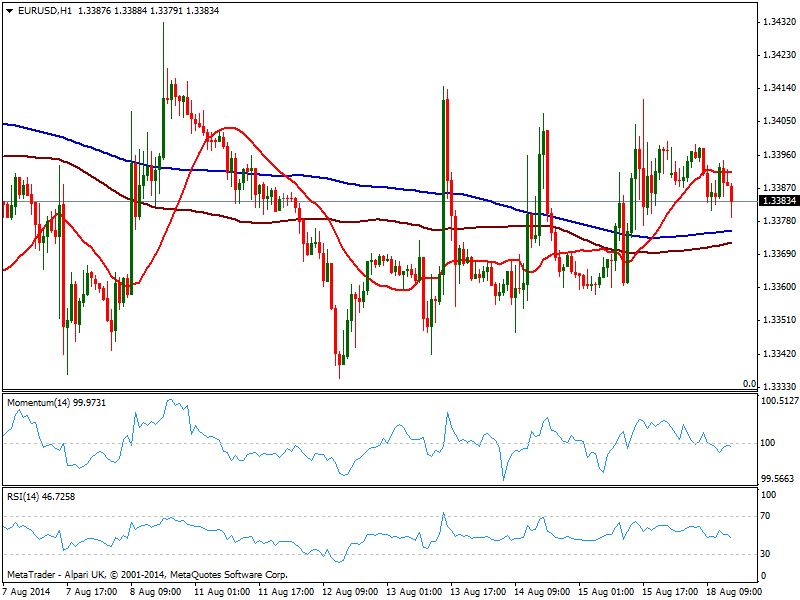

EUR/USD Current price: 1.3383

View Live Chart for the EUR/USD

The EUR/USD eases some this Monday, having been however confined to a 30 pips range and despite European trade balance posted a surplus above expected of 16.8B. Unchanged since previous updates, the hourly chart shows 20 SMA flat above current price, while 100 and 200 ones stand flat in the 1.3370 area, below current price. In the same time frame, indicators head slightly lower below their midlines, limiting advances in the short term. In the 4 hours chart the pair maintains a neutral stance, with the expected range still being 1.3330/1.3440.

Support levels: 1.3370 1.3330 1.3295

Resistance levels: 1.3405 1.3440 1.3485

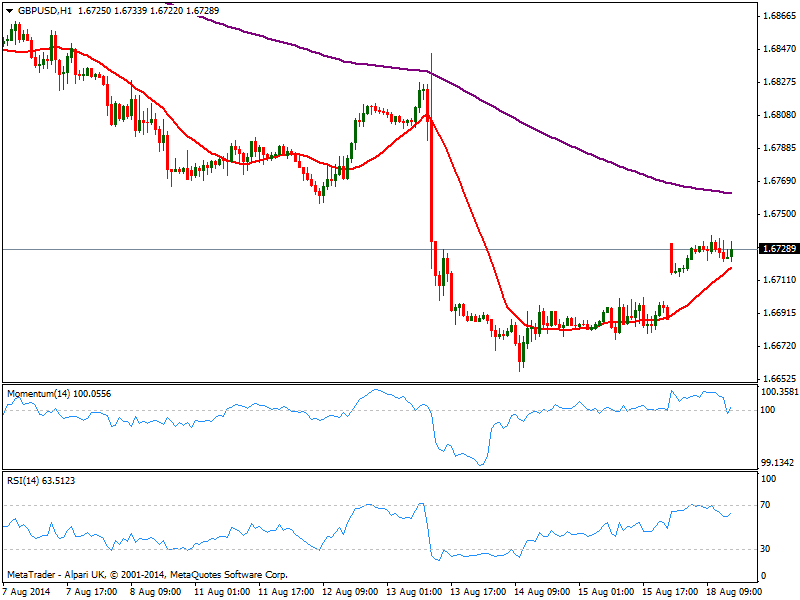

GBP/USD Current price: 1.6729

View Live Chart for the GBP/USD

The GBP/USD trades in the 1.6720/30 price zone, with the early week opening gap still unfilled. Showing little progress ahead of US opening, indicators in the hourly chart present a mild positive tone as per heading higher above their midlines, while 20 SMA heads north below current price. In the 4 hours chart indicators lost their upward strength and stand flat above their midlines, while price develops above a bearish 20 SMA, giving no clues on upcoming moves.

Support levels: 1.6700 1.6650 1.6620

Resistance levels: 1.6730 1.6760 1.6800

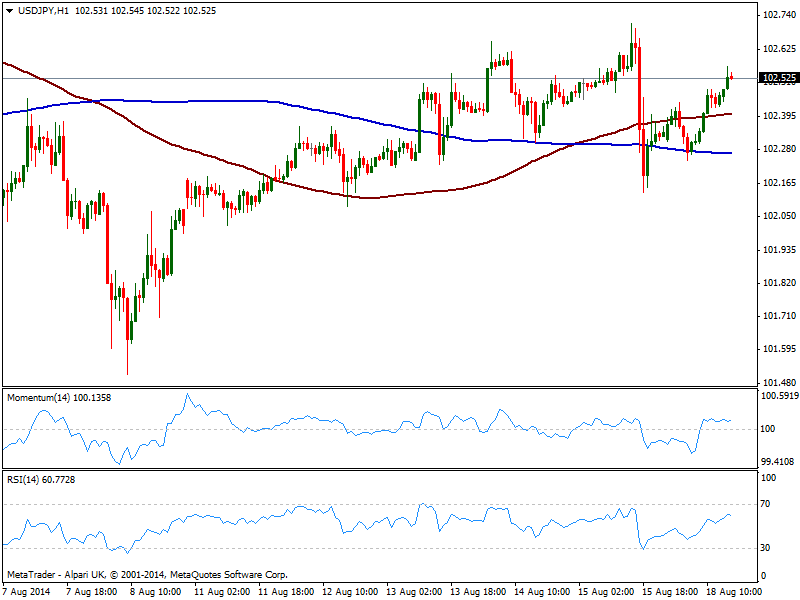

USD/JPY Current price: 102.52

View Live Chart for the USD/JPY

The USD/JPY has managed to advance some despite US 10Y yields trading below 2.40%, supported by the positive mood among stocks traders. Nevertheless, the pair holds below the 102.80 critical price zone, where the pair not only stalled several times over the past few months, but also presents a daily descendant trend line coming from this year high. The hourly chart shows price advancing above its moving averages and indicators in positive territory, albeit lacking strength at the time being. In the 4 hours chart moving averages maintain a strong upward tone, with 100 SMA offering intraday support around 102.35, while indicators remain neutral.

Support levels: 102.30 101.95 101.60

Resistance levels: 102.80 103.10 103.45

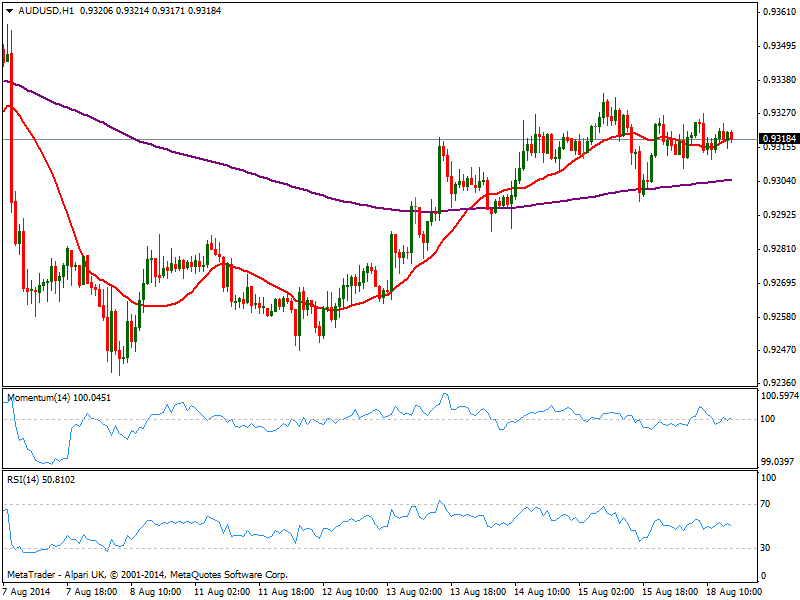

AUD/USD Current price: 0.9318

View Live Chart for the AUD/USD

Trading at its weekly opening, the AUD/USD presents a neutral short term stance, holding below critical 0.9330 static resistance zone. At this point, little should be expected from the pair, until upcoming Asian session, when Minutes from the latest RBA meeting will be released: Governor Stevens can add some action to the pair, and the most likely scenario is that he will insists on the “overvalued” currency, trying to drag Aussie down. In that case, the key support to break stands at 0.9260, strong static midterm support.

Support levels: 0.9300 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.