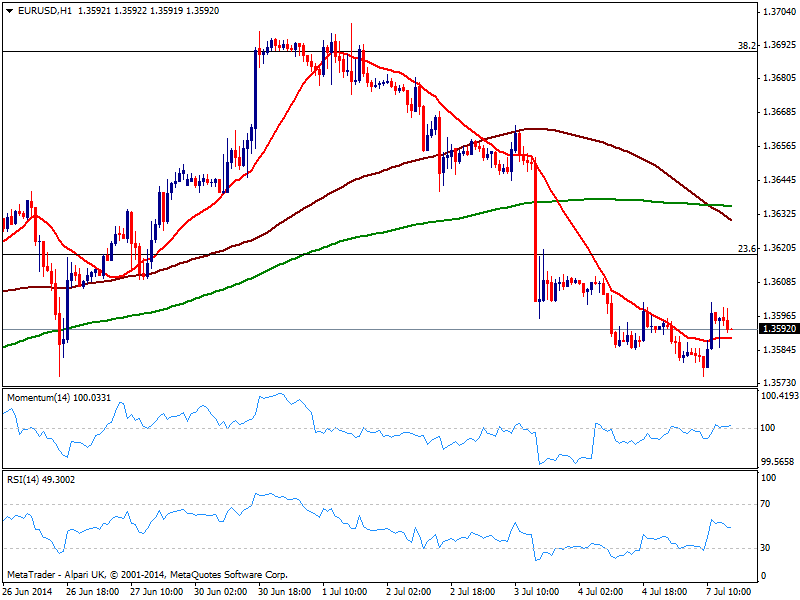

EUR/USD Current price: 1.3592

View Live Chart for the EUR/USD

An ultra thin summer Monday sees EUR/USD confined to a 30 pips range, in between 1.3570 support area and the 1.3600 figure. With no data in Europe or the US to guide price action, traders keep an eye on stocks, down across the world with DAX erasing almost all of Thursday gains, and US indexes trading in red early US session. As for the EUR/USD hourly chart, technical readings maintain a quite neutral stance, giving no clues on upcoming direction. In the 4 hours chart a mild bearish tone prevails with indicators turning now south after correcting oversold readings and price developing below its 20 SMA.

Support levels: 1.3575 1.3530 1.3500

Resistance levels: 1.3645 1.3675 1.3700

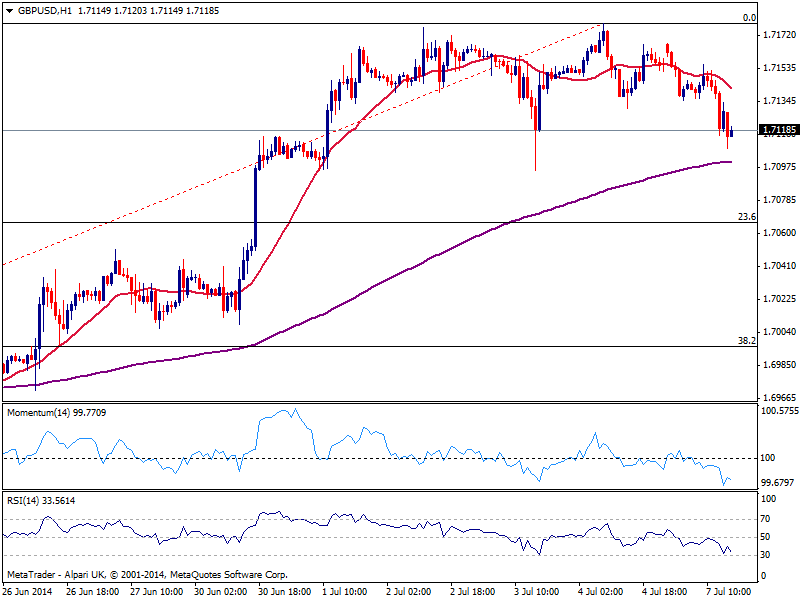

GBP/USD Current price: 1.7118

View Live Chart for the GBP/USD

The GBP/USD eased down to 1.7109 and maintains an intraday bearish tone this Monday, with the hourly chart showing indicators extending their decline into negative territory and 20 SMA turning lower above current price. In the 4 hours chart technical readings also present a bearish tone, favoring a test of 1.7095, post US NFP low, while a break below exposes 1.7060 23.6% retracement of the latest bullish run.

Support levels: 1.7095 1.7060 1.7020

Resistance levels: 1.7130 1.7180 1.7220

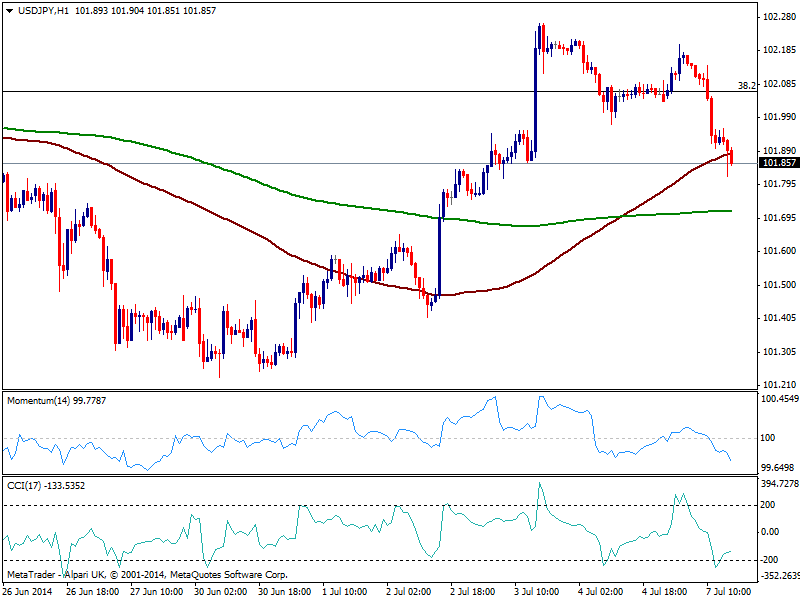

USD/JPY Current price: 101.85

View Live Chart for the USD/JPY

Yen recovers the upside against its rivals, with the USD/JPY down to fresh lows below the 102.00 mark. The hourly chart shows a strong bearish momentum, with price accelerating below its 100 SMA, which favors some downward extension. In the 4 hours chart the technical picture is also bearish, with indicators quickly approaching their midlines: a break below 101.60 exposes the lows around 101.20 in the short term, with risk of a test of the year low in the 100.70 price zone.

Support levels: 101.90 101.60 101.20

Resistance levels: 102.35 102.80 103.10

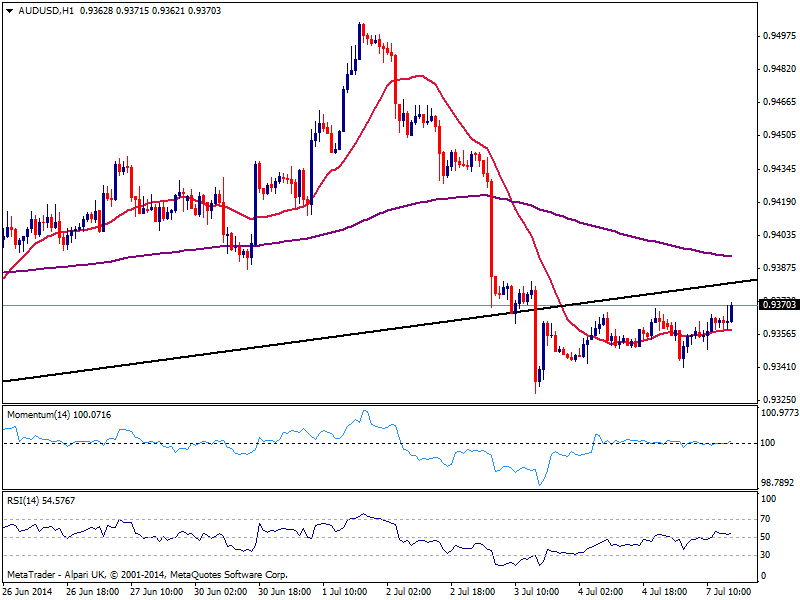

AUD/USD Current price: 0.9370

View Live Chart for the AUD/USD

Australian dollar tests the top of its range against the greenback, but shows little directional strength in the hourly chart, as price extends some above a flat 20 SMA while indicators hovers around their midlines. In the 4 hours chart indicators advance still in negative territory, while 20 SMA maintains a strong bearish slope above current price, offering dynamic resistance around 0.9380.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9380 0.9420 0.9460

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.