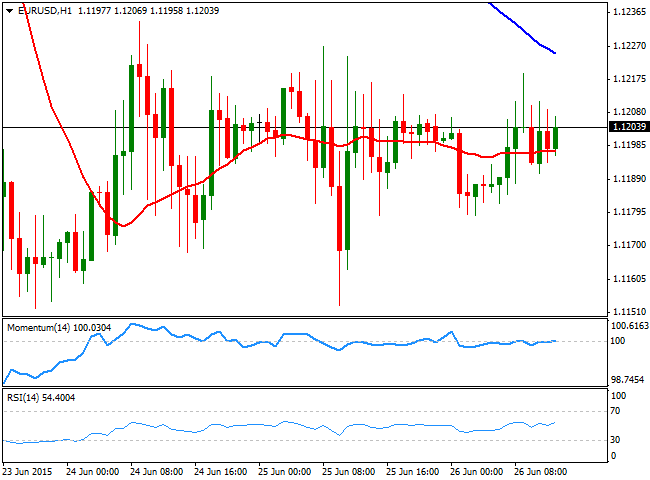

EUR/USD Current price: 1.1204

View Live Chart for the EUR/USD

The EUR/USD pair continues trading around the 1.1200 figure, with traders waiting for upcoming decision on Greece, during the weekend. The EU group will have a meeting this Saturday, to discuss the latest draft of a new bailout proposal. During these last few days, German Chancellor Angela Merkel said that there must be a deal before Monday opening. In the meantime, rumors and talks continue to hit the wires by the hour. The latest one reports that the European Union is preparing an emergency plan if Greek rejects the deal offer on Saturday, and that the proposal is an extension till the end of November.

The technical picture is neutral, with the 1 hour chart showing that the price is barely able to move around a horizontal 20 SMA, whilst the technical indicators hover around their mid-lines. In the 4 hours chart a mild negative tone prevails, although there's nothing indicating selling interest will surge sometime today.

Support levels: 1.1160 1.1120 1.1050

Resistance levels: 1.1245 1.1280 1.1320

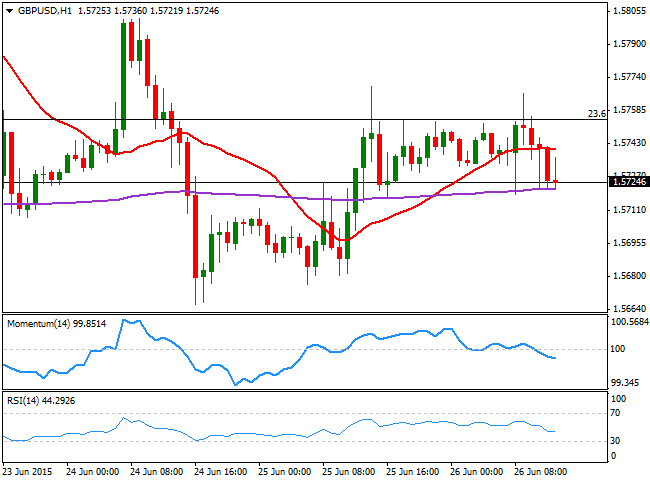

GBP/USD Current price: 1.5723

View Live Chart for the GBP/USD

The British Pound is under mild selling pressure this Friday, with the GBP/USD pair unable to advance the 1.5750 price zone, the 23.6% retracement of its latest bullish run. Nevertheless, the pair holds above the 1.5700 level, and with the 1 hour chart showing that the technical indicators are losing their bearish potential below their mid-lines, whilst the 20 SMA stands flat a few pips above the current price. In the 4 hours chart, the downward potential seems more constructive, with the price unable to establish above a bearish 20 SMA and the Momentum indicator heading sharply lower below the 100 level. At this point, the pair needs to break below the 1.5700 figure to be able to extend its decline down towards the 1.5650 level, 38.2% retracement of the same rally.

Support levels: 1.5700 1.5650 1.5620

Resistance levels: 1.5750 1.5795 1.5840

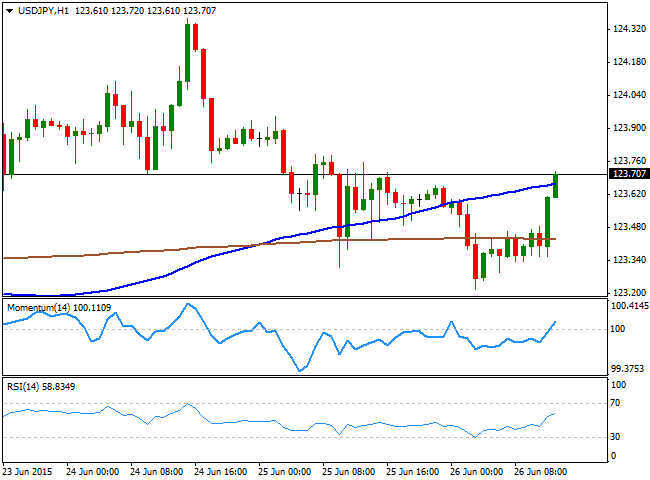

USD/JPY Current price: 123.70

View Live Chart for the USD/JPY

The USD/JPY pair surges ahead of the US opening, and the 1 hour chart shows that an improving upward momentum, as the technical indicators head higher above their mid-lines. In the same chart, the price is advancing above its 100 and 200 SMAs, which means that if the price holds around this region, may continue rising later on in the day. In the 4 hours chart, the price is struggling around its 100 SMA, whist the technical indicators head higher around their mid-lines, supporting the shorter term views. Further advances however, will depend on the ability of the pair to extend beyond 124.10, the immediate resistance.

Support levels: 123.30 122.90 122.45

Resistance levels: 124.10 124.45 124.90

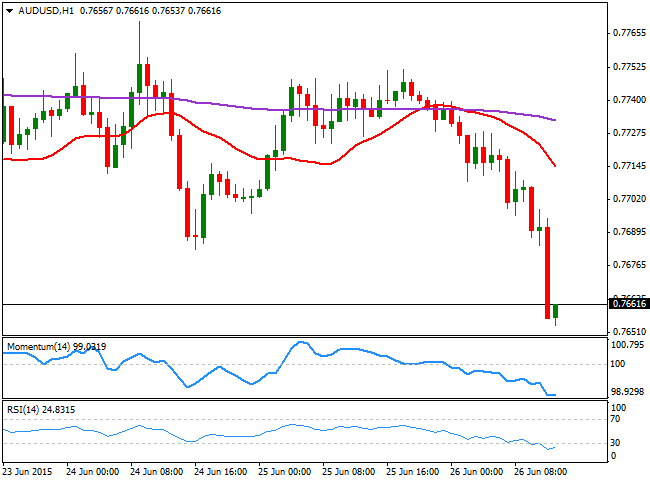

AUD/USD Current price: 0.7660

View Live Chart for the AUD/USD

The AUD/USD pair accelerated its decline after breaking below the 0.7700, triggering stops. The pair reached a fresh weekly low of 0.7653 and trades nearby, with a strong bearish short term tone as the 1 hour chart shows that technical indicators remain in oversold territory, whilst the 20 SMA has turned sharply lower above the current price. In the 4 hours chart, the price has also declined well below its 20 SMA, whilst the technical indicators head sharply lower well below their mid-lines.

Support levels: 0.7640 0.7600 0.7570

Resistance levels: 0.7680 0.7720 0.7760

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.