EUR/USD Current price: 1.10588

View Live Chart for the EUR/USD

The EUR/USD pair corrected higher, reaching a daily high of 1.0618 before settling below the 1.0600 figure, and the 1 hour chart shows that the early upward potential has lost momentum, as the technical indicators retrace from overbought levels, whilst the price's advance failed to overcome the 100 SMA, a few pips above the current level. In the 4 hours chart the price is above a flat 20 SMA, for the first time since late February, whilst the technical indicators head higher although still below their mid-lines. The upward corrective movement could extend further, particularly on renewed strength above the 1.0600 figure, albeit the bearish dominant trend remains intact, and will likely resume with a break below the 1.0550 level.

Support levels: 1.0550 1.0510 1.0470

Resistance levels: 1.0600 1.0645 1.0690

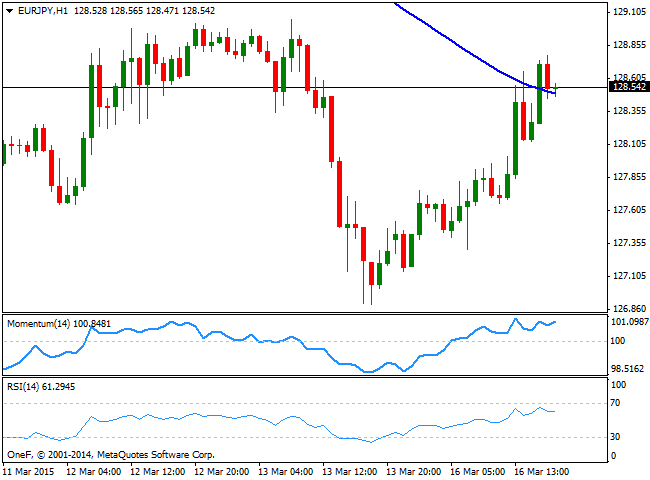

EUR/JPY Current price: 128.54

View Live Chart for the EUR/JPY

The Japanese yen weakened in the crosses, with the EUR recovery helping the EUR/JPY add around 150 pips during the first day of the week. The EUR/JPY 1 hour chart shows that the price struggles around a bearish 100 SMA at the current level, with the 200 SMA at 130.20, whilst the technical indicators maintain their bullish strength near overbought territory, supporting some further advances. In the 4 hours chart the Momentum indicator heads higher right below the 100 level, while the RSI also heads north, but remains below 50, all of which suggest this latest recovery may remain as corrective, particularly if the pair fails to extend its gains above the 129.10 level, the immediate strong resistance. Back below 128.20, should suggest the upward movement is complete and see the pair resuming the slide, back towards the 127.00 level.

Support levels: 128.20 127.50 126.90

Resistance levels: 128.65 129.10 129.50

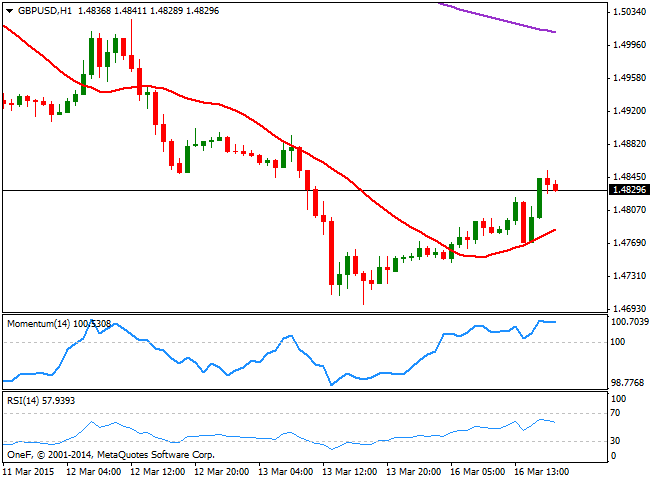

GBP/USD Current price: 1.4827

View Live Chart for the GBP/USD

The GBP/USD pair posted a tepid recovery, reaching a daily high of 1.4852 before stalling. There won't be any relevant data in the UK until next Wednesday, with the release of the BOE's Minutes and the monthly employment figures. In the meantime, the pair can extend its upward corrective movement, as the short term picture maintains a bullish tone. In the 1 hour chart, the price has found buying interest in a now bullish 20 SMA currently around 1.4785, whilst the technical indicators have turned flat near overbought territory. In the 4 hours chart the technical indicators maintain their strong bullish slopes, but remain below their mid-lines, whilst the price stalled right around a strongly bearish 20 SMA around the mentioned daily high. If the price manages to extend beyond it, the rally may extend up to 1.4950 without actually affecting the longer term bearish trend. A break below 1.4785 on the other hand, should confirm the upward corrective movement is complete, and see the pair returning towards its recent lows around the 1.4700 level.

Support levels: 1.4810 1.4785 1.4740

Resistance levels: 1.4850 1.4890 1.4925

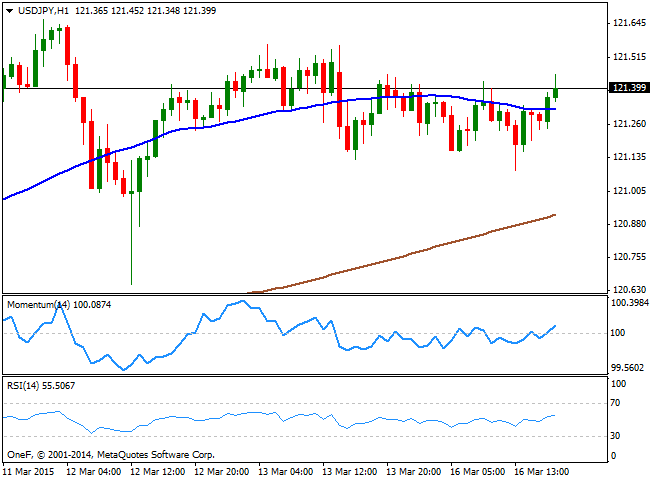

USD/JPY Current price: 121.40

View Live Chart for the USD/JPY

The USD/JPY pair has shown no signs of life at the beginning of the week, confined to a 40 pips range for the past 24 hours. Trading a few pips above its daily opening, the pair was trapped between dollar weakness and stocks strength, as the latest tends to have a negative effect in the Japanese currency. During the upcoming Asian session, the country will release its Trade Balance figures, and the deficit is expected to have shrunk in February to ¥-1,050.0B from previous ¥-1,177.5B. In the meantime, the 1 hour chart shows a mild bullish tone with the price holding above a flat 100 SMA and the Momentum indicator aiming higher above its mid-line, whilst the RSI stands flat around 54. In the 4 hours chart the technical indicators stand directionless around their mid-lines, maintaining a neutral stance. The pair needs to advance firmly above the 121.60 price zone to be able to retest the multi-year high posted last week at 122.02, with some steady gains above this last opening doors for a steadier advance up to the 125.00 level during the upcoming weeks.

Support levels: 121.05 120.65 120.30

Resistance levels: 121.50 121.95 122.40

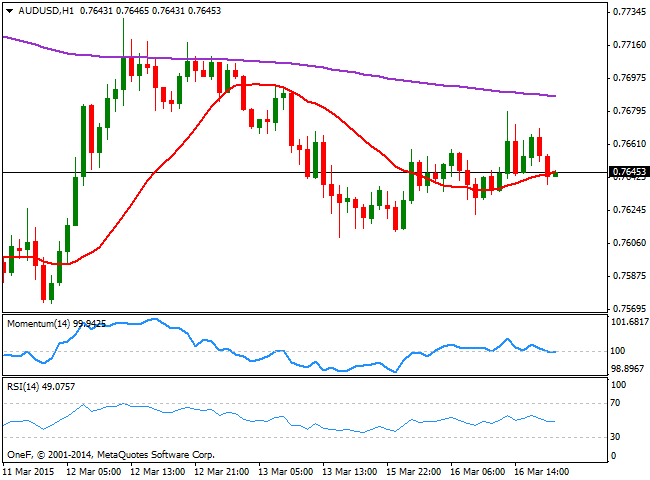

AUD/USD Current price: 0.7645

View Live Chart for the AUD/USD

The Aussie was also benefited by a weaker dollar, with the AUD/USD pair reaching a daily high of 0.7679 before retracing. The lower high daily basis has made of this latest upward move an upward correction rather than the beginning of a recovery, with the market eyeing upcoming RBA meeting's minutes later this week, and waiting for some tips over a possible upcoming rate hike. The short term picture shows that the pair is turning bearish, as in the 1 hour chart, the price struggles around a flat 20 SMA whilst the technical indicators present a mild bearish slope in neutral territory. In the 4 hours chart the price is moving back and forth around a flat 20 SMA, whilst the Momentum indicator gains bearish strength below the 100 level, and the RSI heads lower around 47, all of which increases the chances of a downward continuation, particularly on a break below the 0.7605 support.

Support levels: 0.7640 0.7605 0.7575

Resistance levels: 0.7690 0.7735 0.7770

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.