EUR/USD Current price: 1.0665

View Live Chart for the EUR/USD

Majors are having a hard time to find some direction, and even to attract speculative interest this Wednesday, trading in tight ranges near Tuesday's closes. The EUR/USD pair managed to bounce some from the multi-month low set at 1.0630 as European stocks opened lower but the rally stalled at 1.0691, where selling interest quickly rejected the advance. Investors are waiting for the FOMC Minutes of the latest meeting, to be released in the American afternoon. In the meantime, the 1 hour chart shows that the price is above its 20 SMA, whilst the technical indicators aim slightly higher above their mid-lines, in line with some further advances. In the 4 hours chart, however, the price remains below a bearish 20 SMA, while the technical indicators turned lower in negative territory after correcting oversold readings, maintaining the risk towards the downside.Support levels: 1.0630 1.0590 1.0550

Resistance levels: 1.0690 1.0720 1.0750

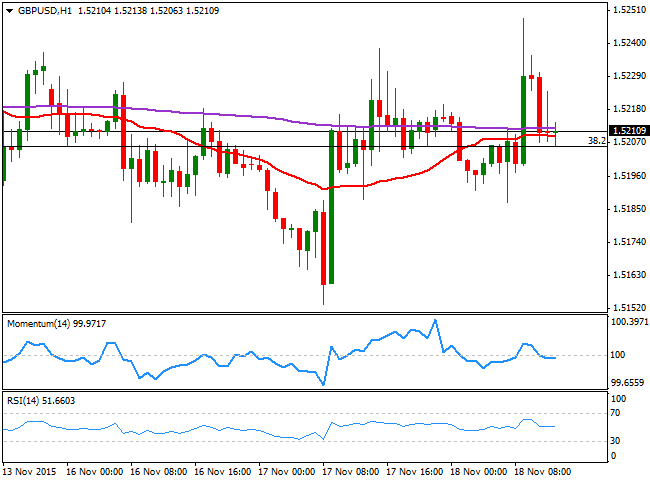

GBP/USD Current price: 1.5210

View Live Chart for the GPB/USD

The British Pound enjoyed some limited demand, advancing against the greenback up to 1.5248 following BOE's member Broadbent comments who said that the Central Bank´s inflation forecast is not as relevant as the economic behavior when it comes to determinate when to rise rates. The pair however, returned to its comfort zone around 1.5210 where it's actually waiting for a clearer trigger. The intraday charts maintain the neutral stance seen ever since the week started, with the price stuck around a horizontal 20 SMA, and the technical indicators heading nowhere around their mid-lines. In the 4 hours chart, the technical readings also remain neutral, with only a clear break above 1.5265, favoring additional gains for this Wednesday.

Support levels: 1.5160 1.5120 1.5070

Resistance levels: 1.5265 1.5320 1.5355

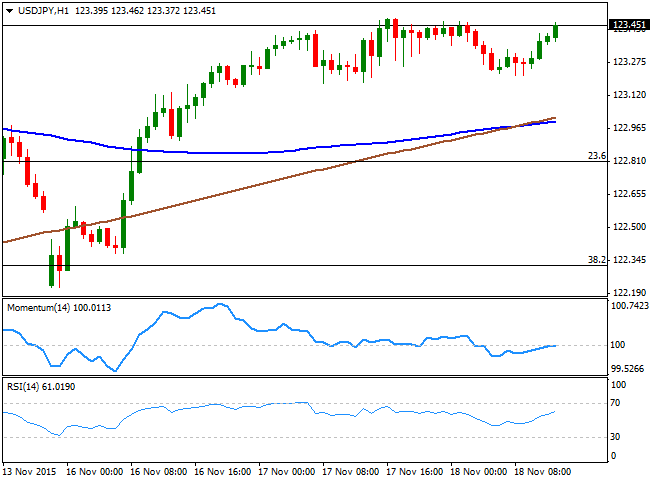

USD/JPY Current price: 123.46

View Live Chart for the USD/JPY

The dollar advances against the Japanese yen ahead of the US opening, as speculation that the FED will finally raise rates in December maintains the pair bid. Holding near its highs, the pair is still 10 pips shy of the monthly high posted at 123.59 earlier this month, and will take a break above it to confirm a more sustainable bullish run. In the meantime, the technical picture favors the upside, as in the 1 hour chart, the moving averages have accelerated higher below the current levels, although the 200 SMA is crossing above the 100 SMA, implying a decreasing upward momentum. In the same chart, the technical indicators aim slightly higher above their mid-lines, not yet confirming further advances. In the 4 hours chart, the Momentum indicator has turned lower near overbought territory, but the RSI indicator heads higher around 63, limiting chances of a downward move, at least from a technical perspective.

Support levels: 123.20 122.80 122.30

Resistance levels: 123.60 123.95 124.40

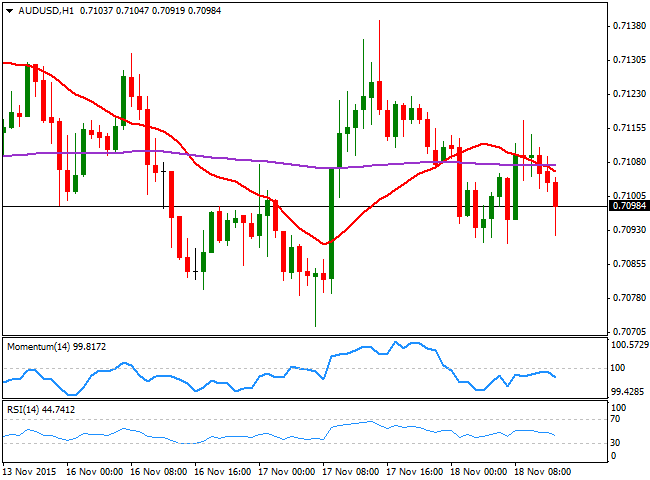

AUD/USD Current price: 0.7098

View Live Chart for the AUD/USD

The Australian dollar weakens against the greenback ahead of the US opening, with the pair struggling to hold gains above the 0.7100 level. Commodity-related currencies are having a hard time this Wednesday, with cooper plummeting to fresh multi-year lows, and generally weaker metals. As for the AUD/USD pair, the 1 hour chart shows that a bearish 20 SMA has contained the upside earlier today, and that the technical indicators have turned south below their mid-lines, in line with further declines. In the 4 hours chart, the technical readings also favor the downside, although a break below 0.7070 is required to confirm further intraday declines.

Support levels: 0.7070 0.7030 0.6990

Resistance levels: 0.7150 0.7190 0.7240

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.