EUR/USD Current price: 1.0868

View Live Chart for the EUR/USD

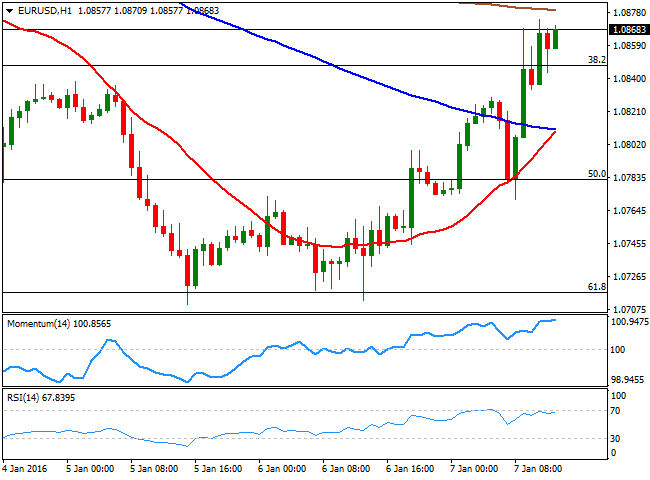

The common currency trades at its highest for the week against the greenback this Thursday, as the markets are again being driven by sentiment. Chinese stocks plummeted, leading to the second early halt in trading of the week, and dragging European stocks lower, something that ended favoring the EUR. Early data released in Europe was mixed, with November Retail Sales falling 0.3% monthly basis, but improved market's sentiment in December, according to the latest confidence indicators. The pair advanced up to 1.0874 so far today, and consolidates nearby ahead of the US opening. Technically, the EUR/USD 1 hour chart shows that the price is below the 200 DMA, while the technical indicators have lost their bullish strength in overbought territory. Also in the 1 hour chart, the price is well above a bullish 20 SMA and the 38.2% retracement of the December rally at 1.0845, indicating some additional gains for the upcoming hours. In the 4 hours chart, the pair is also above its 20 SMA that anyway maintains a bearish tone, whilst the technical indicators head north above their mid-lines, supporting the shorter term view.

Support levels: 1.0845 1.0800 1.0750

Resistance levels: 1.0890 1.0920 1.0960

GBP/USD Current price: 1.4575

View Live Chart for the GBP/USD

The GBP/USD pair fell to a fresh 5-year low of 1.4532 before bouncing amid extreme oversold conditions, but still trading in the red. There were no fundamental releases in the UK that affected the Pound, with the currency easing on mounting speculation over the result of the upcoming Brexit referendum. Technically, the 1 hour chart shows that the 20 SMA has extended its decline further, above the current price, while the technical indicators are correcting oversold readings, but far from suggesting some further advances. In the 4 hours chart, the technical indicators are consolidating in oversold territory, while the price is below a bearish 20 SMA, currently around 1.4660 and the level to overcome to revert the ongoing bearish tone.

Support levels: 1.4535 1.4500 1.4470

Resistance levels: 1.4620 1.4660 1.4700

USD/JPY Current price: 117.61

View Live Chart for the USD/JPY

Bearish potential increases, 116.10 possible. Another round of risk aversion triggered by China sent the USD/JPY down to 117.32, the lowest since Chinese Black Monday late August. The Yen's strength accelerated, and the pair trades in the red for a fourth consecutive day, which leaves the daily technical indicators in oversold territory, although still heading south and supporting some further declines. In the shorter term, the 1 hour chart the price has been consolidating below 117.70 and the moving averages have accelerated their declines well above the current level, whilst the technical indicators are heading lower near oversold levels. In the 4 hours chart, the technical indicators have stalled their declines around oversold readings, not yet confirming further advances. The technical picture is clearly bearish, but the US will release its Nonfarm Payroll report this Friday, which may interrupt, at least temporally, the ongoing JPY strength.

Support levels: 117.25 116.80 116.50

Resistance levels: 117.90 118.40 118.80

AUD/USD Current price: 0.6087

View Live Chart for the AUD/USD

The AUD/USD pair fell down to 0.6980 this Thursday and trades a few pips above the level, unable to recover ground. Weighed by Chinese woes, the Aussie is now biased lower against its American rival, given that the pair has broken below the 0.7000 figure, and the 1 hour chart shows a strong bearish Momentum, while the RSI indicator stands flat around 27. In the 4 hours chart, the technical indicators have partially lost their bearish strength in oversold levels, maintain the risk towards the downside and exposing the 0.6906 multi-year low posted last September

Support levels: 0.6980 0.6955 0.6905

Resistance levels: 0.7000 0.7040 0.7075

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.