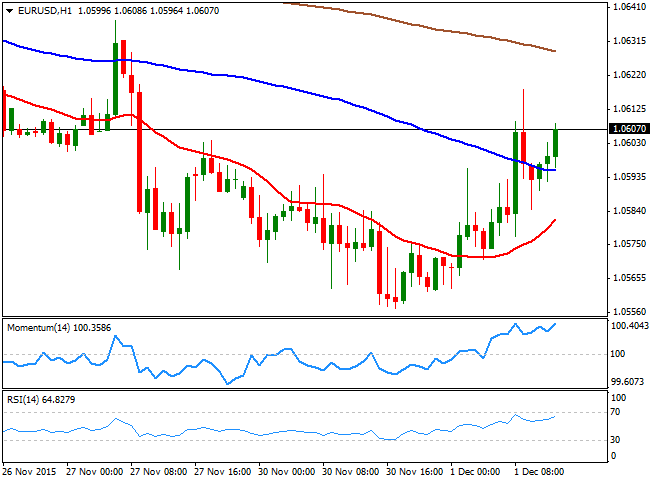

EUR/USD Current price: 1.0606

View Live Chart for the EUR/USD

The dollar trades generally lower this Tuesday, yet the EUR can manage to attract buyers, not even on positive EU data. Early in the London session the Markit manufacturing PMIs showed that the EU recovery gathered pace in November, with the final adjusted reading for November at 52.8, the highest since April 2014. In Germany, the final reading resulted at 52.9 from the previous estimate of 52.6. Also, the EU unemployment rate fell down to 10.7%, the lowest since January 2012. The positive readings sent the EUR/USD pair up to 1.0618, its daily high, but the price quickly retraced back below the 1.0600 figure, standing around it ahead of the US opening. After Wall Street opening, investors will known the final readings of the November manufacturing PMIs, which if they result positive, can revert the negative tone of the American currency.

In the meantime, the technical picture is mild positive, given that the price is a few pips above its 100 SMA for the first time this week, while the 20 SMA heads higher below the current level. In the same chart, the technical indicators head higher well above their mid-lines, limiting chances of a bearish move, but not yet confirming an upward continuation. In the 4 hours chart, the price is a couple of pips above a still bearish 20 SMA, while the technical indicators aim higher in neutral territory, also limiting declines, although lacking enough strength to confirm an upward continuation.

Support levels: 1.0550 1.0520 1.0485

Resistance levels: 1.0620 1.0660 1.0695

GBP/USD Current price: 1.5067

View Live Chart for the GPB/USD

The GB/USD pair erased most of its intraday gains, achieved after the release of the BOE stress test's results, showing that all of the country´s biggest banks passed the annual health check. The pair rose up to 1.5124, but retreated on a worse-than-expected Markit Manufacturing PMI for November, down to 52.7 from a previous 55.2. The 1 hour chart for the pair shows that its currently developing below its 20 SMA, while the technical indicators are posting tepid bounces from their mid-lines, still risking a downward continuation. In the 4 hours chart, the price is hovering around a bearish 20 SMA, while the Momentum indicator aims slightly higher around its 100 level, and the RSI indicator aims lower at 47, failing to offer clear directional clues at the time being.

Support levels: 1.5050 1.5010 1.4980

Resistance levels: 1.5105 1.5135 1.170

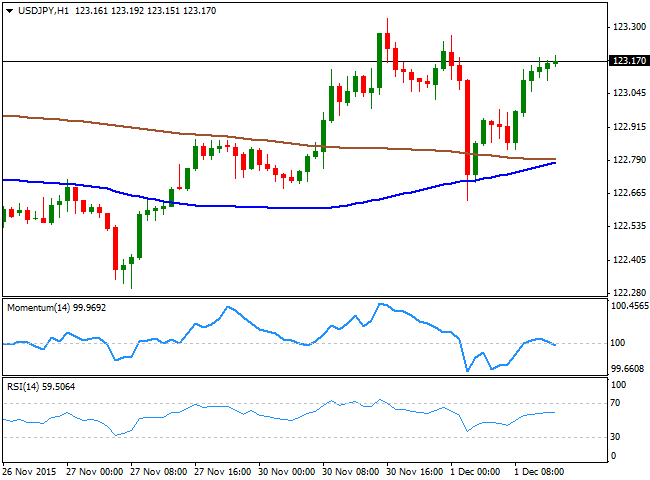

USD/JPY Current price: 123.16

View Live Chart for the USD/JPY

Still in wait and see mode. The Japanese yen firmed up at the beginning of the Asian session, with the USD/JPY pair down to 122.63, o broad dollar's weakness. The pair however, recovered early Europe, and regained the 123.00 level, although still unable to confirm an upward continuation for this Tuesday. From a technical point of view, the 1 hour chart shows that the price is well above its 100 and 200 SMAs, both converging around 122.80, while the technical indicators diverge from price action, heading lower around their mid-lines. In the 4 hours chart, the price has managed to recover above its 100 SMA after briefly falling below it, whilst the technical indicators have lost their upward strength, but hold above their mid-lines. The pair remains in wait and see mode, and will likely remain so for the next 48 hours, as the market will wait for the ECB meeting and the US NFP report, before pushing prices too far away.

Support levels: 122.60 122.20 121.70

Resistance levels: 123.40 123.75 124.40

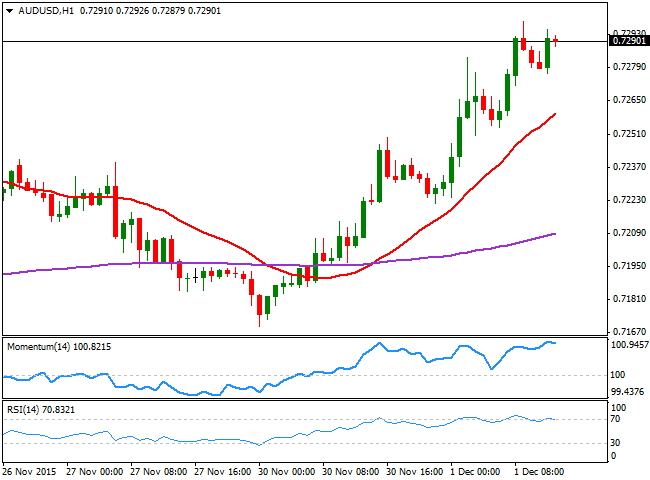

AUD/USD Current price: 0.7290

View Live Chart for the AUD/USD

The RBA decided to left its monetary policy unchanged, giving a lift to the Aussie, as the Central Bank removed the previous reference to "at this meeting" signaling that rates will remain unchanged for some time now. Nevertheless, the Central Bank left doors open for a rate cut if needed, yet the more hawkish than-expected tone was enough for the Aussie to rise up to 0.7298 against the greenback. Trading a few pips below the mentioned high, the pair maintains a bullish tone, as in the 1 hour chart, the price holds well above a bullish 20 SMA, whilst the technical indicators consolidate in overbought territory, with no signs of turning south. In the 4 hours chart, the technical readings maintain a strong upward momentum well above their mid-lines, supporting additional gains on a upward extension above the 07300 level.

Support levels: 0.7280 0.7240 0.7200

Resistance levels: 0.7300 0.7335 0.7380

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.