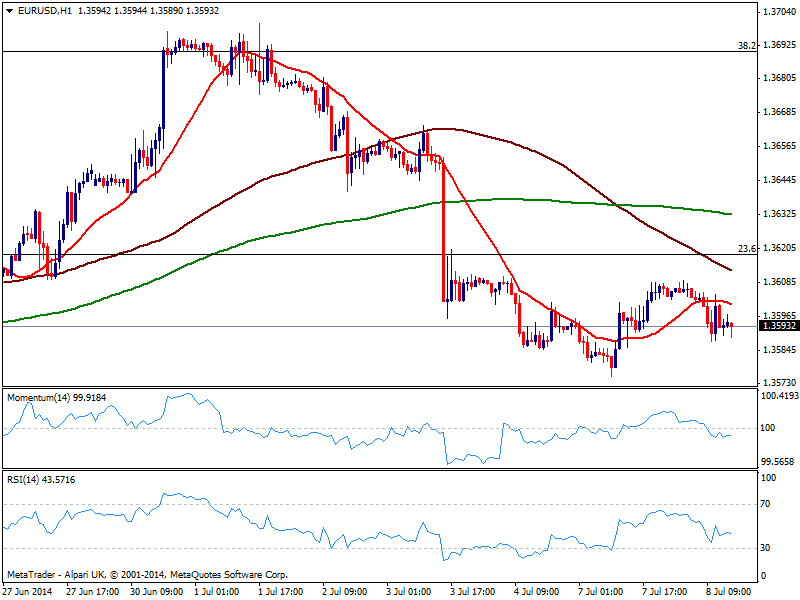

EUR/USD Current price: 1.3592

View Live Chart for the EUR/USD

Having shown no progress over Asian or European hours, the EUR/USD has lost some ground ahead of US opening, down from a daily high of 1.3609. The hourly chart shows a mild bearish tone with price below its 20 SMA while indicators hold below their midlines mostly flat and directionless. In the 4 hours chart price continues developing below moving averages all of them converging in a tight 10 pips range, which clearly reflects the lack of direction in the pair. As commented on previous updates, stops are likely large below the 1.3570, and if trigger the pair may extend its slide towards the 1.3500/30 price zone.

Support levels: 1.3570 1.3530 1.3500

Resistance levels: 1.3620 1.3675 1.3700

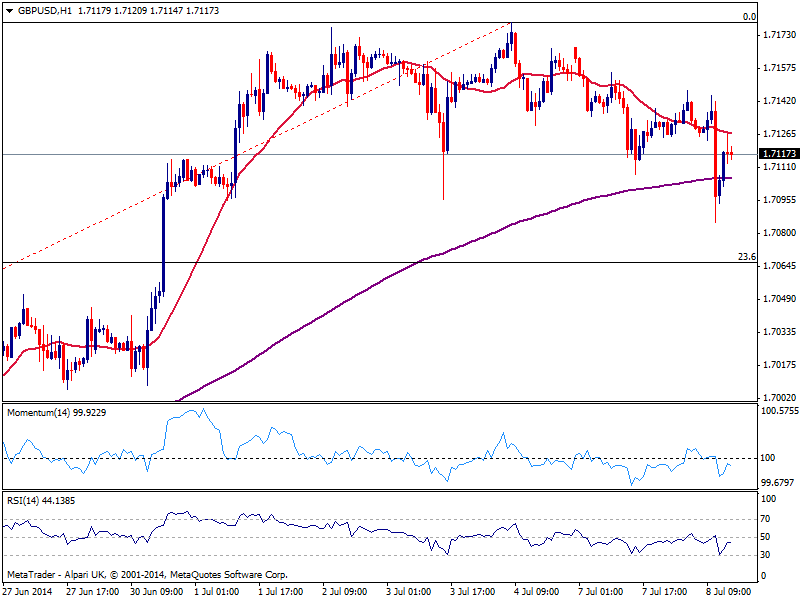

GBP/USD Current price: 1.7117

View Live Chart for the GBP/USD

Pound suffered from worse than expected data down to 1.7085 on the day against the dollar. Buyers however took their chances and price recovered above the 1.7100 figure, still unable to confirm a break higher in the short term, as per the hourly chart showing price capped below a bearish 20 SMA and indicators heading lower below their midlines. In the 4 hours chart technical readings present a strong bearish tone, with price below its 20 SMA and indicators heading south into negative territory. Nevertheless risk to the downside is being limited by 1.7060, 23.6% retracement of the latest daily bullish run.

Support levels: 1.7095 1.7060 1.7020

Resistance levels: 1.7130 1.7180 1.7220

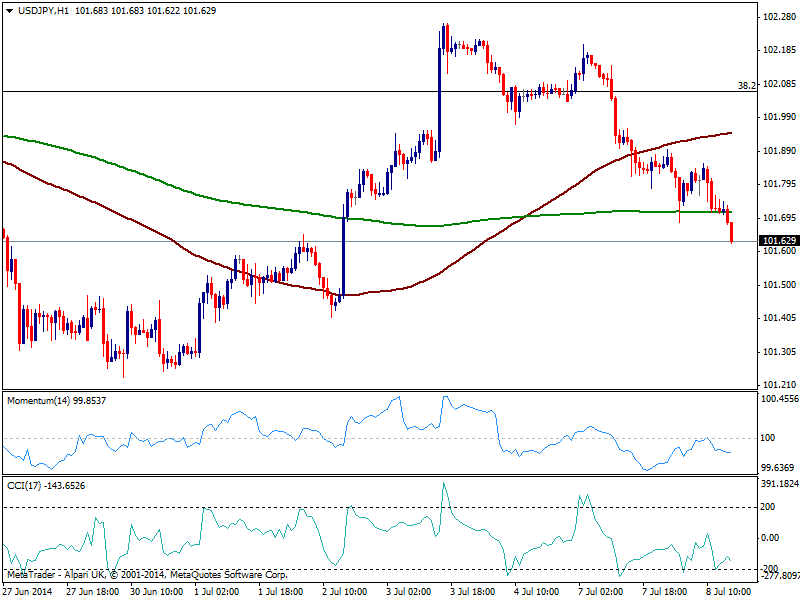

USD/JPY Current price: 101.70

View Live Chart for the USD/JPY

Yen maintains its strength against most rivals, with the USD/JPY trading at fresh 4-day lows, challenging 101.60 support. The hourly chart shows price extending below 200 SMA, with momentum heading south in negative territory, supporting a downward continuation. In the 4 hours chart indicators look a bit exhausted to the upside, but far from oversold readings. Current level has prove strong in the past so a break should not be that easy on a first attempt, yet if pressure remains and US stocks extend their decline, the slide can quickly extend down to 101.20 price zone.

Support levels: 101.60 101.20 100.70

Resistance levels: 101.95 102.35 102.80

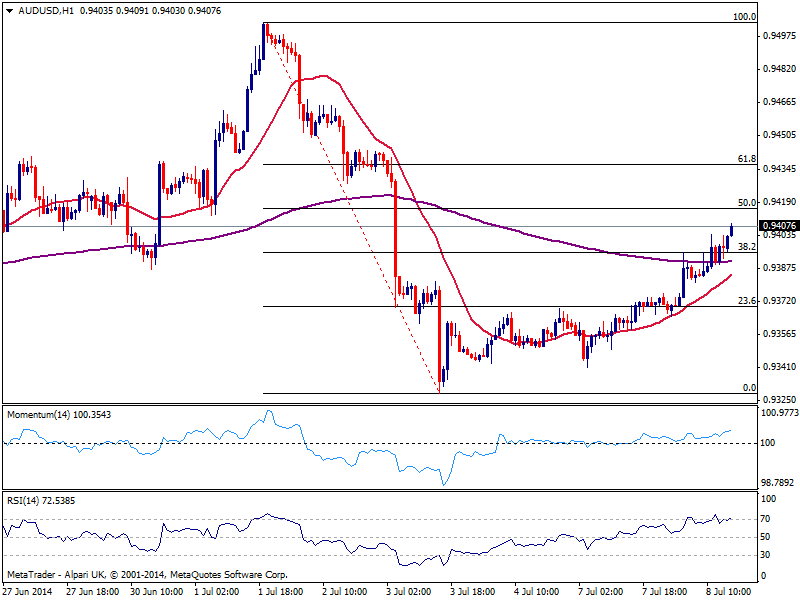

AUD/USD Current price: 0.9407

View Live Chart for the AUD/USD

The AUD/USD trades back above the 0.9400 mark having regained the level on the back of positive local data. The hourly chart shows price extended above the 38.2% retracement of its latest bearish run, now acting as immediate short term support around 0.9390. Indicators in the same time frame head north above their midlines, while 20 SMA presents a clear bullish slope below current price, all of which maintains the risk to the upside. In the 4 hours chart the outlook is also bullish, with 0.9420 as immediate resistance as per being the 50% retracement of the same Fibonacci rally.

Support levels: 0.9400 0.9370 0.9330

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.