EUR/USD Current price: 1.0950

View Live Chart for the EUR/USD

Broad dollar strength led the forex board ahead of the ECB economic meeting, with the EUR/USD pair extending down to 1.0854 with Draghi's press conference. The ECB has left its economic policy unchanged as expected, whilst the speech has brought nothing new to the table. Against his will, the ECB head answered questions regarding Greece, saying that the priority is to keep the country within the EU and that the Central Bank's total exposure to Greece now is of €130B. In the US, weekly unemployment claims released by the time Draghi started to speak, resulted better-than-expected, down to 281K against previous 297K, falling for the first time in a month. The EUR/USD pair managed to bounce from the mentioned low, but is now struggling to recover the 1.0900 level. Technically, the short term picture suggest the ongoing recovery is corrective, as the technical indicators have bounced from oversold territory, whilst the 20 SMA heads lower above the current price. In the 4 hours chart, the 20 SMA maintains its sharp bearish slope, albeit the technical indicators are also suggesting the pair may correct higher, with the next line of sellers waiting now in the 1.0950 region.

Support levels: 1.0860 1.0820 1.0790

Resistance levels: 1.0950 1.0990 1.1045

GBP/USD Current price: 1.5607

View Live Chart for the GPB/USD

The British Pound has fell down to 1.5556 against the greenback, ahead of the ECB economic policy meeting, bouncing afterwards, as the pair reached a critical support level, the 38.2% retracement of its latest bearish run. The 1 hour chart shows that the price remains below its 20 SMA while the technical indicators are recovering from oversold levels, but are still below their mid-lines, presenting a limited upward momentum at the time being. In the 4 hours chart, the technical indicators are still above their mid-lines, while the brief slide was not enough to send the pair below its 20 SMA. Overall the pair maintains its bullish dominant tone, albeit at this point, some follow through beyond 1.5645 is required to confirm a new leg higher.

Support levels: 1.5560 1.5520 1.5485

Resistance levels: 1.5615 1.5645 1.5685

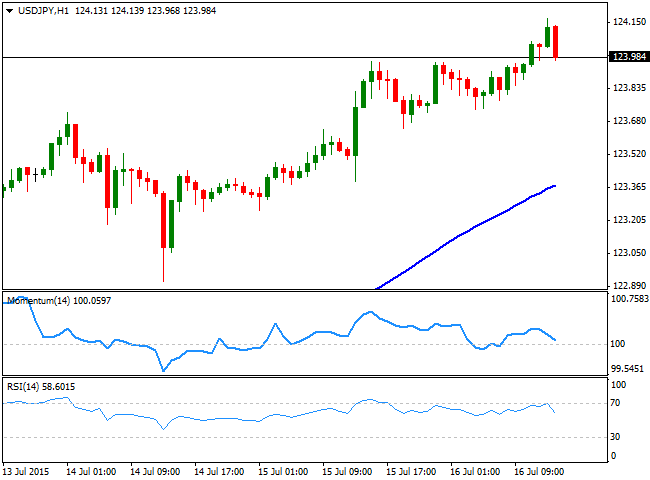

USD/JPY Current price: 123.98

View Live Chart for the USD/JPY

The USD/JPY pair struggles around the 124.00 figure, still finding selling interest on spikes above the level. The 1 hour chart shows that the technical indicators are turning lower above their mid-lines, but that the price holds well above a bullish 100 SMA, currently around 123.40. In the 4 hours chart, the technical indicators lack directional strength in positive territory, whilst the moving averages are still flat well below the current price, suggesting little upward strength at the time being. The downside however, seems also limited with deeps down to 123.30 probably attracting buyers.

Support levels: 123.30 122.90 122.45

Resistance levels: 124.10 124.50 124.90

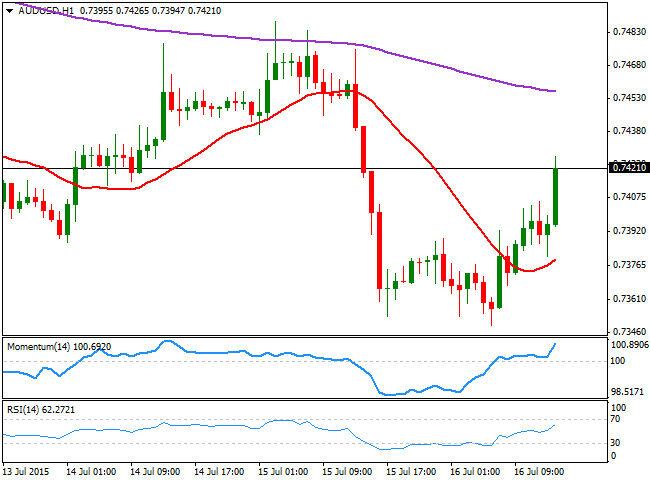

AUD/USD Current price: 0.7421

View Live Chart for the AUD/USD

The AUD/USD pair is in recovery mode, back above the 0.7400 level after falling down to 0.7349 during the past Asian session. The technical picture favors a short term upward continuation, as the 1 hour chart shows that the price is advancing strongly above its 20 SMA, whilst the technical indicators are now approaching overbought levels. In the 4 hours chart, the price is advancing through its 20 SMA while the technical indicators are aiming to cross their mid-lines towards the upside supporting additional short term advances. Further advances are likely, yet selling interest is strong on approaches to the 0.7500 figure, where the pair is expected to resume its decline if reached.

Support levels: 0.7400 0.7350 0.7310

Resistance levels: 0. 7445 0.7470 0.7500

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.