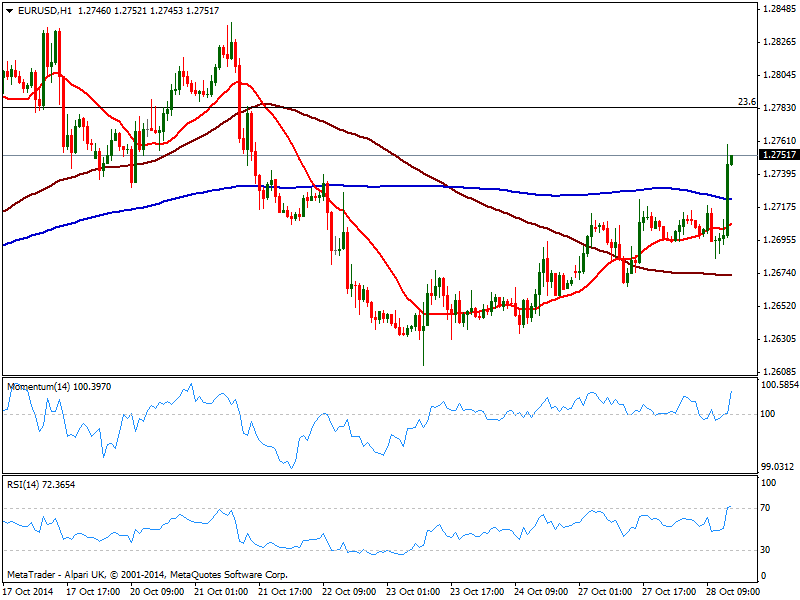

EUR/USD Current price: 1.2750

View Live Chart for the EUR/USD

US Durable Goods Orders finally give European currencies a reason to move, accelerating higher against the greenback on the back of a quite weak number of -1.3% against the 0.5% expected. Having been confined to tight ranges, dollar selloff seems larger than it actually easy on a first glance, yet its weakness is undeniable. Consumer confidence in the US is up next, and if the number also disappoints, then the rallies may become much more significant ahead of FED meeting tomorrow.

As for the EUR/USD, the hourly chart shows price at fresh highs above 1.2750 and above its moving averages that remain pretty horizontal due to latest range, while indicators aim higher above their midlines. In the 4 hours chart, RSI turned higher above its midline, having found intraday support in a mild bullish 20 SMA now around 1.2670. Immediate resistance comes at the 1.2780/90 area, with a break above probably fueling the run up to recent highs in the 1.2840 price zone.

Support levels: 1.2740 1.2700 1.2670

Resistance levels: 1.2790 1.2840 1.2885

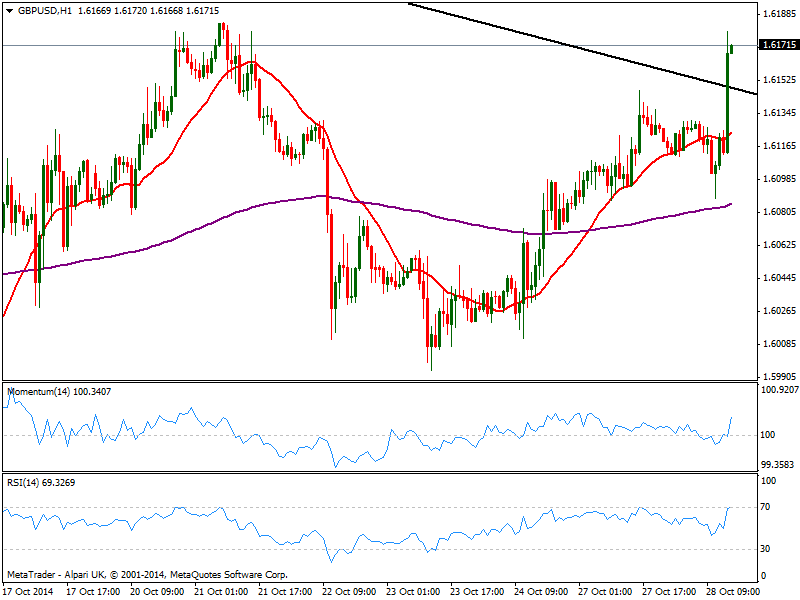

GBP/USD Current price: 1.6171

View Live Chart for the GBP/USD

The GBP/USD accelerated through the daily descendant trend line at 1.6145 with the news, printing 1.6179 before a shallow retracement, now suggesting more gains ahead moreover if upcoming US data also misses expectations. Short term, the hourly chart shows price extending above its 20 SMA and RSI heading strongly up above its midline, while the 4 hours chart also presents a bullish bias, with 200 EMA at 1.6190 acting as immediate resistance and the level to break to confirm more intraday gains in the pair.

Support levels: 1.6145 1.6100 1.6070

Resistance levels: 1.6190 1.6220 1.6250

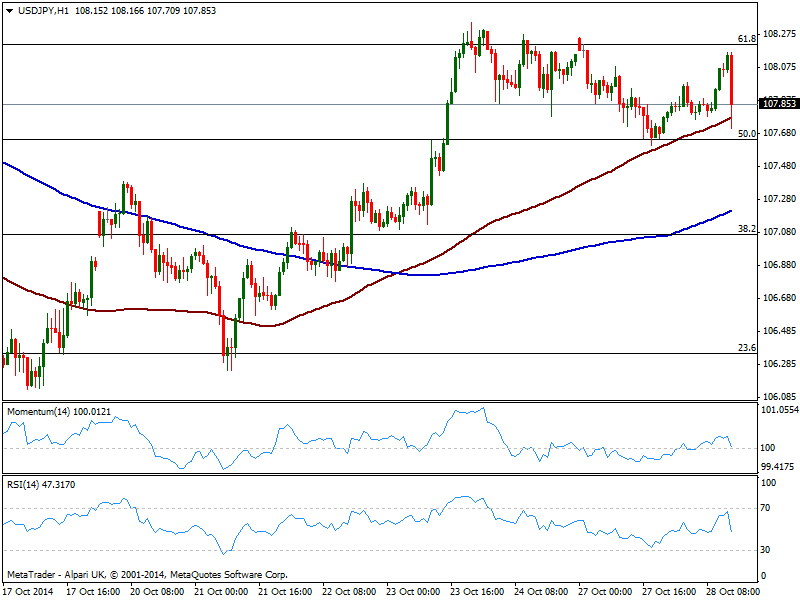

USD/JPY Current price: 107.85

View Live Chart for the USD/JPY

The USD/JPY erased most of its intraday gains, retracing from the 108.20 price zone, but for the most confined to its latest range: The 1 hour chart shows price contained in between the 50% and the 61.8% retracements of the latest bearish run, with 100 SMA offering short term support a few pips below current price. In the 4 hours chart indicators head lower around their midlines, lacking strength at the time being: a break through 107.55 is required to confirm a new leg lower, eyeing in the short term 107.10 price zone.

Support levels: 107.55 107.10 106.70

Resistance levels: 108.20 108.50 108.90

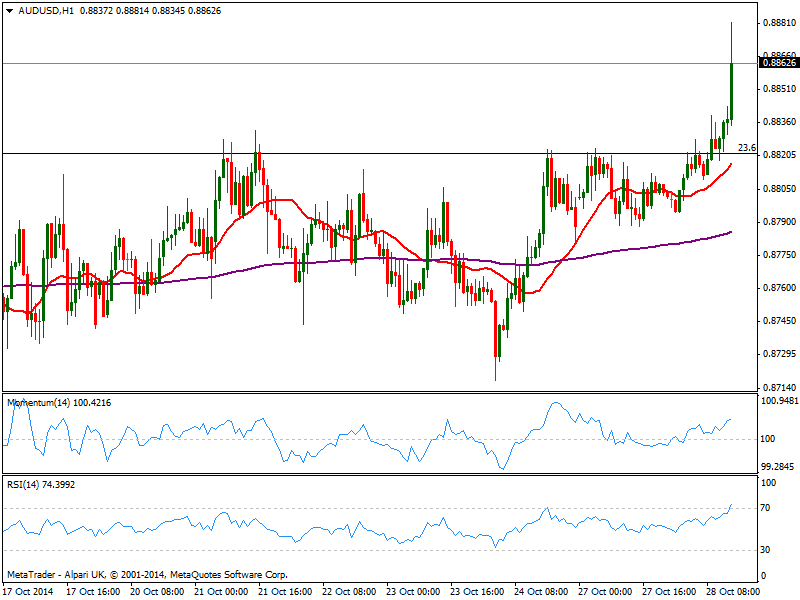

AUD/USD Current price: 0.8861

View Live Chart of the AUD/USD

Commodity currencies are the best performers so far today, with the pair finally breaking higher and reaching 0.8881 fresh 3-weeks high. The 1 hour chart shows a strong upward momentum coming from technical readings, with 20 SMA now converging with the strong support at 0.8820. In the 4 hours chart indicators turned strongly bullish with some follow through above 0.8900 pointing for a test of the 38.2% retracement of its latest bearish run at 0.8930.

Support levels: 0.8820 0.8770 0.8730

Resistance levels: 0.8890 0.8930 0.8970

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.