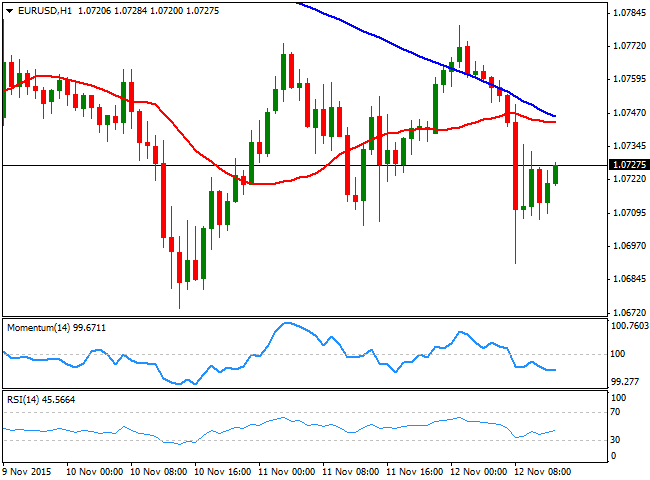

EUR/USD Current price: 1.0725

View Live Chart for the EUR/USD

The common currency trades a few pips above the 1.0700 level against the greenback, having been as low as 1.0690 during the European morning, amid ECB Draghi's comments on economic policy. The head of the European Central Bank, reaffirmed that they are willing to review their ongoing stimulus program by December, pretty much anticipating an extension of facilities before year end. He also highlighted the downward risk of inflation in the region, in a speech before European lawmakers. The EUR/USD pair bounced some after the news, but remains in the lower side of its weekly range, ahead of the US session. In America, several FED officers including Yellen, are scheduled to speak, and investors will be looking there for clues on whether a rate hike in December is more likely.In the meantime the EUR/USD 1 hour chart shows that a mild negative tone prevails, as the price is below its 20 and 100 SMAs, both around 1.0750, whilst the technical indicators hold below their mid-lines, albeit lacking directional strength. In the 4 hours chart, the price is below a flat 20 SMA, while the technical indicators present limited bearish slopes below their mid-lines. Despite the lack of bearish momentum, the downside is favored, with a break below the mentioned daily low opening doors for a decline towards fresh monthly lows.

Support levels: 1.0690 1.0650 1.0620

Resistance levels: 1.0750 1.0785 1.0810

GBP/USD Current price: 1.5183

View Live Chart for the GPB/USD

The GBP/USD pair advanced up to 1.5248 during the Asian session, meeting selling interest around the strong static resistance level. There were no macroeconomic releases in the UK, and the pair turned south early in the European session, breaking below the 1.5200 level on broad dollar strength. Holding near the daily low set at 1.5173, the pair is being contained by the 23.6% retracement of its latest bullish move around 1.5195, and the 1 hour chart shows that the price is below a directionless 20 SMA whilst the technical indicators head south below their mid-lines, all of which favors additional declines. In the 4 hours chart, the price remains well above a bullish 20 SMA, while the technical indicators are losing upward strength, but hold above their mid-lines, limiting the downside as long as the price holds above 1.5160, the 38.2% retracement of the same rally.

Support levels: 1.5160 1.5135 1.5110

Resistance levels: 1.5195 1.5220 1.5250

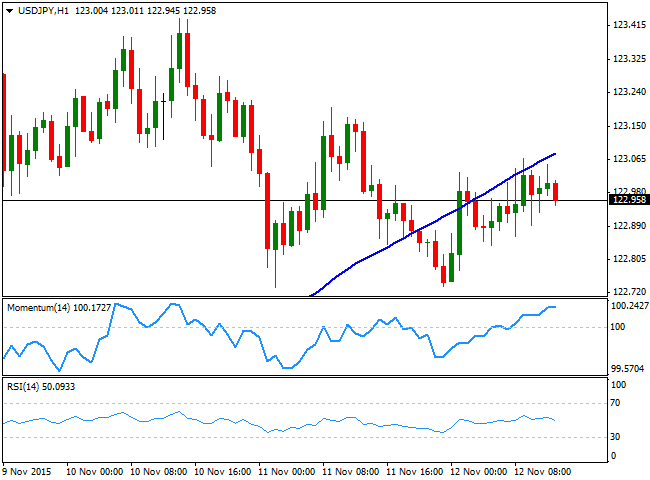

USD/JPY Current price: 122.97

View Live Chart for the USD/JPY

Lower in range. The USD/JPY pair maintains its neutral stance, having been consolidating below the 123.00 level, ever since the day started. The pair however, set a lower low daily basis at 122.73 before bouncing some. Nevertheless, the pair lacks directional strength as the 1 hour chart shows that the price is trading a few pips below a 100 SMA while the technical indicators are losing their upward strength above their mid-lines. In the 4 hours chart, however, the technical indicators are turning south below their mid-lines after a limited upward correction, increasing the risk of a bearish run on a break below the 122.50 level.

Support levels: 122.80 122.50 122.20

Resistance levels: 123.10 123.45 123.80

AUD/USD Current price: 0.7116

View Live Chart for the AUD/USD

The Australian dollar skyrocketed after the release of much better-than-expected local employment figures, resulting in the AUD/USD reaching a daily high of 0.7153. According to official data, the country added 58,600 new jobs in October, way out of the average, whilst the unemployment rate fell to 5.9%. The headline is really hard to believe, but anyway the reading was enough to boost the pair by 100 pips. Broad dollar strength is triggering a downward corrective movement in the pair, although the 1 hour chart shows that the price is holding above a strongly bullish 20 SMA and that the technical indicators have turned flat in positive territory after correcting overbought readings, limiting chances of further declines. In the 4 hours chart, the pair is retreating from its 200 EMA, whilst the technical indicators are turning lower in but are still above their mid-lines. Only below 0.7100, the pair can extend its bearish intraday move, down to the 0.7030 region on a strong dollar's advance.

Support levels: 0.7100 0.7070 0.7030

Resistance levels: 0.7150 0.7190 0.7240

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.