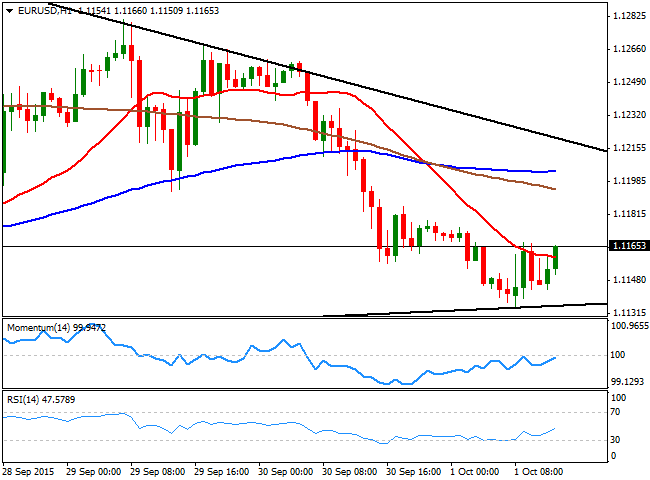

EUR/USD Current price: 1.1165

View Live Chart for the EUR/USD

The EUR/USD pair traded as low as 1.1134 at the beginning of the day, with an European session high posted at 1.1167, following the release of the EU PMIs. Readings were soft but in line with a tepid growth during the third quarter of 2015, not enough however, to boost the EUR. Stocks traded strongly higher in Asia, leading to an also strong opening in Europe. But local share markets have turned into the red, which maintained the common currency in the red ahead of the release of US data. So far, the country has released its weekly unemployment claims for the week ended Sep 25, which resulted at 277K, worse than the 271K expected.

Ahead of the release of US manufacturing figures, the pair advances towards the session high, but with a limited short term upward potential, as the 1 hour chart shows that the price is still struggling to overcome a bearish 20 SMA, whilst the technical indicators are still unable to confirm a continuation rally, heading higher below their mid-lines. In the 4 hours chart however, the price is well below its 20 SMA and below daily descendant trend line coming from 1.1459 around 1.1220, whilst the technical indicators lack directional strength near oversold levels, all of which limits chances of a stronger advance, as long as below 1.1180 the immediate resistance.

Support levels: 1.1120 1.1080 1.1050

Resistance levels: 1.1180 1.1220 1.1250

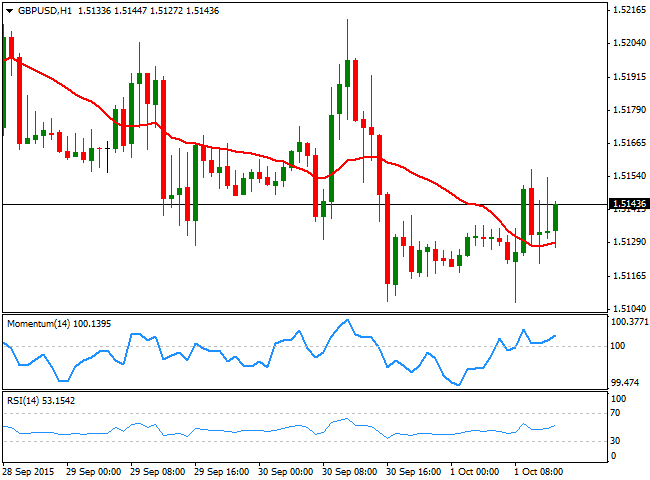

GBP/USD Current price: 1.5143

View Live Chart for the GPB/USD

The GBP/USD pair continues trading range bound near its lows, having however bounced from the 1.5106 daily high. In the UK, the Markit manufacturing PMI resulted better-than-expected, printing 51.5 against market's forecast of 51.3, but the pair remains capped below 1.5160, an immediate short term resistance. The 1 hour chart shows that the price is a few pips above a flat 20 SMA, whilst the technical indicators head higher above their mid-lines, albeit the price is not able to follow. In the 4 hours chart, however, the price remains below its 20 SMA, whilst the technical indicators remain below their mid-lines, showing no directional momentum at the time being.

Support levels: 1.5120 1.5090 1.5060

Resistance levels: 1.5160 1.5200 1.5245

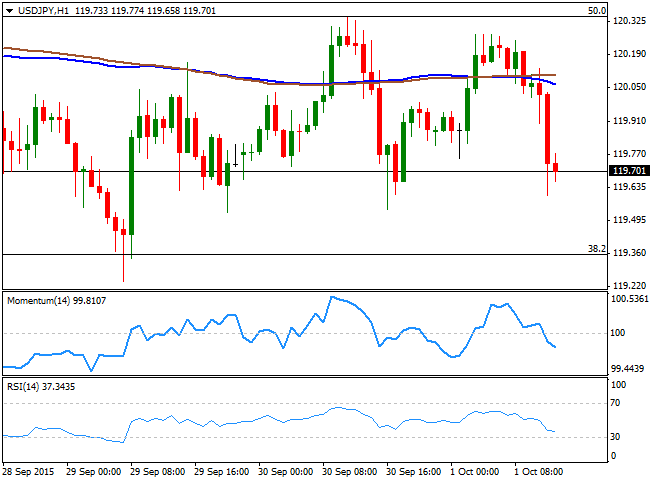

USD/JPY Current price: 119.70

View Live Chart for the USD/JPY

Short term bearish. The USD/JPY pair trades near its daily low, set at 119.60, with the Japanese yen recovering ground as European share markets fall and the US employment data resulted worse-than-expected, pretty discouraging ahead of the US Nonfarm Payroll release this Friday. The short term picture is now bearish, as the 1 hour chart shows the price is below its 100 and 200 SMAs whilst the technical indicators head south below their mid-lines. In the 4 hours chart, the 200 SMA is extending its decline above the 100 SMA, with the shortest capping the upside around 120.30. In this last time frame, the technical indicators are turning south around their mid-lines, supporting the short term negative view. Overall, the pair maintains the range and will likely do so until the release of US employment data, which needs to be a real surprise either positive or negative to produce a breakout of its usual range.

Support levels: 119.60 119.35 119.00

Resistance levels: 120.00 120.35 120.70

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.