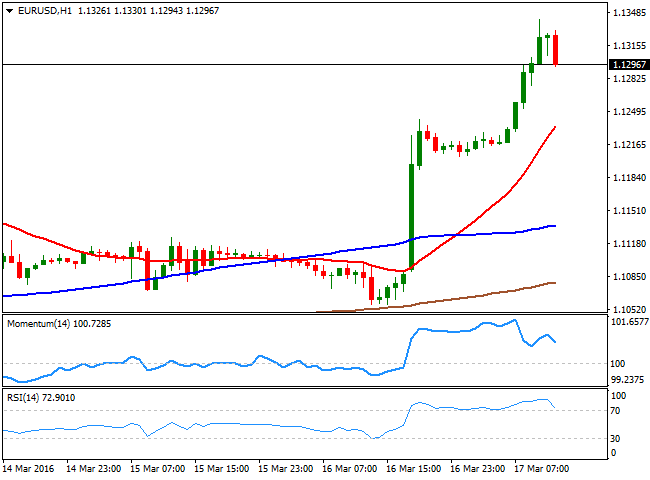

EUR/USD Current Price: 1.1293

View Live Chart for the EUR/USD

The EUR/USD pair retreats from a daily high posted at 1.1341, in quite a nervous environment across the board, compliments to Mrs. Yellen from the FED. This Wednesday, the US Central Bank joined its worldwide counterparts in the perspective of a doom economic future, with a much more dovish-than-expected statement after the two-day meeting, indicating the possibility of just two rate hikes for this 2016. The dollar entered a selling spiral that extended during the Asian and European sessions, resulting in the USD/JPY pair falling to its lowest since October 2014. Current dollar advance is a consequence of the sharp over 100 pips bounce in the USD/JPY, with strong rumors of a BOJ's intervention, although no official comments on that.

Nevertheless, the EUR holds on to gains as European equities plummet, now trading right below the 1.1300 level. The downward move can extend in correction mode, albeit demand for the greenback will likely remain limited. Short term the 1 hour chart shows that the technical indicators are correcting extreme overbought readings, with the RSI still around 72. In the same chart, the 20 SMA maintains a strong bullish slope in the 1.1245 region the immediate support. In the 4 hours chart, the downward potential remains limited, as despite the indicators have lost their upward strength, are still within overbought territory.

Support levels: 1.1245 1.1200 1.1160

Resistance levels: 1.1310 1.1340 1.1375

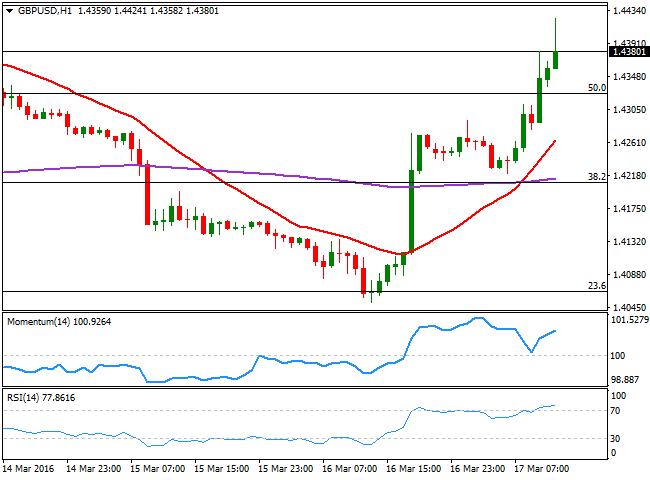

GBP/USD Current price: 1.4377

View Live Chart for the GBP/USD

The GBP/USD soared up to 1.4424, following the latest BOE decision. The Central Bank has left its policy unchanged, with rates at record low of 0.5%, and all of the nine policy makers voting to keep them steady. The BOE also warned about the uncertainty surrounding a Brexit represents a downward risk for the economy in the months ahead of the vote, leading to a pullback in price. However, broad dollar's weakness prevails across the board, and the pair shows little aims to fall further. According to the 1 hour chart, the bias is higher, as the price remains well above a bullish 20 SMA, whilst the technical indicators maintain their bullish slope well into positive territory. In the 4 hours chart, the pair has managed to accelerate higher after meeting buying interest around its 200 EMA, while the technical indicators maintain their bullish slopes above their mid-lines, supporting the shorter term outlook.

Support levels: 1.4330 1.4295 1.4260

Resistance levels: 1.4410 1.4450 1.4490

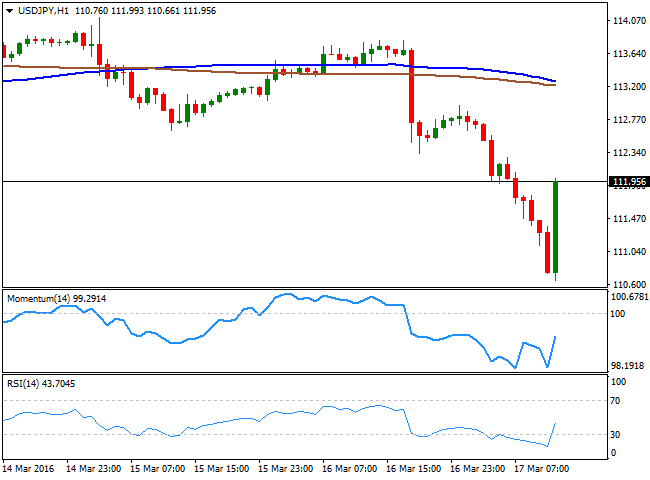

USD/JPY Current price: 111.92

View Live Chart for the USD/JPY

BOJ stepping in? The USD/JPY pair recovers ahead of the US opening, from a low set at 110.66, level not seen since October 2014. Plummeting stocks and a soft dollar have supported yen's rally, but the almost 150 pips bounce has not much of a technical or fundamental base, beyond some rumors of the BOJ intervening the market. US initial jobless claims printed 265K, below market's expectations of 268K but above previous revised 258K, helping the greenback correct higher. Now flirting with the 112.00 level, the 1 hour chart shows that the price remains far below its 100 and 200 SMAs, both in the 113.30 region, while the technical indicators turned sharply higher from extreme oversold levels, now heading higher within negative territory. In the 4 hours chart, the technical indicators also bounced higher from oversold levels, but remain well below their mid-lines, far from supporting additional recoveries. Is not for sure that the Bank of Japan is acting, and is even more unlikely that this gains will sustain after this initial reaction to some jawboning. The risk remains towards the downside, and a break below the mentioned low will likely see the pair extending down to 110.00 a major psychological support.

Support levels: 111.45 111.00 110.65

Resistance levels: 112.00 112.35 112.70

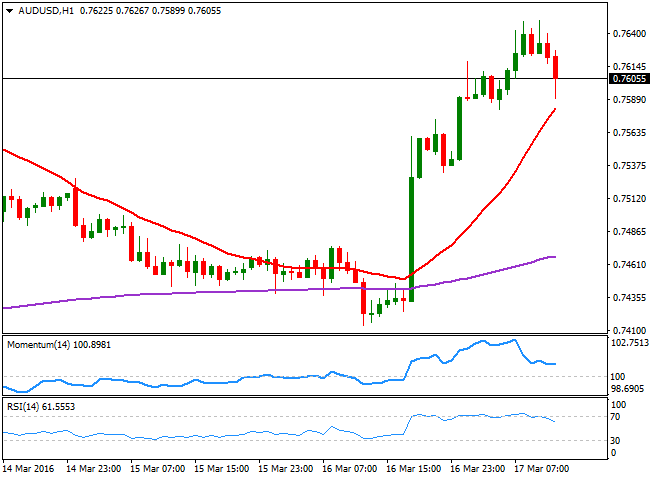

AUD/USD Current price: 0.7606

View Live Chart for the AUD/USD

The AUD/USD pair rallied overnight up to 0.7650 on a mixed job report, showing that the country created less jobs than-expected, but that the unemployment rate fell down to 5.8%. The rally was also clearly supported by dollar's sell-off post FED, whilst the ongoing downward correction tracks stocks´ decline. The dominant trend is bullish, and the 1 hour chart supports the case for an upward recovery, given that the price has recovered after approaching its 20 SMA, while the Momentum indicator resumes its advance after correcting overbought readings. In the 4 hours chart, the upward momentum prevails, while the RSI retreats partially from overbought levels, all of which suggests that fresh highs are likely, once the correction is complete.

Support levels: 0.7590 0.7550 0.7520

Resistance levels: 0.7650 0.7690 0.7730

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.