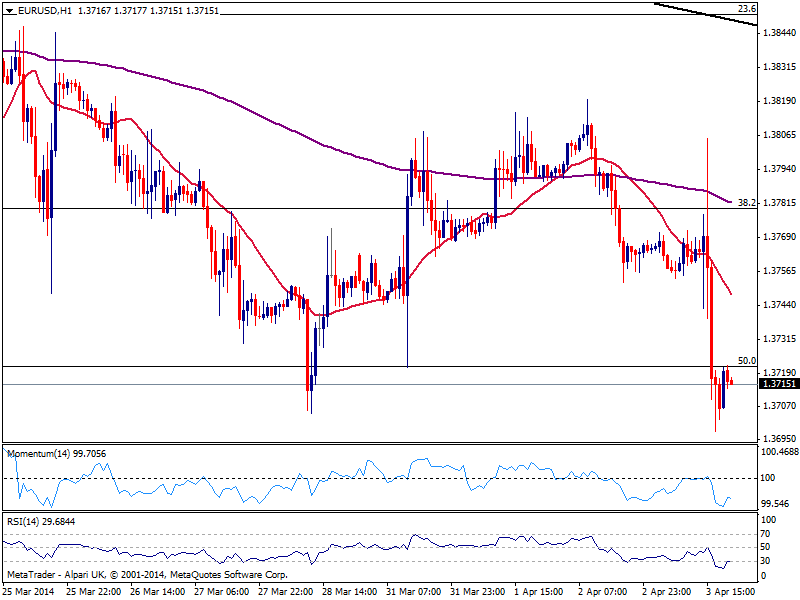

EUR/USD Current price: 1.3720

View Live Chart for the EUR/USD

The EUR/USD shed more ground after ECB President press conference, having exhibited a pretty wild behavior in between the unchanged rates of the Central Bank, and the final dovish statement opening doors to the use of “unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation.”

Investors run to price in the future action, and the pair tested a low of 1.3695, before putting a shy bounce that extended up to 1.3722. Nevertheless, the bearish tone prevails with the hourly chart showing price developing below the 50% retracement of its latest bullish run, and indicators recovering some from extreme oversold readings. In the 4 hours chart the technical picture is also quite bearish, with immediate support now around 1.3640/60 price zone, where daily lows and highs converge with a long term ascendant trend line. A break below this last, on positive US employment readings, may trigger a strong downward continuation for the days to come, eyeing 1.3420 as next midterm support area.

Support levels: 1.3710 1.3670 1.3640

Resistance levels: 1.3750 1.3780 1.3815

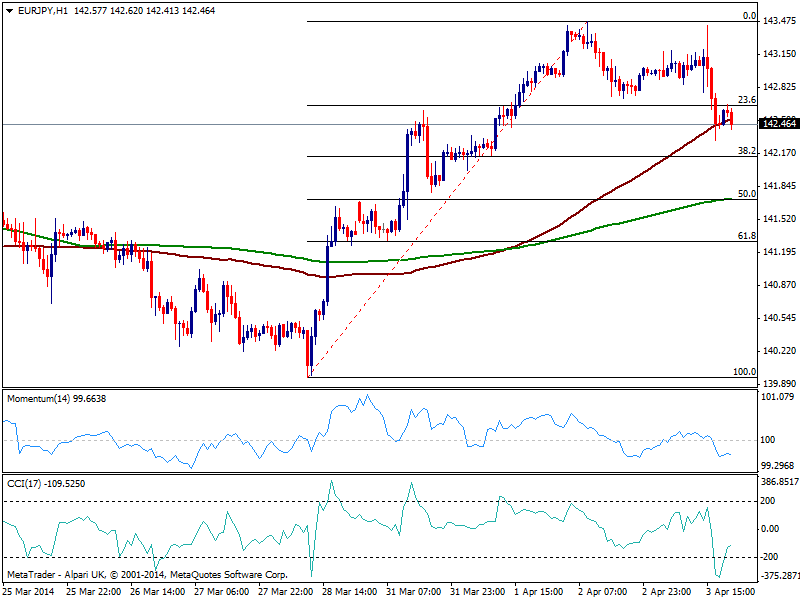

EUR/JPY Current price: 142.46

View Live Chart for the EUR/JPY

Yen weakness with the news maintained slides in EUR/JPY limited, albeit the hourly chart shows price struggling to hold now above its 100 SMA. Indicators in the same time frame stand near oversold readings, while the 4 hours chart shows an increasing bearish potential, with indicators heading strongly down and approaching their midlines. The 38.2% retracement of the latest bullish run stands at 142.10, and a break below will likely force buyers to unwind positions, sending the pair lower towards 140.80 price zone.

Support levels: 142.10 141.30 140.80

Resistance levels: 143.40 143.90 144.60

GBP/USD Current price: 1.6586

View Live Chart for the GBP/USD

The GBP/USD was under pressure already before the ECB announcement, and despite being affected by dollar demand, the move lower remained subdue. Ahead of Asian opening the hourly chart shows price below a bearish 20 SMA and indicators flat in negative territory, while in the 4 hours chart technical indicators maintain a clear bearish tone while price finds short term sellers around its 200 EMA currently at 1.6600. Still quite close to the 1.6600 figure, the short term slide may extend down to 1.6550 yet it would be a break of this last that will confirm a bearish continuation in the pair.

Support levels: 1.6550 1.6510 1.6470

Resistance levels: 1.6610 1.6650 1.6690

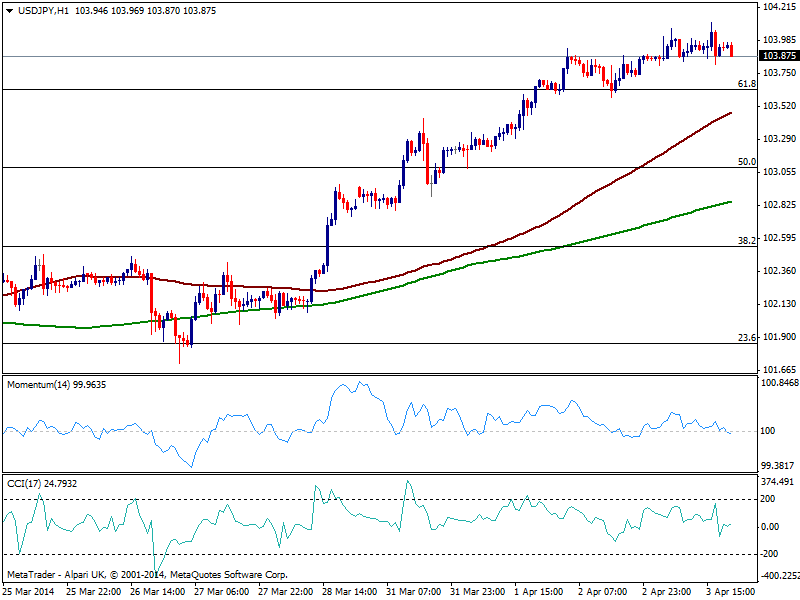

USD/JPY Current price: 103.87

View Live Chart for the USD/JPY

The USD/JPY was unable to extend beyond the 104.00 figure but remains close to it, and will likely maintain the range ahead of US employment data, that could be determinant for current bullish trend. Technically, the pair will remain on demand as long as above 103.60 with a break above 104.10 now required to confirm another leg higher.

Support levels: 103.60 103.30 102.80

Resistance levels: 104.10 104.45 104.80

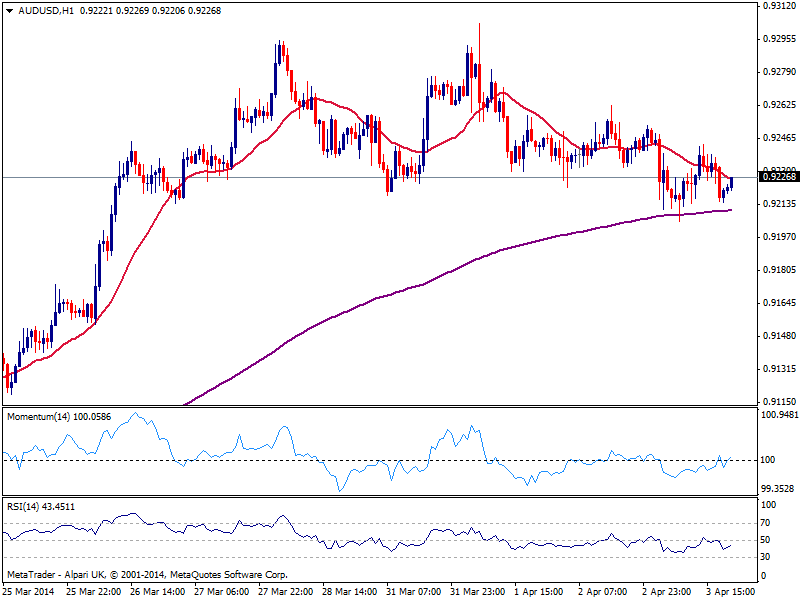

AUD/USD Current price: 0.9226

View Live Chart for the AUD/USD

The AUD/USD continues to quietly consolidate with a slightly bearish tone as per lower lows reached daily basis. The hourly chart shows 20 SMA heading lower and price hovering around it, while indicators present a neutral stance consolidating around their midlines. In the 4 hours chart technical indicators grind lower below their midlines, wile 20 SMA stands flat above current price acting as short term resistance around 0.9250.

Support levels: 0.9220 0.9170 0.9135

Resistance levels: 0.9250 0.9300 0.9345

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.