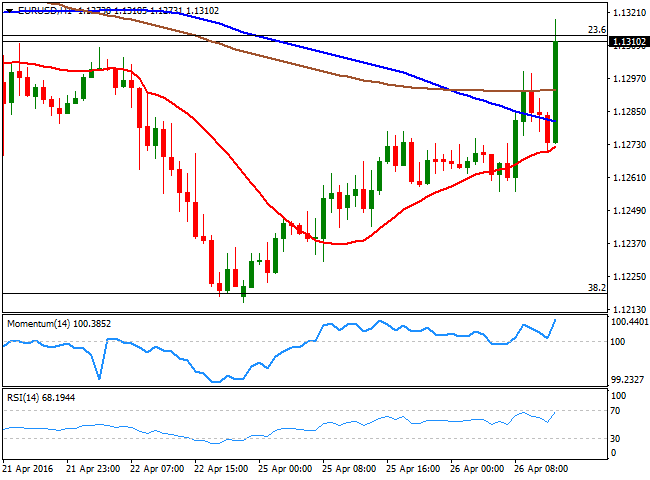

EUR/USD Current Price: 1.1310

View Live Chart for the EUR/USD

The greenback came under selling pressure at the London opening, and the EUR/USD pair advanced up to 1.1299, from where it quickly retreated, on strong selling interest aligned around the level. Nevertheless, the pair remained range bound ahead of the release of US Durable Goods Orders figures for March, which came in below expected, posting a modest growth of 0.8% in March. The core reading, excluding transportation, fell by 0.2%, missing expectations of a 0.5% advance. US bad news sent the dollar back down across the board, and the EUR/USD pair extended its advance a couple of pips above the 1.1300 level, and is now poised to continue advancing, as in the 1 hour chart, the price has now extended above all of its moving averages, whilst the technical indicators head north after bouncing from their mid-lines. In the 4 hours chart, the technical bias is also bullish, as the technical indicators have accelerated their advances after surpassing their mid-lines. The pair has an immediate resistance at 1.1315, the 23.6% retracement of the latest bullish run, and further gains beyond it should keep the rally going during the upcoming US session.

Support levels: 1.1270 1.1230 1.1200

Resistance levels: 1.1315 1.1340 1.1380

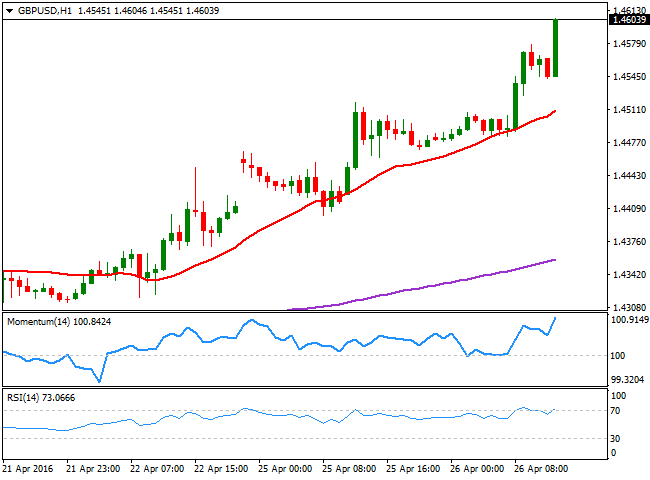

GBP/USD Current price: 1.4601

View Live Chart for the GBP/USD

The British Pound surged to a fresh 2-month high against the greenback of 1.4577, and held nearby ahead of US data, which missed expectations, and sent the GBP/USD pair above the 1.4600 level for the first time since February 4th. Latest Sterling demand is the result of a constant anti-Brexit rhetoric from UK policy makers, and polls showing that those voting to leave are now less than a 30%. The short term technical picture is bullish, as in the 1 hour chart, the price is bouncing from a strongly bullish 20 SMA, whilst the technical indicators resumed their advances within bullish territory. In the 4 hours chart, the RSI indicator heads north around 76, while the Momentum indicator also heads strongly higher near overbought levels, supporting some additional gains up to the 1.4660 region.

Support levels: 1.4585 1.4550 1.4520

Resistance levels: 1.4610 1.4660 1.4700

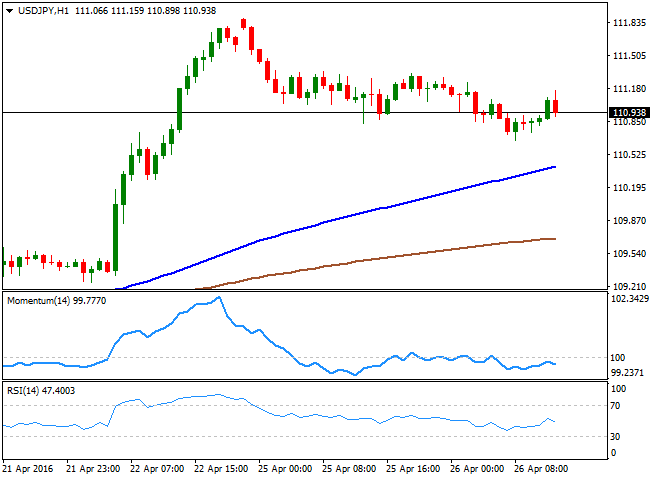

USD/JPY Current price: 110.92

View Live Chart for the USD/JPY

Wait-and-see mode ahead of FED and BOJ. The USD/JPY pair continues trading around the 111.00 figure, pretty contained within a tight range ahead of the FED and BOJ's economic policy decisions. Investors have choose to remain side-lined due to the high levels of uncertainty both events generate, and is unlikely that the pair will move too far away from the current region during the upcoming sessions. In the meantime, the technical picture is bearish, as the indicators have turned lower after failing to overcome their mid-lines, albeit the 100 SMA continues heading higher below the current level. In the 4 hours chart, the price is still struggling around a bearish 200 SMA, while the Momentum indicator heads nowhere around its 100 level, and the RSI aims higher around 58. The pair has an immediate support at 110.65, and a break below it should trigger stops and fuel the decline towards the 110.00 region, while only above 111.40 the pair will begin to look more constructive in the short term.

Support levels: 110.65 110.30 109.80

Resistance levels: 111.40 111.90 112.30

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.