EUR/USD Current Price: 1.1029

View Live Chart for the EUR/USD

The dollar traded higher across the board on Monday, posting sharp gains against the pound and the euro amid renewed fears of a Brexit. The shared currency was further weighed by disappointing PMIs readings and advances in stocks amid higher oil prices. During the New York session, data showed US national activity improved, with the Chicago Fed index rising to 0.28 in January versus -0.34 the previous month, while Markit manufacturing PMI for February came in at 51.0 slightly below the 52.0 expected.

EUR/USD fell sharply and bottomed out at 1.1003, where the 200-day SMA halted the decline at the beginning of the American session. The pair closed the day with losses after a short-lived bounce seen on Friday. Technically, short-term indicators favour a downward continuation as in the hourly chart the pair consolidates at daily lows and indicators remain flat well below their mid-lines. However, in 4 hours chart, the RSI remains in oversold territory which might signal further consolidation or even a limited bounce before the next leg lower.

Support levels: 1.1000 1.0962 1.0903

Resistance levels: 1.1050 1.1090 1.1140

GBP/USD Current price: 1.4148

View Live Chart for the GBP/USD

The pound was among the worst performers in the FX space on Monday as the currency was hit by growing fears of a Brexit. Prime Minister David Cameron scheduled a UK referendum for June 23rd for Britons to vote on whether they want to remain in or leave the European Union. He later defended EU deal before the Parliament and said Britain will have a ‘special status’ following his renegotiation. However, London Mayor Boris Johnson and six of the 23 members of Cameron's Cabinet continue to campaign for the exit. GBP/USD plummeted and broke below January’s lows to hit its lowest level since March 2009 at 1.4056, although it managed to trim losses during the American afternoon to end around 1.4150. In the 1 hour chart, the RSI has already corrected from oversold levels, while the pair hovers below a bearish 20-SMA. In the 4 hour chart indicators have bounced from lows but are far from suggesting a lasting recovery. Next downside targets stands at the 1.4000 zone with a break exposing the 1.3840 area.

Support levels: 1.4050 1.4000 1.3900

Resistance levels: 1.4200 1.4260 1.4305

USD/JPY Current price: 113.14

View Live Chart for the USD/JPY

USD/JPY finished the day higher, posting its first gain in 3 days, as the dollar strengthened broadly, although the USD rally was tempered during the New York session following softer-than-expected US manufacturing PMI. The pair pulled back from a peak of 113.38, but the downside was contained around 112.90 during the American afternoon. From a technical point of view, the 1 hour chart shows indicators have turned south, with Momentum crossing the 100 level upside-down which suggests upside potential might be limited. In the 4 hours chart, the pair remains limited by the 20-SMA while indicators have turned flat below their midlines, supporting the shorter-term view. A decisive break above 113.50 is needed to pave the way for further gains over the upcoming sessions.

Support levels 112.30 111.65 111.00

Resistance levels 113.50 114.00 114.30

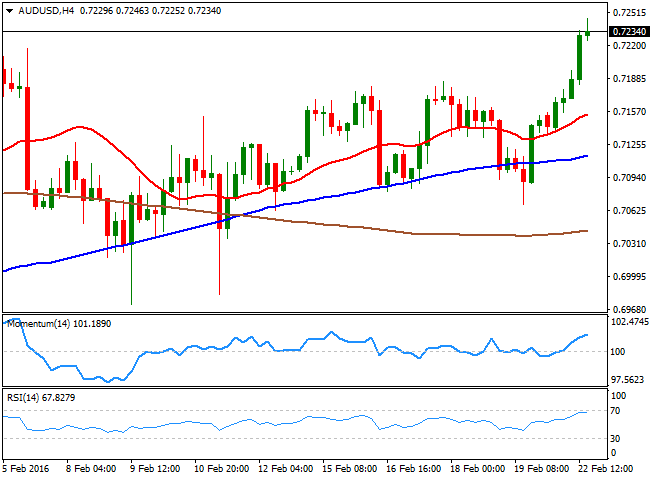

AUD/USD Current price: 0.7234

View Live Chart for the AUD/USD

The Australian dollar broke above the 0.7200 level and advanced to its highest level since January 4th against the greenback, underpinned by higher oil prices and the rise in global stocks. AUD/USD recovered nearly 180 pips from Friday’s lows and peaked at 0.7246 before losing steam. However, the pair clings to a daily gain of more than 1% as it finishes the day around 0.7230. The short-term bullish tone persists as the pair has broken above the 200-day SMA and indicators point sharply higher in the daily chart. In the 4 hour charts RSI indicator has turned flat near overbought levels, while Momentum began to correct lower following Monday’s sharp rise, suggesting a phase of consolidation might precede another leg higher. AUD/USD is close to completely retrace its 2016 fall, which saw the pair hitting a 7-year low a month ago.

Support levels 0.7150 0.7100 0.7070

Resistance levels 0.7250 0.7280 0.7300

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.