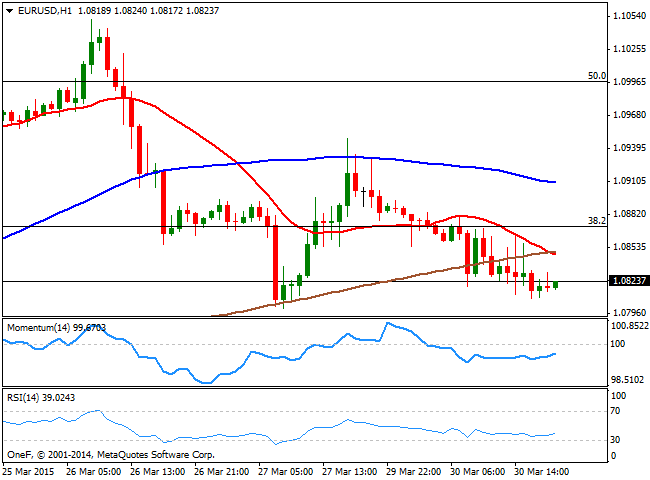

EUR/USD Current price: 1.0823

View Live Chart for the EUR/USD

The American dollar staged a strong come back this Monday, surging across the board ever since the day started, and rallying alongside with stocks. The EUR/USD pair traded as low as 1.0810 in the day, consolidating near the level ahead of US session´s close. But it was a quite choppy session, with the pair moving suddenly up and down with speculation as the only driver. During the European morning, Germany released its inflation rates, with the CPI monthly basis at 0.5% in February, for the most matching expectations, but weak. In the US, the price index for personal consumption expenditures rose by 0.3% from a year earlier, signaling inflation remains subdued, while pending home sales in February increased to their highest level since June 2013.

Technically, the pair remained below the 1.0865 Fibonacci level ever since broking below it during Asian hours, with sellers surging on intraday attempts to break higher. The 1 hour chart shows that the price broke below its 100 SMA that now converges with the 20 SMA around 1.0845, whilst the technical indicators stand flat below their mid-lines. In the 4 hours chart the price extended further below a bearish 20 SMA, whilst the Momentum indicator aims higher below 100 and the RSI indicator maintains a bearish slope around 41, anticipating additional declines, particularly if the price extends below the 1.0800 level.

Support levels: 1.0790 1.0755 1.0710

Resistance levels: 1.0865 1.0910 1.0950

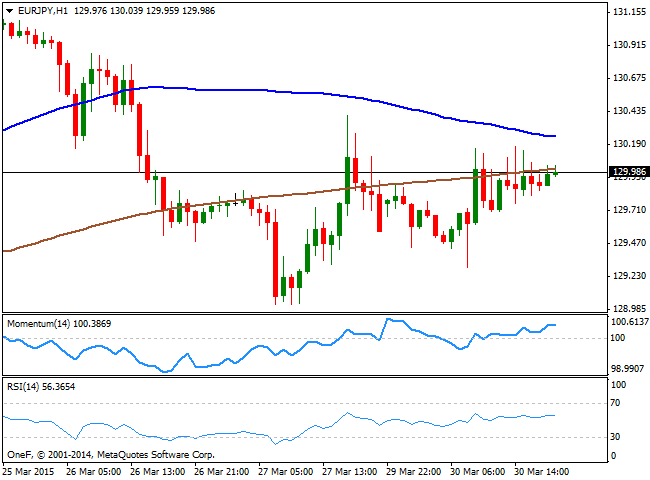

EUR/JPY Current price: 129.97

View Live Chart for the EUR/JPY

The yen fell on the back of disappointing local data, as Japanese industrial production collapsed -3.4% monthly basis verse -1.9% expected in February. The decline was broad-based, but critically focused in key export industries. The EUR/JPY cross however, failed to regain the 130.00 level, despite several intraday attempts. In the short term, the 1 hour chart shows that the price remains limited below its 200 SMA, with the 100 SMA offering additional resistance in the 130.35 price zone, the immediate resistance level. In the same chart, the technical indicators stand directionless above their mid-lines, offering little clues on what's next for the pair. In the 4 hours chart, the price is right above a bearish 100 SMA, whilst the Momentum indicator aims higher and is about to cross its mid-line, while the RSI stands flat around 49, limiting the upward potential at the time being. The price needs to extend above 130.35 to be able to advance further, up to the 131.20 price zone.

Support levels: 129.75 129.30 128.80

Resistance levels: 130.35 130.80 131.20

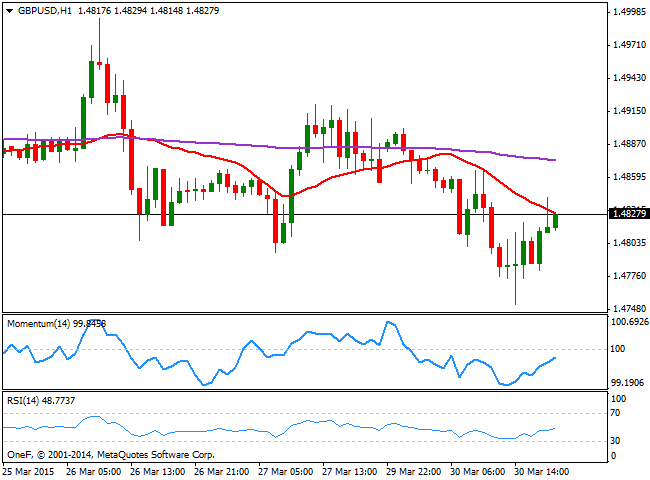

GBP/USD Current price: 1.4827

View Live Chart for the GBP/USD

The GBP/USD pair bounced from a fresh 2-week low set at 1.4752 early Europe, now trading back above the 1.4800 level. There were no news coming from the UK, albeit on Tuesday, the kingdom will release its GDP and Current Account figures, both for the last quarter of 2014, with the first expected to remain as previously reported at 0.5%. From a technical point of view, the short term picture suggests the pair may advance further as the 1 hour chart shows that the price advances towards its 20 SMA, currently around 1.4840 whilst the technical indicators aim higher coming from oversold territory, but still below their mid-lines. In the 4 hours chart, the price also stands below a bearish 20 SMA, currently at 1.4860, while the technical indicators aim higher below their mid-lines. The price can extend up to this 20 SMA at 1.4860, but it will take some steady advances above it to confirm additional gains for the upcoming sessions. A break below 1.4790 on the other hand, should lead to a negative continuation towards the 1.4700 price zone.

Support levels: 1.4790 1.4740 1.4700

Resistance levels: 1.4840 1.4890 1.4930

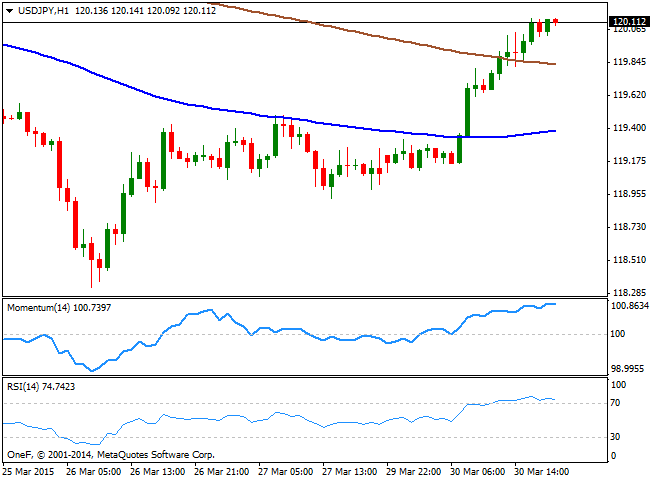

USD/JPY Current price: 120.12

View Live Chart for the USD/JPY

The USD/JPY pair surged above the 120.00 level in the American afternoon, supported by the strong recovery in stocks. Technically the 1 hour chart shows that the price advanced above the 100 and 200 SMAs, although indicators are starting to look exhausted in extreme overbought territory. The price however, remains at the daily high, diverging from the indicators and suggesting that if there is a bearish corrective, it may be short lived and shallow. In the 4 hours chart, the price advanced above its 200 SMA, while the Momentum indicator is turning sharply lower from overbought territory, and the RSI maintains a bullish slope around 64. As for the shorter term, the Momentum indicator divergence is not enough to confirm a change in the ongoing upward move: the pair needs to break below the 119.65 support to gain bearish track.

Support levels: 119.90 119.65 119.20

Resistance levels: 120.45 120.80 121.30

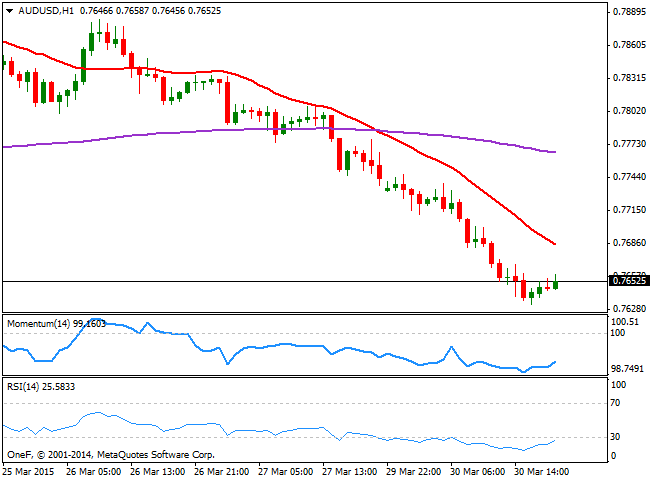

AUD/USD Current price: 0.7652

View Live Chart for the AUD/USD

The AUD/USD pair has been under strong selling pressure all day long, as investors are pricing in the possible announcement of a rate cut coming from the RBA this month. The pair fell as low as 0.7632 before posting a limited bounce by US close, but maintains a strong negative bias. Technically the 1 hour chart shows that the price holds below a strongly bearish 20 SMA, whilst the Momentum indicator remains flat below 100 and the RSI aims higher around 24. In the 4 hours chart the 20 SMA crossed below the 200 EMA in the 0.7770/80 area, whilst the technical indicators are posting some tepid advances in overbought territory, still not enough to confirm a short term recovery. As long as below the 0.7700 figure, the downside is favored, with a break below the mentioned daily low exposing 0.7559, this year low posted early March.

Support levels: 0.7630 0.7585 0.7555

Resistance levels:0.7700 0.7745 0.7780

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.