day 18 peak bonds printed their lowest point on Thursday, which was day 23. That places bonds in their timing band for a daily cycle low. Friday's break above the declining trend line signaled a new daily cycle.

Bonds formed a swing high today as they closed back below the upper daily cycle band. While bonds could be extending their daily cycle decline, I suspect that the new daily cycle is rolling over. And if I am right that the new daily cycle is already rolling over, then a break below 130.49 forms a failed daily cycle and signals that the intermediate cycle is in decline.

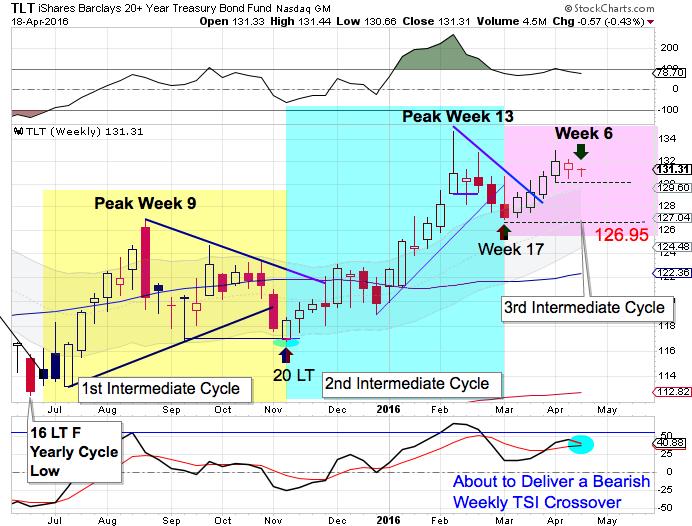

The yearly bond cycle is typically comprised of 2 to 3 intermediate cycles. Bonds are currently in their 3rd intermediate cycle of the year. A failed, left translated intermediate cycle is required to usher in the yearly cycle decline. Left translated intermediate cycles normally peak by week 8.

So getting back to the daily cycle. If today was day 2 for the new daily cycle, then a break below 130.49 forms a failed daily cycle signaling that bonds have begun their intermediate cycle decline. With bonds only on week 6, that leaves 10 to 16 weeks for bonds to print their intermediate cycle low. A break below the week 17 low 126.95 forms a failed intermediate cycle and confirms the yearly cycle decline.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.